Hello everyone, i've been trying to translate a strategy into wealth lab backtest but unfortunately i'm doing something wrong.

Here's the strategy.

the minimum of a candle need to be lower than the previous two candles;

the close needs to be higher than the last candle;

the buy order needs to be at the maximum of this candle;

and the stop loss at the minimum of the candle of entry.

i'm looking for a 2x profit the size of the candle, and a 1x stop loss the size of the candle.

i believe this pattern is really known, so im looking forward for some help. ty in advance.

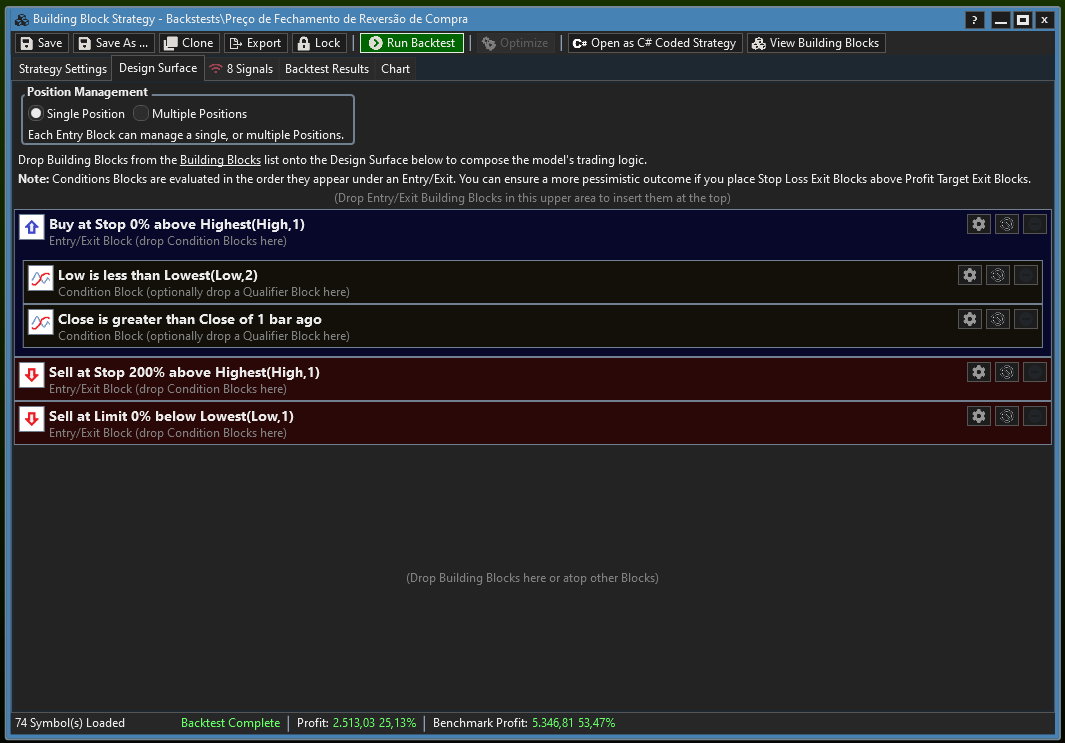

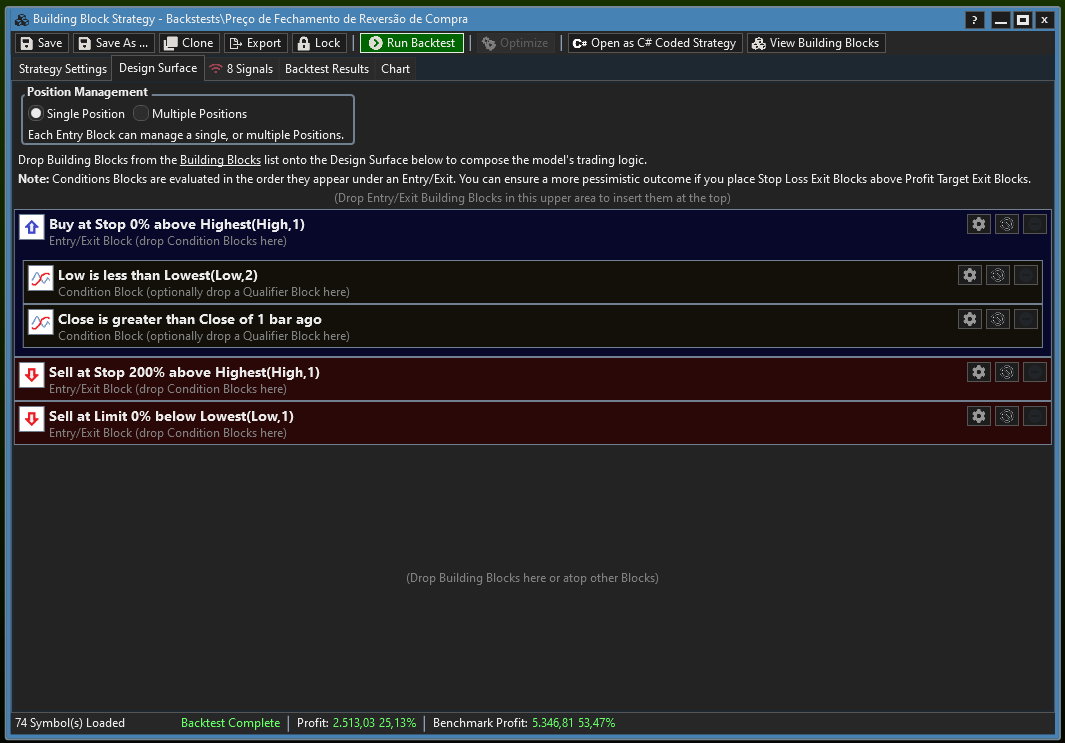

this is what i came up with.

Here's the strategy.

the minimum of a candle need to be lower than the previous two candles;

the close needs to be higher than the last candle;

the buy order needs to be at the maximum of this candle;

and the stop loss at the minimum of the candle of entry.

i'm looking for a 2x profit the size of the candle, and a 1x stop loss the size of the candle.

i believe this pattern is really known, so im looking forward for some help. ty in advance.

this is what i came up with.

Rename

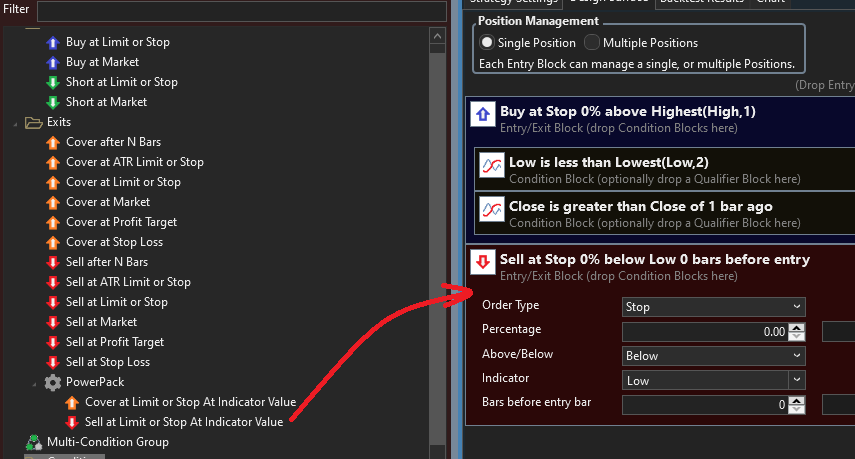

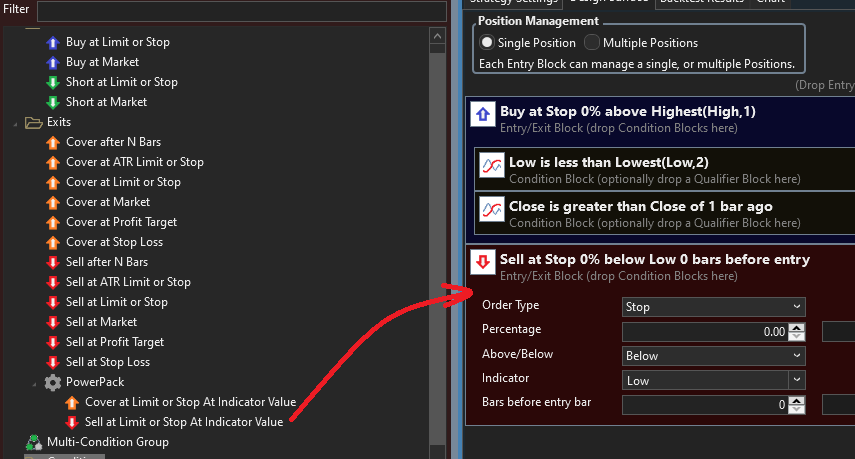

It looks like you got the entry part right. For the stop, you need this rule from the PowerPack extension -

There isn't a block rule available right now to specify a candle and use its range for a limit target. It's easy to do in a C# strategy, so just open a New C# Coded Strategy, replace the code with this, Compile, Save, and Run -

There isn't a block rule available right now to specify a candle and use its range for a limit target. It's easy to do in a C# strategy, so just open a New C# Coded Strategy, replace the code with this, Compile, Save, and Run -

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript123 { public class MyStrategy : UserStrategyBase { //create indicators and other objects here, this is executed prior to the main trading loop public override void Initialize(BarHistory bars) { _L = Lowest.Series(bars.Low, 2); StartIndex = 2; PlotStopsAndLimits(3); } //execute the strategy rules here, this is executed once for each bar in the backtest history public override void Execute(BarHistory bars, int idx) { if (!HasOpenPosition(bars, PositionType.Long)) { //code your buy conditions here if (bars.Low[idx] < _L[idx - 1]) if (bars.Close[idx] > bars.Close[idx - 1]) PlaceTrade(bars, TransactionType.Buy, OrderType.Stop, bars.High[idx]); } else { //code your sell conditions here Position pos = LastPosition; int ebar = pos.EntryBar; ClosePosition(pos, OrderType.Stop, bars.Low[ebar]); double tgt = bars.High[ebar] + 2 * (bars.High[ebar] - bars.Low[ebar]); ClosePosition(pos, OrderType.Limit, tgt); } } //declare private variables below Lowest _L; } }

We may need to create a condition that refers to the size of the bar before entry. That should benefit the users of Building Blocks.

Instead of creating a new condition, maybe it can be expressed via an indicator and maybe a qualifier?

It'd be possible but complicated for a new or demo user to construct this with e.g. MathIndOpInd. I think a simpler and more intuitive for Blocks users would be to expand the good old "Sell/Cover at Profit Target/Stop Loss" conditions with two extra inputs:

[ ] Multiple of bar size [DoubleUpDown] e.g. 1x, 2x... the bar size

[ ] Bars before entry bar [0, 1...]

With the new parameter enabled, the ProfitTarget/StopLoss parameter would instead refer to a multiple of the size of the bar before entry. What do you think?

[ ] Multiple of bar size [DoubleUpDown] e.g. 1x, 2x... the bar size

[ ] Bars before entry bar [0, 1...]

With the new parameter enabled, the ProfitTarget/StopLoss parameter would instead refer to a multiple of the size of the bar before entry. What do you think?

The topic reminds me of the following discussion and the calculation for the ATR exit via blocks. Nested indicators became a problem.

https://www.wealth-lab.com/Discussion/How-to-set-get-entry-bar-s-price-in-exits-7976

https://www.wealth-lab.com/Discussion/How-to-set-get-entry-bar-s-price-in-exits-7976

QUOTE:I was thinking the same, but to generalize it more, I'd make it a multiple of the HighestHigh - LowestLow for n-lookback and x-bars on or before the entry bar.

With the new parameter enabled, the ProfitTarget/StopLoss parameter would instead refer to a multiple of the size of the bar before entry. What do you think?

The Blocks for "Take profit/Stop loss as a fraction of the signal bar size" are added to PowerPack B15:

https://www.wealth-lab.com/extension/detail/PowerPack#changeLog

https://www.wealth-lab.com/extension/detail/PowerPack#changeLog

Your Response

Post

Edit Post

Login is required