I'm wondering whether its possible to build a multi-step limit order with the goal of bidding lower, then incrementally bidding higher in order to get a good fill (without just doing a market order and often times getting really unfavorable fills).

It would ideally go something like this:

1) Enter limit order at X% below last bar close

...wait 3 seconds...

if not filled:

2) Enter limit order at 0% above last bar close

...wait 3 seconds...

if not filled:

3) Enter limit order at .1% above last bar close

...wait 3 seconds...

if not filled:

4) Enter market order (as backup, to ensure it ultimately gets filled)

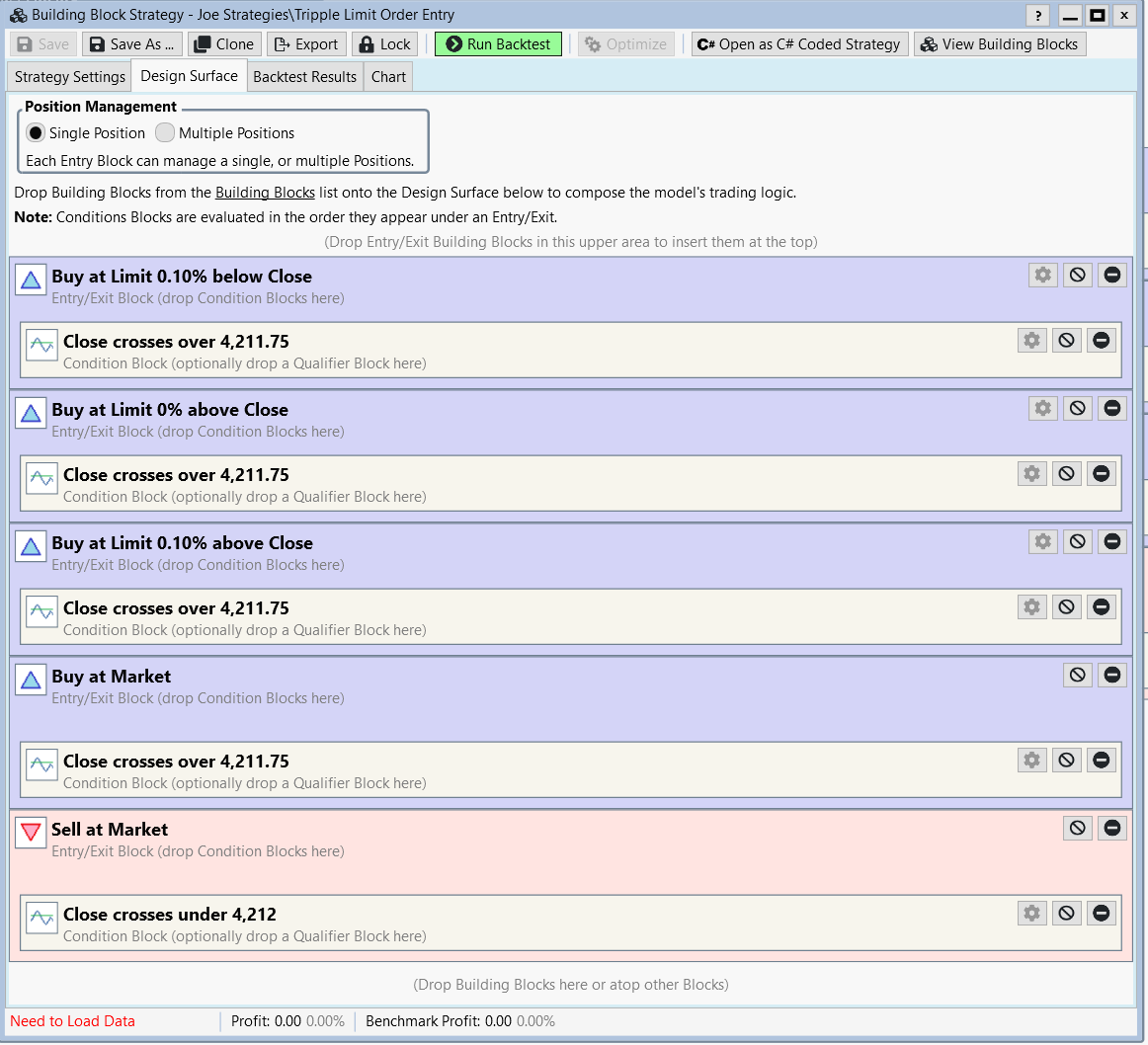

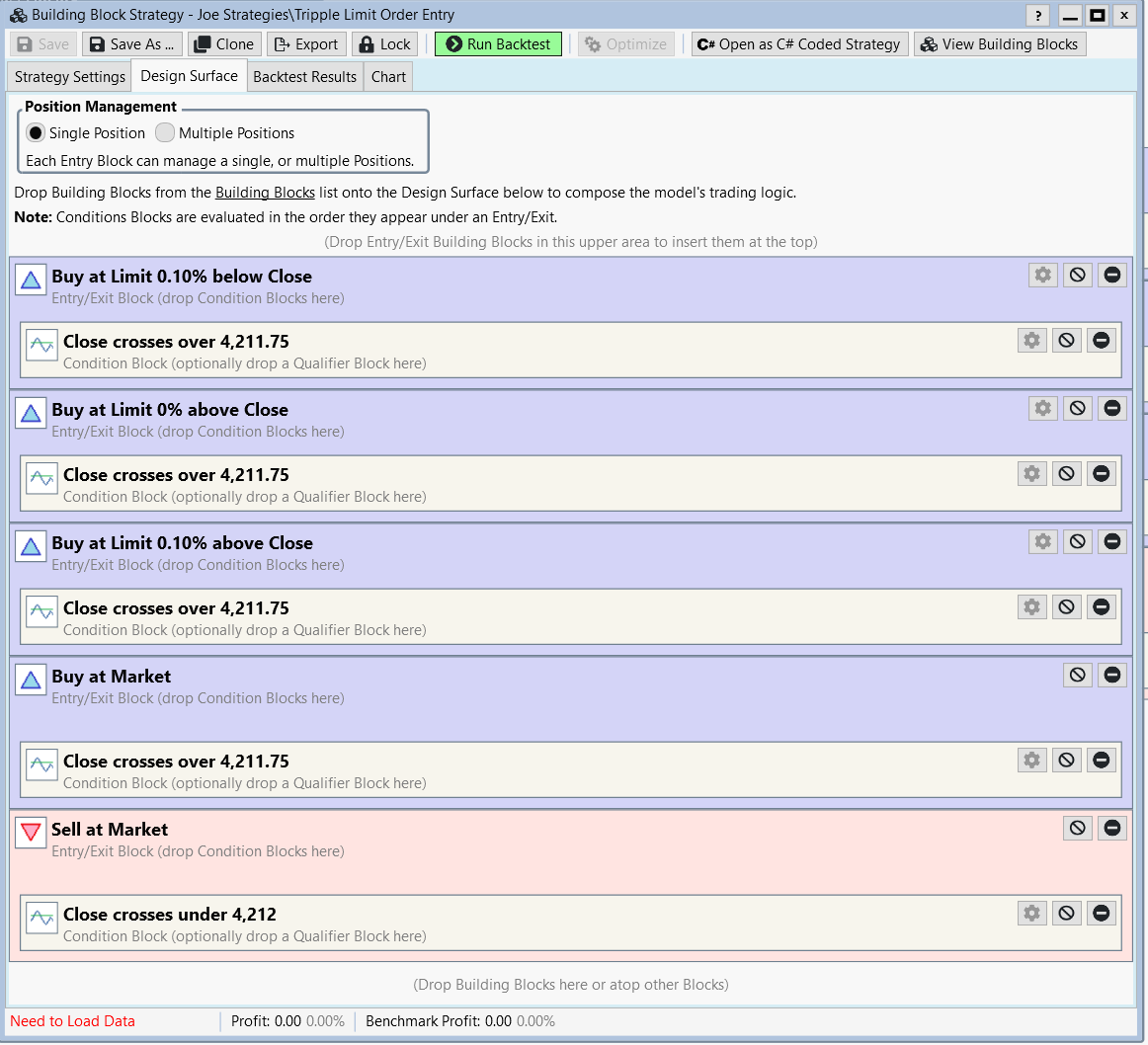

Here's the closest thing I've come up with, but I bet this would end up just opening many positions, which I don't want:

Any suggestions on how to get closest to a multi-step limit order to achieve best fill?

Thanks!

It would ideally go something like this:

1) Enter limit order at X% below last bar close

...wait 3 seconds...

if not filled:

2) Enter limit order at 0% above last bar close

...wait 3 seconds...

if not filled:

3) Enter limit order at .1% above last bar close

...wait 3 seconds...

if not filled:

4) Enter market order (as backup, to ensure it ultimately gets filled)

Here's the closest thing I've come up with, but I bet this would end up just opening many positions, which I don't want:

Any suggestions on how to get closest to a multi-step limit order to achieve best fill?

Thanks!

Rename

WealthLab places orders at the end of complete bars.

The kind of logic you described is possible using a 3-second bar chart, but you're not going to be able to create that logic with the blocks... it will require a lot of fine-tuning with a custom C# coded strategy.

The kind of logic you described is possible using a 3-second bar chart, but you're not going to be able to create that logic with the blocks... it will require a lot of fine-tuning with a custom C# coded strategy.

A good candidate for our concierge support: https://www.wealth-lab.com/Support/Concierge

Sounds interesting. I'll reach out and get a quote.

Question: Sounds like I'll need access to 3-second bars/chart but when I try choosing, "custom" and dial in 3 second bars, I get an error of sorts saying that 3 second bars aren't available so is it even possible to view 3-second bars in this platform?

(I already pay for "level 2" futures data plan from Interactive Brokers which is supposed to be the fastest).

Question: Sounds like I'll need access to 3-second bars/chart but when I try choosing, "custom" and dial in 3 second bars, I get an error of sorts saying that 3 second bars aren't available so is it even possible to view 3-second bars in this platform?

(I already pay for "level 2" futures data plan from Interactive Brokers which is supposed to be the fastest).

Yes, the platform can even do ticks. But look, IB is a terrible data provider if you need a lot of data - which will be the case if you start looking at anything under 30 minute bars.

Bottom line -

Forget about the 3 second strategy with IB's data. It's not going work. If you want to do it, you'll need a true data provider - IQFeed. I won't even look at it any other way.

Bottom line -

Forget about the 3 second strategy with IB's data. It's not going work. If you want to do it, you'll need a true data provider - IQFeed. I won't even look at it any other way.

I received your email and am thinking about some ways to handle this, will get back to you when I have some ideas fleshed out!

Your Response

Post

Edit Post

Login is required