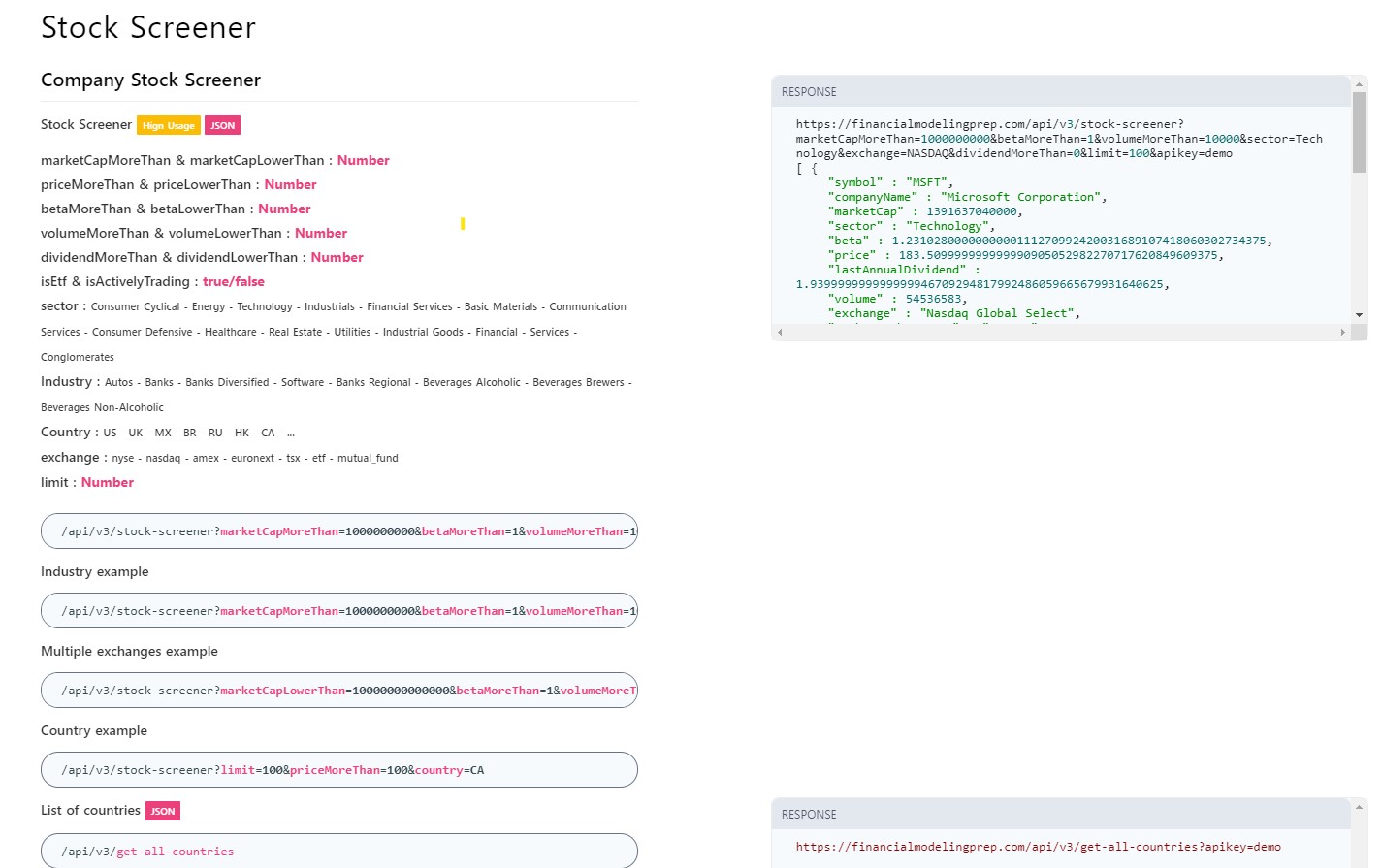

Is it possible to make a data set with the variables that are provided with the below api?

Of all the data set api's I have reviewed in depth, this one has the most variable options.

https://financialmodelingprep.com/developer/docs#Stock-Screener

I'd see this as a data set that you could select the options from the screener and it results in those specific stocks populating the data set for you to trade as a result, but I am not a good computer programmer to figure out how to do this.

Thanks

Rename

You could develop a dynamic DataSet around this API with the help of a DataSetProvider:

https://www.wealth-lab.com/Support/ExtensionApi/DataSetProvider

However, dynamic DataSets are currently parameterless and have to operate with hardcoded parameters.Additionally, they're processed just once at Wealth-Lab startup so any configuration would not be reflected until restart. To reconfigure it, I would suggest exposing a GUI dialog using this API:

https://www.wealth-lab.com/Support/ExtensionApi/WealthLabClientExtension

If you were to create such provider, the GUI would serialize and deserialize its settings to a text file, for example, using Wealth-Lab's Tokenizer class. Thenat startup the DataSetProvider could apply the changed settings.

https://www.wealth-lab.com/Support/ExtensionApi/DataSetProvider

However, dynamic DataSets are currently parameterless and have to operate with hardcoded parameters.

https://www.wealth-lab.com/Support/ExtensionApi/WealthLabClientExtension

If you were to create such provider, the GUI would serialize and deserialize its settings to a text file, for example, using Wealth-Lab's Tokenizer class. Then

Don't forget to vote for your feature request from this page:

https://www.wealth-lab.com/wishlist

The idea of having dynamic DataSets for screening stocks has potential. They don't even have to be tied to FinancialModelingPrep which is a subscription service.But the fact that any changes to parameters would be reflected after restart makes them somewhat less intuitive to use.

https://www.wealth-lab.com/wishlist

The idea of having dynamic DataSets for screening stocks has potential. They don't even have to be tied to FinancialModelingPrep which is a subscription service.

QUOTE:This is a workaround because

If you were to create such provider, the GUI would serialize and deserialize its settings to a text file, for example, using Wealth-Lab's Tokenizer class. Then at startup the DataSetProvider could apply the changed settings.

The better solution

---

Getting back on topic, with the current WL restrictions, the better solution would be to use a stock screener like Fidelity has where you can configure it outside of WL. Then you just run the screener on Fidelity's website and let it generate its Excel output that WL can read on startup to generate the dataset.

And that's the way I do it now with WL6 using a little C# command-line program, which generates the WL6 datasets. Works great.

Superticker, what we are talking about here is development of an extension, it’s something that non programmers won’t be doing so I feel your last complaint is out of context.

Eugene, DataSet providers can already update their symbols while WL7 is running, see how WealthData does this in its provider using the EventRouter.

Eugene, DataSet providers can already update their symbols while WL7 is running, see how WealthData does this in its provider using the EventRouter.

Dion, this makes sense. Good to know.

QUOTE:Agreed.

what we are talking about here is development of an extension, it’s something that non programmers won’t be doing

QUOTE:Great news! Where do I find this event router code? With this on-demand update solution, it makes me want to write a DataSetProvider to replace my C# command-line dataset generating program.

DataSet providers can already update their symbols while WL7 is running, see how WealthData does this in its provider using the EventRouter.

What would be nice is to have a right-click "Update Now" menu item on any DataSetProvider datasets.

I like the idea of having a dynamic DataSet with parameters. Not sure if it should be built around the FMP API though. Mainly because FinancialModelingPrep is a paid subscription and the number of parameters is a bit limited. There are free and more flexible screeners out there. Take TradingView but it suffers from the opposite issue: way too many criteria. :)

I am open to any dynamic data set with parameters, FMP was just the one I found with easieat selectable criteria for a novice programmer aka me. 😂

Good to know we're on the same page. I believe that your idea would be an important feature enhancement. I'll make some more research into stock scanners with a potential for integration while you (and everybody) are welcome to share their parameters for scanning here!

The biggest scanner parameters I use and would be highly valuable for this dynamic data set:

1. (Unusual Volume) This is just Relative Volume (Relative Volume = Current Volume / 3-month Average Volume) x Multiplier (usually 2-5x) - used to find a list of the most actively traded stocks of the day

2. Gappers (Gap up or Gap Down: Enterable %)

3. Market Cap (marketCapMoreThan & marketCapLowerThan : Number)

4. Exchange ( nyse - nasdaq - amex - euronext - tsx - etf - mutual_fund)

5. RSI(14) Technical analysis term for stocks with extreme price decrease or increase over past two weeks calculated by RSI(14) indicator.

6. Sector (Consumer Cyclical - Energy - Technology - Industrials - Financial Services - Basic Materials - Communication Services - Consumer Defensive - Healthcare - Real Estate - Utilities - Industrial Goods - Financial - Services - Conglomerates)

7. Industry (Autos - Banks - Banks Diversified - Software - Banks Regional - Beverages Alcoholic - Beverages Brewers - Beverages Non-Alcoholic)

8. Current Volume (volumeMoreThan & volumeLowerThan)

9. Price (PriceMoreThan & PriceLowerThan)

10. Country (US - UK - MX - BR - RU - HK - CA )

Extra Parameters that may be a lot harder to program in and get info from Data Providers from my research

1. Shares Outstanding

2. Shares Float

3. Short Interest

4. Short Float

1. (Unusual Volume) This is just Relative Volume (Relative Volume = Current Volume / 3-month Average Volume) x Multiplier (usually 2-5x) - used to find a list of the most actively traded stocks of the day

2. Gappers (Gap up or Gap Down: Enterable %)

3. Market Cap (marketCapMoreThan & marketCapLowerThan : Number)

4. Exchange ( nyse - nasdaq - amex - euronext - tsx - etf - mutual_fund)

5. RSI(14) Technical analysis term for stocks with extreme price decrease or increase over past two weeks calculated by RSI(14) indicator.

6. Sector (Consumer Cyclical - Energy - Technology - Industrials - Financial Services - Basic Materials - Communication Services - Consumer Defensive - Healthcare - Real Estate - Utilities - Industrial Goods - Financial - Services - Conglomerates)

7. Industry (Autos - Banks - Banks Diversified - Software - Banks Regional - Beverages Alcoholic - Beverages Brewers - Beverages Non-Alcoholic)

8. Current Volume (volumeMoreThan & volumeLowerThan)

9. Price (PriceMoreThan & PriceLowerThan)

10. Country (US - UK - MX - BR - RU - HK - CA )

Extra Parameters that may be a lot harder to program in and get info from Data Providers from my research

1. Shares Outstanding

2. Shares Float

3. Short Interest

4. Short Float

Thanks for the feedback, I will consider it when developing the screener.

And you can already screen for premarket gaps with the dynamic DataSet for Upcoming Events in DataExtensions:

https://www.wealth-lab.com/extension/detail/DataExtensions#screenshots

And you can already screen for premarket gaps with the dynamic DataSet for Upcoming Events in DataExtensions:

https://www.wealth-lab.com/extension/detail/DataExtensions#screenshots

It would be nice to post such as DynamicDataSet screener implementation in Community.Components so we can see how this is done and further enhance it. Wasn't there going to be a GitHub project for WL Community.Components?

I haven't decided on the source for this screener but believe that this is going to have enough complexity (and some tricks if it would be a non-official API) to share it. It's a good idea for later to have some vanilla example for the documentation though.

As I've been working on this dynamic DataSet, let's post an update.

1. Although FMP's API might make it a cinch to implement (https://financialmodelingprep.com/developer/docs/stock-screener-api#C#), it would require registration which could scare away some users. Looked into many screeners that do not require an extra step (signup) or where it can be avoided 😂 and seem to have found a good candidate.

2. It makes sense to keep it Unlinked so we'll limit it to U.S. symbols.

There's a good chance we'll deliver the stock screening DataSet tool in DataExtensions build 11.

1. Although FMP's API might make it a cinch to implement (https://financialmodelingprep.com/developer/docs/stock-screener-api#C#), it would require registration which could scare away some users. Looked into many screeners that do not require an extra step (signup) or where it can be avoided 😂 and seem to have found a good candidate.

2. It makes sense to keep it Unlinked so we'll limit it to U.S. symbols.

There's a good chance we'll deliver the stock screening DataSet tool in DataExtensions build 11.

I would prefer a provider that didn't have a signup; however, if the ones requiring a signup offer something special the free ones don't have, I would consider signing up if it wasn't too expensive.

Today I used Fidelity's stock screener, which writes an Excel file that I read into Wealth-Lab.

Today I used Fidelity's stock screener, which writes an Excel file that I read into Wealth-Lab.

Here's a sneak peek preview of the upcoming stock screener (DataExtensions build 11) which is currently under development with more criteria being added. It will use an external source to update its custom DataSet on-the-fly.

At first there's just one criteria active (price within $1,111 and $6,666) which results in 22 symbols. Then I'm activating a filter on the 14-day RSI above 66 and upon clicking Rebuild, the DataSet gets instantly updated with just 4 symbols.

At first there's just one criteria active (price within $1,111 and $6,666) which results in 22 symbols. Then I'm activating a filter on the 14-day RSI above 66 and upon clicking Rebuild, the DataSet gets instantly updated with just 4 symbols.

Nice). I didn't think I need this, now I think I do need).

Note that in the initial release the unlinked DataSet will cover U.S. stocks only.

This looks great so far! Great job at making my request a reality!

For the fundamentals on the new Dynamic Data Set:

RSI is that for period 14?

ADX is that for period 20?

ROC is that for Period 20?

For the fundamentals if the period is not adjustable can you adjust the text to indicate the period for clarification?

RSI (14):

ADX (20):

ROC (20):

Thanks!

RSI is that for period 14?

ADX is that for period 20?

ROC is that for Period 20?

For the fundamentals if the period is not adjustable can you adjust the text to indicate the period for clarification?

RSI (14):

ADX (20):

ROC (20):

Thanks!

The periods are fixed at the data source and not adjustable: RSI(14), ADX(14), ROC(1). Updating the labels for build 12 of the DataExtensions.

If you're interested in more parameters or indicators, we're open to suggestions.

If you're interested in more parameters or indicators, we're open to suggestions.

Eventually I plan to make a screener that will let you use our condition building blocks to compose the criteria. it will also be integrated as a new historical data provider so you’ll be able to maintain multiple Screener DaraSets using the existing user interface.

Is relative volume an option?

I will play around with it more and offer more suggestions.

Thanks again, this data set is a great addition for trading!

I will play around with it more and offer more suggestions.

Thanks again, this data set is a great addition for trading!

Unfortunately, relative volume is not available. :/

QUOTE:

Eventually I plan to make a screener that will let you use our condition building blocks to compose the criteria. it will also be integrated as a new historical data provider so you’ll be able to maintain multiple Screener DaraSets using the existing user interface.

Sounds great. I like your ideas-generating skills! :)

That's ok, I will be able to just have that in my strategy criteria for now. Your dataset already allows me to widdle down multiple exchanges simultaneously for strategy implementation.

QUOTE:

Unfortunately, relative volume is not available. :/

In WL8 Dion made the Stock Scanner a historical data provider. It will be possible to maintain multiple stock screener DataSets.

Your Response

Post

Edit Post

Login is required