Hello,

no drawing levels on building Blocks.

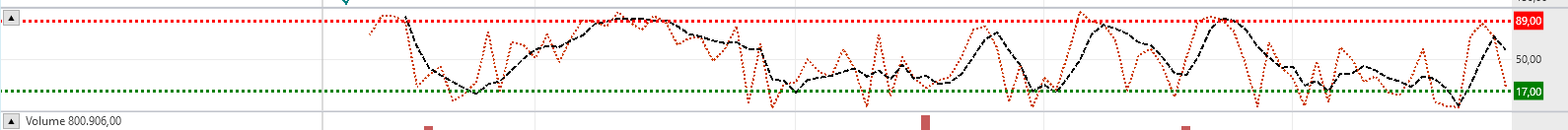

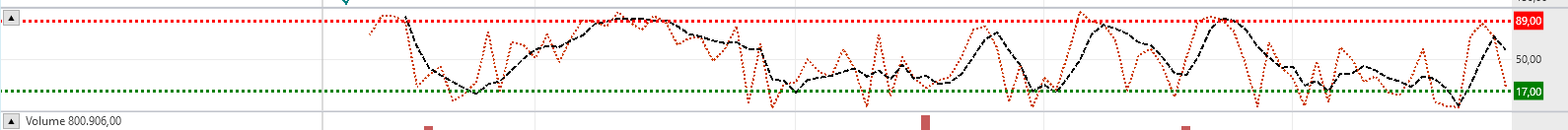

Can someone help me with this code (something is wrong), adding drawing levels. See image.

Error: RSI.Series

Thanks.

no drawing levels on building Blocks.

Can someone help me with this code (something is wrong), adding drawing levels. See image.

Error: RSI.Series

Thanks.

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Data; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript2 { public class RSIDrawingLevels : UserStrategyBase { public RSIDrawingLevels() : base() { AddParameter("RSILevels", ParameterType.Int32, 10, 10, 100, 5); // Index start at 0 AddParameter("RSIlong", ParameterType.Int32, 70, 10, 100, 5); StartIndex = 20; } public override void Initialize(BarHistory bars) { _levelLong = Parameters[0].AsInt; _RSIindicatorLong = RSI.Series(bars, Parameters[0].AsInt); PlotIndicator(_RSIindicatorLong, new WLColor(0, 0, 0)); DrawHorzLine(_levelLong, WLColor.Green, 3, LineStyle.Dotted, _RSIindicatorLong.PaneTag); } public override void Execute(BarHistory bars, int idx) { int index = idx; Position foundPosition0 = FindOpenPosition(0); bool condition0; if (foundPosition0 == null) { condition0 = false; { if (_RSIindicatorLong[idx] < Parameters[0].AsInt) { condition0 = true; } } if (condition0) { _transaction = PlaceTrade(bars, TransactionType.Buy, OrderType.Market, 0, 0, "Buy At Market (1)"); } } else { condition0 = false; { condition0 = true; } if (condition0) { Backtester.CancelationCode = 351; ClosePosition(foundPosition0, OrderType.Market, 0, "Sell At Market (1)"); } } } public override void NewWFOInterval(BarHistory bars) { _RSIindicatorLong = new RSI(bars.Close, 20); } private IndicatorBase _RSIindicatorLong; private int _levelLong; private Transaction _transaction; } }

Rename

I found the error.

The error is that _levelLong isn't assigned.

No, the Blocks generated code is modified - the error comes from here.

Also, code will not compile:

QUOTE:

no drawing levels on building Blocks

No, the Blocks generated code is modified - the error comes from here.

Also, code will not compile:

CODE:

//_RSIindicatorLong = RSI.Series(bars, Parameters[0].AsInt); _RSIindicatorLong = RSI.Series(bars.Close, Parameters[0].AsInt);

Okay. I did again. Modified Block, adding Levels.

Assigned Levels. But no I am getting short positions only and no drawing levels.

I thought it couldn't be that difficult to build in the levels.

Someone an idea?

Assigned Levels. But no I am getting short positions only and no drawing levels.

I thought it couldn't be that difficult to build in the levels.

Someone an idea?

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Data; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript10 { public class MyStrategy : UserStrategyBase { public MyStrategy() : base() { AddParameter("RSILevelsLong", ParameterType.Double, 30, 10, 100, 5); // Index start at 0 AddParameter("RSILevelsShort", ParameterType.Double, 80, 10, 100, 5); StartIndex = 20; } public override void Initialize(BarHistory bars) { _levelLong = Parameters[0].AsDouble; _levelShort = Parameters[1].AsDouble; indicator = new RSI(bars.Close,20); PlotIndicator(indicator,new WLColor(0,0,0)); indicator2 = new RSI(bars.Close,20); DrawHorzLine(_levelLong, WLColor.Green, 2, LineStyle.Solid, indicator.PaneTag ); DrawHorzLine(_levelShort, WLColor.DarkRed, 2, LineStyle.Solid, indicator2.PaneTag); } public override void Execute(BarHistory bars, int idx) { int index = idx; Position foundPosition0 = FindOpenPosition(0); bool condition0; if (foundPosition0 == null) { condition0 = false; { if (indicator[index] < _levelLong) { condition0 = true; } } if (condition0) { _transaction = PlaceTrade(bars, TransactionType.Buy, OrderType.Market, 0, 0, "Buy At Market (1)"); } } else { condition0 = false; { condition0 = true; } if (condition0) { Backtester.CancelationCode = 484; if (idx - foundPosition0.EntryBar + 1 >= 10) { ClosePosition(foundPosition0, OrderType.Market, 0,"Sell after 10 bars"); } } } Position foundPosition1 = FindOpenPosition(1); bool condition1; if (foundPosition1 == null) { condition1 = false; { if (indicator2[index] > _levelShort) { condition1 = true; } } if (condition1) { _transaction = PlaceTrade(bars, TransactionType.Short, OrderType.Market, 0, 1, "Short At Market (2)"); } } else { condition1 = false; { condition1 = true; } if (condition1) { Backtester.CancelationCode = 486; if (idx - foundPosition1.EntryBar + 1 >= 5) { ClosePosition(foundPosition1, OrderType.Market, 0,"Cover after 5 bars"); } } } } public override void NewWFOInterval(BarHistory bars) { indicator = new RSI(bars.Close,20); indicator2 = new RSI(bars.Close,20); } private double _levelLong; private double _levelShort; private IndicatorBase indicator; private IndicatorBase indicator2; private Transaction _transaction; } }

QUOTE:

But no I am getting short positions only

Bet you can make a complete system in Blocks first and then export it before adding the thresholds (by the way, using Parameters[...].AsInt).

I ran your code using WL NASDAQ 100, daily, for 6 years, $100K capital, 5% equity per position. There were many long and short positions generated. However, the horizontal lines did not appear in the RSI pane. Using WriteToDebugLog($"{indicator2.PaneTag}, {_levelLong}"); shows the correct values (RSI and 30).

Thanks.

Will test it.

Will test it.

The RSI thresholds are plotted with either .AsInt or .AsDouble, there's no error.

@mrsic - I stated that the horizontal lines did not show up. I was not correct. The mistake I made was that I initially did not look at a dataset's symbol after a back test run. I was looking at an existing chart of a symbol that wasn't part of the back test dataset. Ooops. I double-clicked on a position, scrolled back and forth, and the horizontal lines appear.

Thanks to both.

It's works after first clicking on another portfolio and then back on the previous one.

It's works after first clicking on another portfolio and then back on the previous one.

fwiw, you can use the indicator's Overbought/Oversold fields to store those values. Here's the code with that change and with the verbosity of the blocks removed -

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Data; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript10 { public class MyStrategy : UserStrategyBase { public MyStrategy() : base() { AddParameter("RSILevelsLong", ParameterType.Double, 30, 10, 100, 5); AddParameter("RSILevelsShort", ParameterType.Double, 80, 10, 100, 5); StartIndex = 20; } public override void Initialize(BarHistory bars) { _rsi = new RSI(bars.Close, 20); _rsi.OversoldLevel = Parameters[0].AsDouble; //was _levelLong _rsi.OverboughtLevel = Parameters[1].AsDouble; //was _levelShort PlotIndicator(_rsi); DrawHorzLine(_rsi.OversoldLevel, WLColor.Green, 2, LineStyle.Solid, _rsi.PaneTag); DrawHorzLine(_rsi.OverboughtLevel, WLColor.DarkRed, 2, LineStyle.Solid, _rsi.PaneTag); } public override void Execute(BarHistory bars, int idx) { int index = idx; Position foundPosition0 = FindOpenPosition(0); if (foundPosition0 == null) { if (_rsi[index] < _rsi.OversoldLevel) { _transaction = PlaceTrade(bars, TransactionType.Buy, OrderType.Market, 0, 0, "Buy At Market (1)"); } } else { Backtester.CancelationCode = 484; if (idx - foundPosition0.EntryBar + 1 >= 10) { ClosePosition(foundPosition0, OrderType.Market, 0, "Sell after 10 bars"); } } Position foundPosition1 = FindOpenPosition(1); if (foundPosition1 == null) { if (_rsi[index] > _rsi.OverboughtLevel) { _transaction = PlaceTrade(bars, TransactionType.Short, OrderType.Market, 0, 1, "Short At Market (2)"); } } else { Backtester.CancelationCode = 486; if (idx - foundPosition1.EntryBar + 1 >= 5) { ClosePosition(foundPosition1, OrderType.Market, 0, "Cover after 5 bars"); } } } public override void NewWFOInterval(BarHistory bars) { _rsi = new RSI(bars.Close, 20); } private IndicatorBase _rsi; private Transaction _transaction; } }

Great Cone. Many Thanks :-)

Your Response

Post

Edit Post

Login is required