7 Ways to Publish Signals at Collective2Published: 8/4/2023

Updated: 9/3/2023

|

Introduction

In the ever-evolving landscape of financial markets, trading strategy authors (leaders) face the challenge of developing and validating their strategies while also gaining visibility and attracting followers. WealthLab's collaboration with Collective2 (C2) offers an array of benefits that can significantly enhance the success of trading strategy authors.

This article discusses how WealthLab empowers trading system authors, known as Trade Leaders on C2, to effectively showcase their strategies, build a robust track record through automated signal publishing, and attract a wider audience of potential followers.

Backtesting and Optimization

Renowned for its comprehensive backtesting and trading platform, WealthLab provides Trade Leaders with the tools to develop, fine-tune, and optimize their trading strategies. Traders can leverage WealthLab's exclusive historical data, advanced technical analysis tools, and intuitive interface to thoroughly evaluate their strategies before taking them live. This ensures a solid foundation for leaders when presenting their strategies to potential followers on Collective2.com.

Strategy Publication and Verification

Once a trading strategy has been created and refined using WealthLab, leaders can seamlessly publish their strategies on Collective2.com. This platform acts as a marketplace for trading strategies, connecting leaders with interested followers. By showcasing their strategies on Collective2.com, leaders gain exposure to a vast community of traders actively seeking proven and reliable approaches.

Track Record Verification and Transparency

Collective2 offers a vital component in the success equation for leaders—track record verification. Traders can connect their WealthLab account to Collective2, allowing the platform to independently verify their trading results. This integration instills confidence in potential followers by providing transparency and ensuring the accuracy of the reported performance. Verified track records are essential for leaders looking to attract followers and build trust in their strategies.

Auto-Trading and Trade Replication

Collective2 provides an auto-trading functionality that allows followers to automatically replicate the trades executed by leaders. This feature simplifies the execution process and eliminates the need for manual trade replication, enhancing the overall user experience for followers. Leaders can leverage this auto-trading capability to attract and retain a broader audience, as it provides a convenient solution for followers who prefer automated trade execution.

Revenue Generation

A notable benefit of the partnership between WealthLab and Collective2 is the potential for leaders to monetize their trading strategies. By attracting followers who choose to replicate their trades, leaders can generate revenue through subscription fees or profit-sharing arrangements offered by Collective2. This incentivizes leaders to continue refining and enhancing their strategies, ultimately fostering a win-win scenario where leaders' success is aligned with the success of their followers.

7 Ways to Publish Signals at Collective2 with WealthLab

WealthLab has several tools to automate signal placement at C2. The method you use will depend on the type of trading your system is designed for: end-of-day (EOD) or intraday, systematic or discretionary.

Supported instruments

- Stocks

- Futures

- Forex

- Options

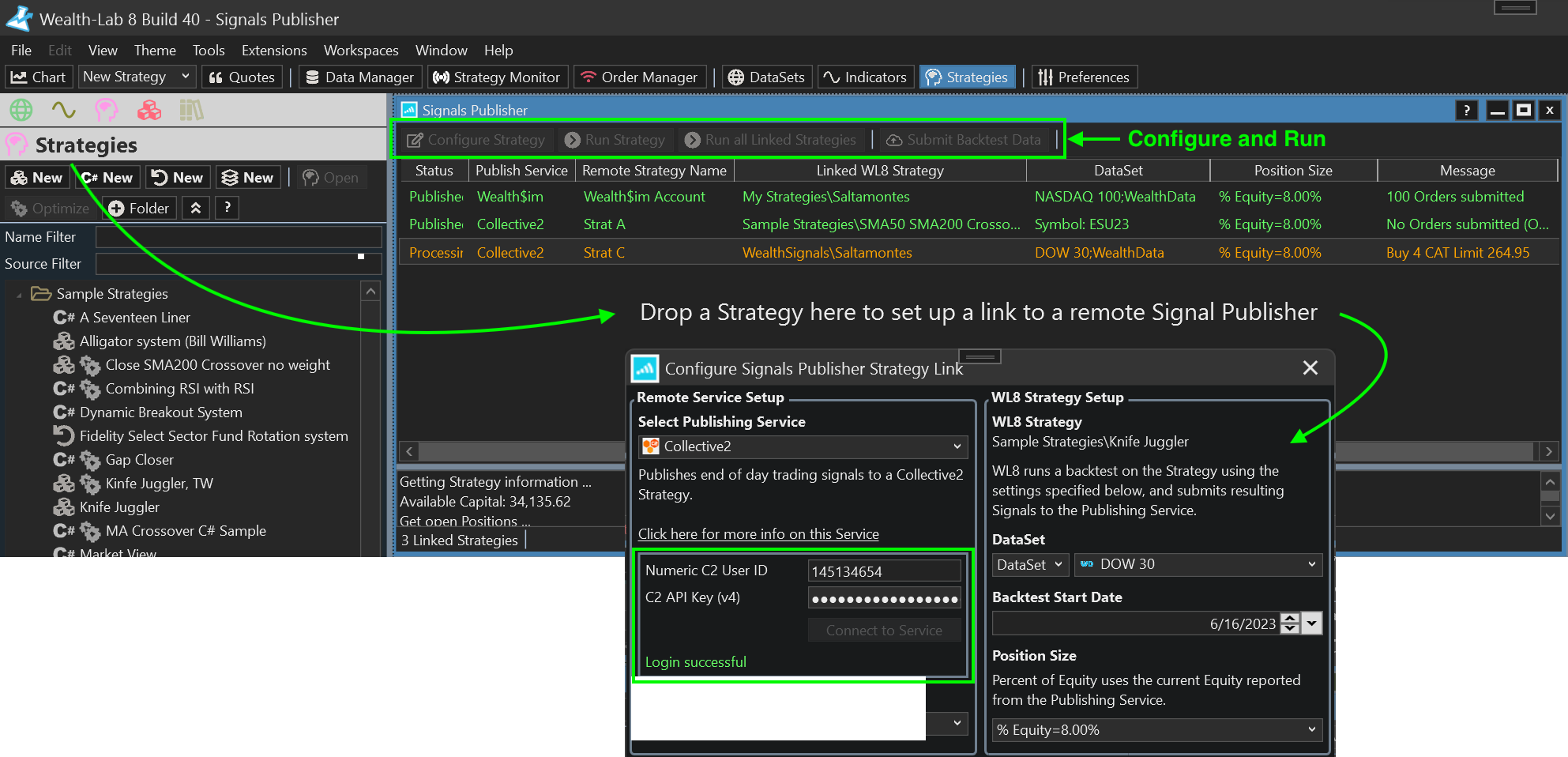

1. Signals Publisher

Type: EOD, Systematic

WealthLab's Signals Publisher establishes links between WealthLab strategies and strategies at Collective2 to publish daily (EOD) trading signals for the U.S. Stock Market at C2. You create the link just by dragging and dropping a strategy from the WL8 Strategies tree into the tool, selecting an available strategy from your C2 account.

WealthLab's Signal Publisher automates sending EOD signals to Collective2

WealthLab's Signal Publisher automates sending EOD signals to Collective2

The Signals Publisher will remember the strategy associations and their configurations for data and Position Sizing. You only need to click one of the Run Strategies buttons to publish new trading signals at C2 each day before the U.S. trading session opens at 09:30 ET. And if clicking a button is too much work, just set it up for automatic signal publishing using the Windows Task Manager!

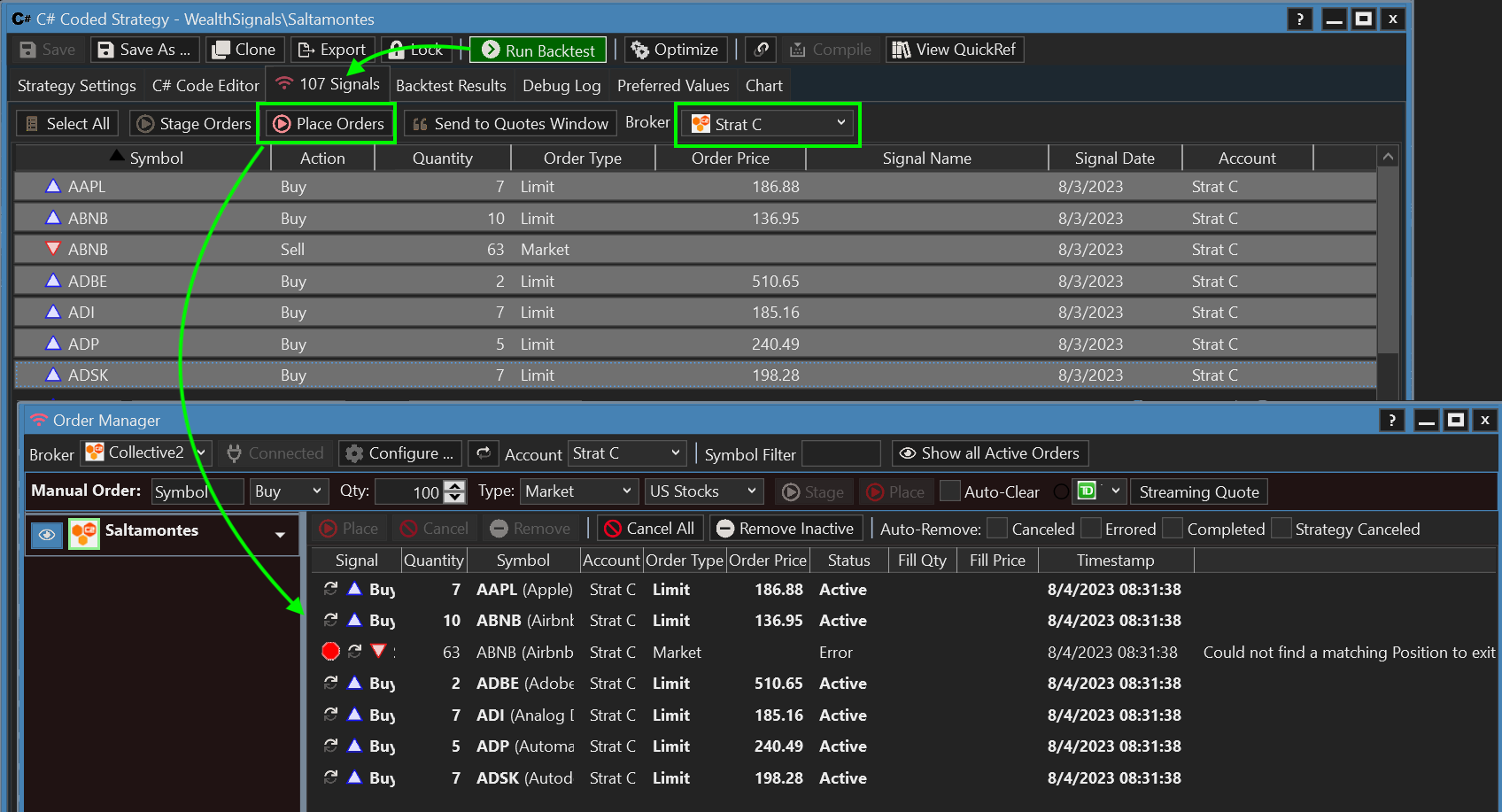

2. Strategy Window

Type: EOD or Intraday, Systematic

The Strategy Window has everything you need to design, develop, validate, and backtest strategies using zero-code drag-and-drop blocks or C# code. But you can also use it to generate and place signals at any time of the day. Just hit the Run Backtest button, click on the Signals view, specify the C2 broker and strategy (account), and select the signals to Place them.

WealthLab's Strategy Window can place Signals from a backtest with C2 at any moment

WealthLab's Strategy Window can place Signals from a backtest with C2 at any moment

In this image, notice how WealthLab's Portfolio Sync logic detected that the Strat C strategy at C2 didn't have a matching ABNB backtest position to exit. Consequently, the Order Manager "errors out" the order instead of placing it. Had you been allowed to shoot yourself in the foot (which you can do with method 7 below), it's likely that the C2 account would have created a undesired short position.

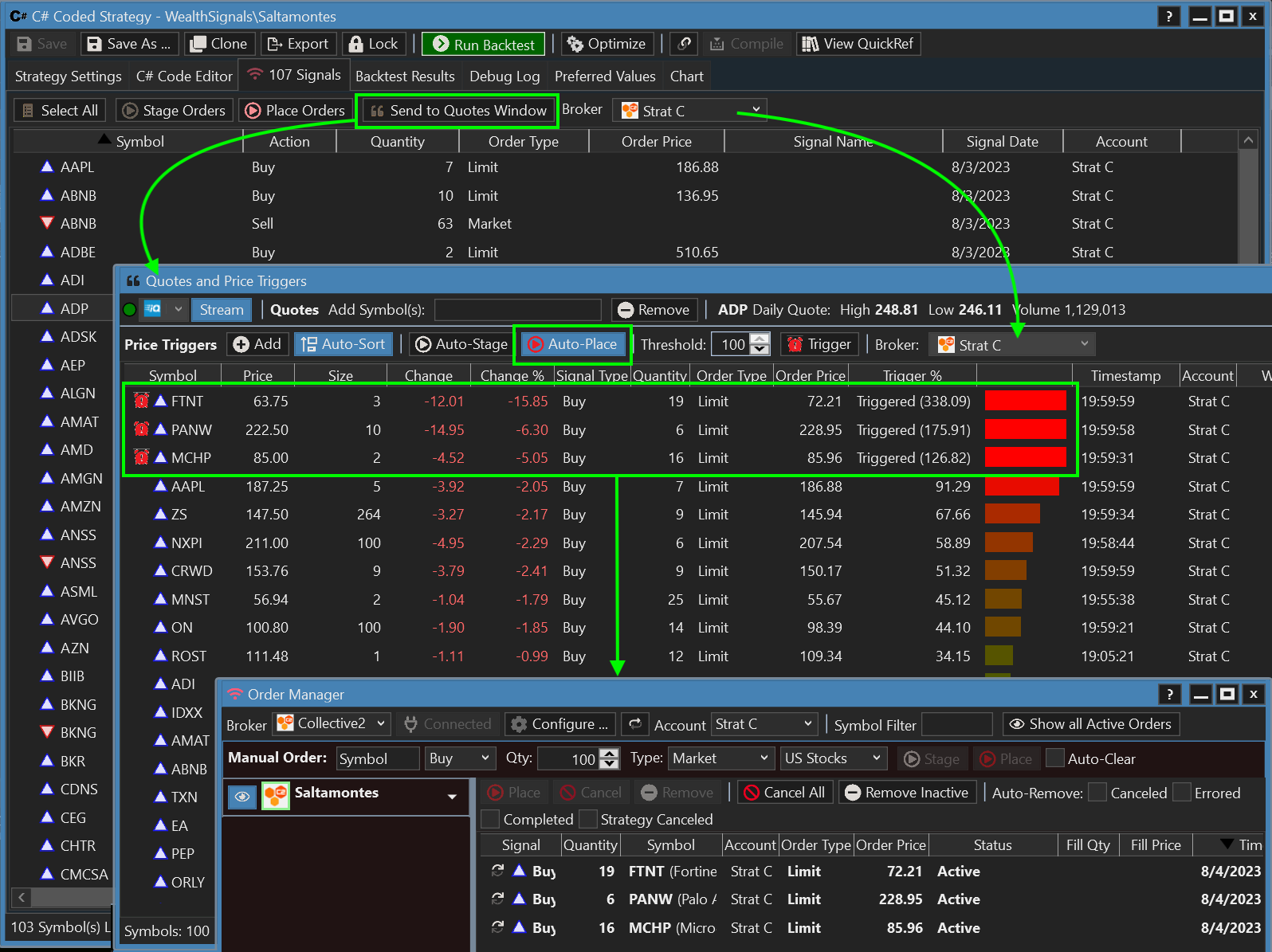

3. Quotes & Triggers

Type: EOD, Systematic or Discretionary

WealthLab's Quotes & Price Triggers (Quotes for short) accesses streaming quotes for symbols to trigger Limit or Stop orders from EOD strategies when their market reaches the order price. Quotes provides a handy way to trade strategies (like Dip buyers) that generate many more Limit/Stop orders a day than you could possibly submit to your Broker/C2 at one time.

You can populate Quotes 3 different ways:

- Send Limit/Stop orders from the Strategy Window Signals view (shown above),

- Send Limit/Stop orders from the Strategy Monitor (discussed below), or,

- Manually, by right clicking and adding a Price Trigger

The previous image shows the Quotes tools monitoring streaming prices for 100 Limit orders, 3 of which triggered and were Auto-Placed and Active at C2 (premarket).

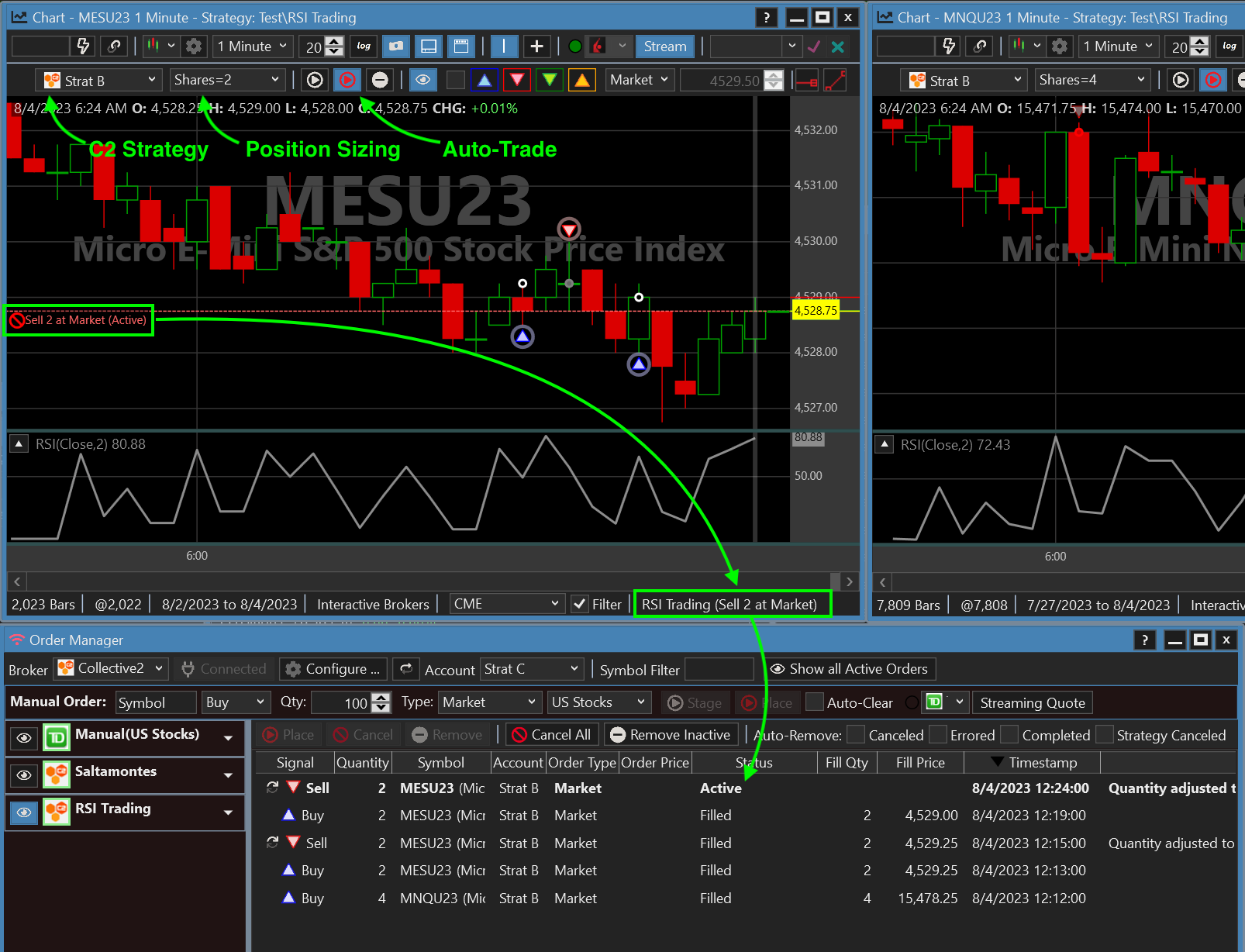

4. Streaming Chart

Type: Intraday, Systematic

If your intraday trading concentrates on one or just a handful of instruments, a streaming chart is a gratifying way to follow the trading action. To set it up, here's the one-time process:

- Open a chart and adjust the scale, e.g., 5-minute bars

- Choose your streaming provider and enable the Stream button

- The Chart Trading toolbar will appear to specify the C2 Strategy, Position Sizing, and Auto-Stage/Place buttons.

- Drag and drop the Trading Strategy into the chart.

- Save the Workspace so that you don't have to repeat the steps

- Check that Auto-Place is enabled!

At the end of each new bar interval, WealthLab executes the trading system on the chart data. Trading signals are automatically placed with C2 if the red Auto-Place button is enabled.

Use Streaming Windows to monitor and execute your intraday trading systems with C2

Use Streaming Windows to monitor and execute your intraday trading systems with C2

5. Streaming Chart with Tradable Trendlines

Type: Intraday, Discretionary

Some traders with ice in their veins can identify short term opportunities without help from a tried and backtested trading system. For that select group of traders, WealthLab's streaming chart toolbar includes a set of buttons to place ad-hoc Buy/Sell/Short/Cover orders at Market, Limit, or Stop.

And, if you like to trade trendlines and price levels, you can use Tradable Horizontal and diagonal trendlines. The Tradables are based on their Drawing toolbar equivalents with the added ability to Auto-Place Market orders when the most-recent closing price crosses (or closes) above or below the line.

Visual and discretionary traders can trade at C2 with streaming chart Trade buttons or Tradable Trendlines

Visual and discretionary traders can trade at C2 with streaming chart Trade buttons or Tradable Trendlines

In the chart example above, the 1-minute close crossed above the diagonal trendline, which Auto-Placed an order for 5 MESU23 contracts at C2.

Note!

Futures symbology differs depending on the broker/data provider. To trade MESU23 at C2, we used WealthLab's broker mapping feature to map MESU23 to @MESU3, the C2 Symbol.

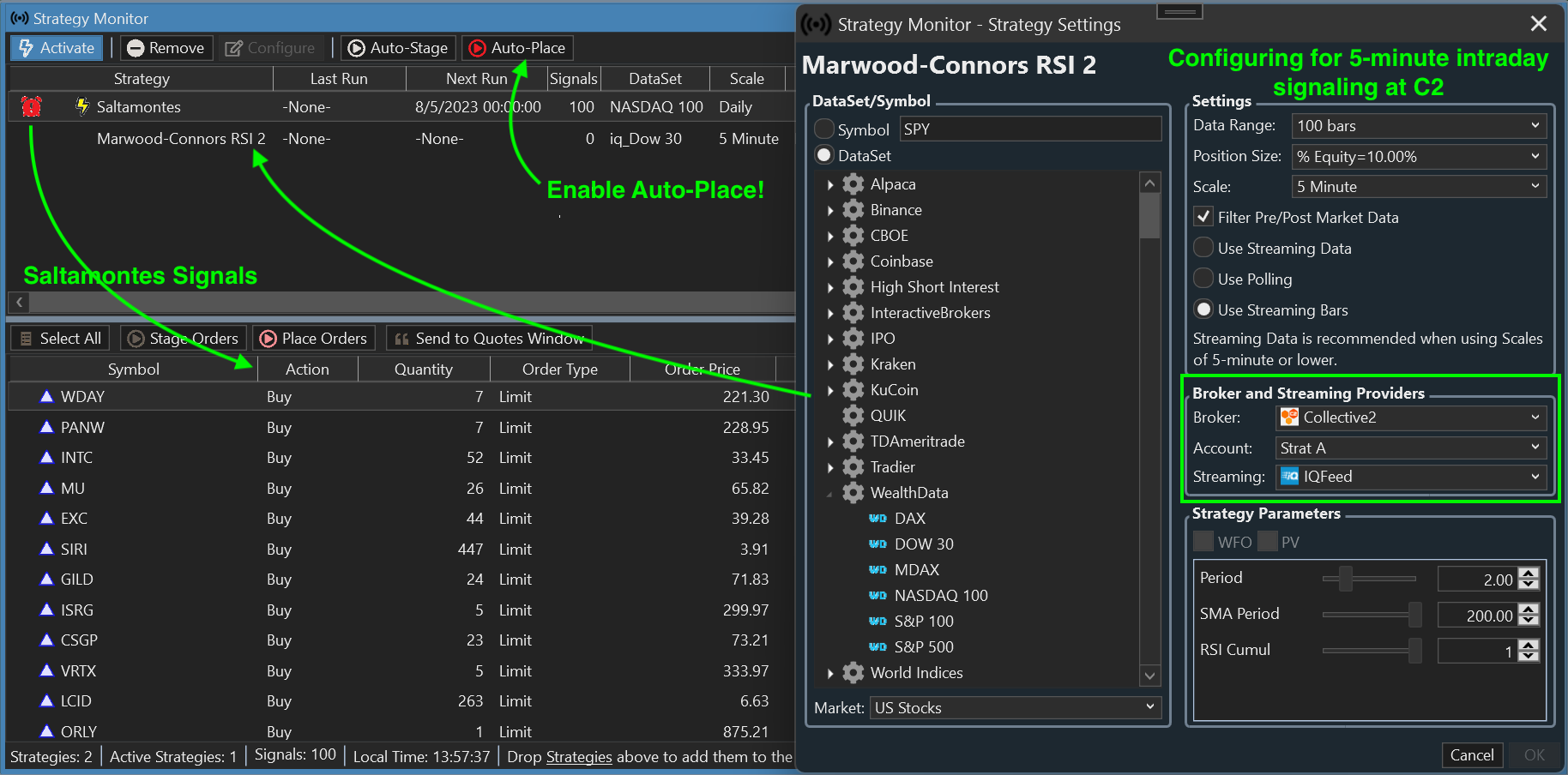

6. Strategy Monitor

Type: Intraday and EOD, Systematic

WealthLab's Strategy Monitor lets you configure store and Auto-Trade one or more Strategies on entire DataSets so that you can manage all trading signals from one location. Each Strategy can have it's own set of custom Parameters, data, scale, position sizing, and streaming provider. For the most demanding trading workloads, the Strategy Monitor will do the heavy lifting!

WealthLab's Strategy Monitor can Auto-Trade multiple strategies on hundreds of instruments simultaneously

WealthLab's Strategy Monitor can Auto-Trade multiple strategies on hundreds of instruments simultaneously

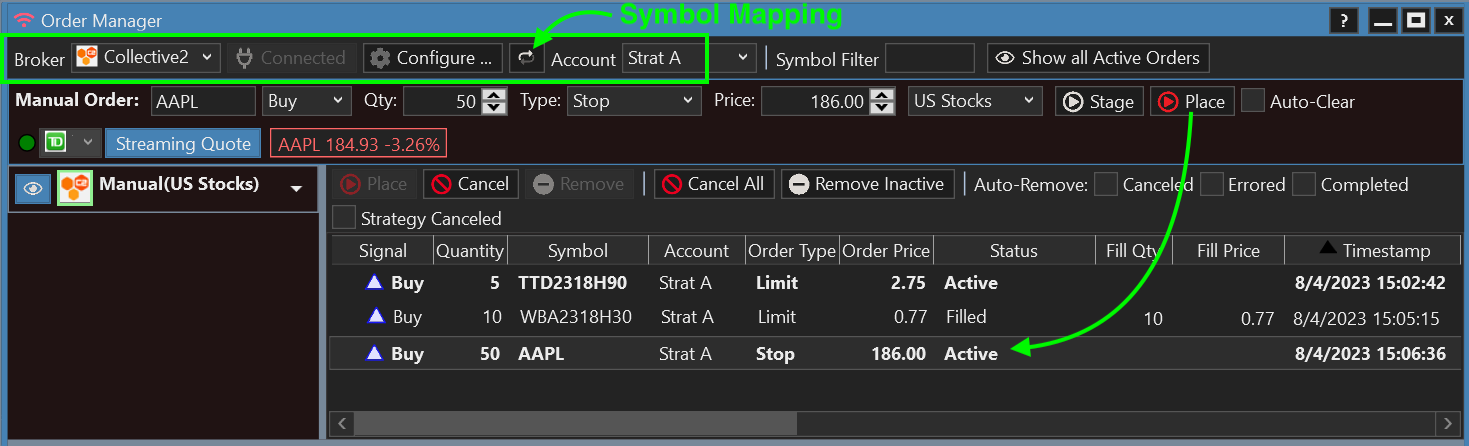

7. Order Manager

Type: Discretionary

Although the Order Manager is a "sink" for trading with many brokers - even at the same time - the Broker selected at the top left is the destination for orders placed from the **Manual Order ** ticket in the toolbar below. When you don't even need a chart to trade, make sure to select Collective2 as the broker and the C2 Strategy as the Account. Then, specify the C2 symbol, order type, price, etc. and click Place to shoot the order right to C2.

In the example below, we've placed manual orders for stocks and options.

WealthLab's Strategy Monitor can Auto-Trade multiple strategies on hundreds of instruments simultaneously

WealthLab's Strategy Monitor can Auto-Trade multiple strategies on hundreds of instruments simultaneously

Caution!

When placing orders manually WealthLab assumes you know what you're doing and doesn't synchronize or double check offsetting positions at the C2 broker. Be careful what you ask for!

Bonus Method! The Screener

Type: EOD, Discretionary, Systematic WealthLab's built in end-of-day Screener processes technical filters for major U.S. Watchlists or even the entire U.S. stock market in a matter of a seconds! A technical filter is easier than it sounds - it's simply the entry logic to any Strategy, and the Screener's result is a list of trading signals. Just select and place the ones you want to C2 Strategy account!

Live Position Synchronization

As briefly mentioned above, WealthLab checks the C2 account value and C2 strategy positions in order to synchronize strategy trading. WealthLab has several Trading Preferences, one of which is Live Positions. When enabled, Live Positions will inject the C2 Account Positions, if they exist, into WealthLab's backtester, allowing the strategy to process in the correct logic - enter or exit - in Streaming Strategy windows and the Strategy Monitor.

C2 Accounts holdings are synchronized in WealthLab's Accounts tool

C2 Accounts holdings are synchronized in WealthLab's Accounts tool

Conclusion

The collaboration between WealthLab and Collective2 gives trading strategy authors (leaders) a comprehensive ecosystem to develop, validate, publish, and monetize their strategies. With WealthLab's powerful backtesting and optimization capabilities combined with Collective2's track record verification, trade replication, and revenue generation features, leaders can gain visibility, build trust, and attract a wider audience of followers.

Download WealthLab for a free 14-day trial!

Already a WealthLabber? Create your Leader account at C2 now!

No Credit Card required.