I have a C# strategy running on 60-min bars, on ten IQ Feed symbols. I ran the backtest in the morning, and it showed three signals at 10:30. I then activated the strategy in Strategy Monitor and watched the log pane throughout the day. At the designated times there was an entry "Ran strategy on . . . : 0 signals, run time xxx ms."

I also manually ran the strategy backtest around each hour. There were no signals during the day from the backtests.

I kept WL running, with the computer in sleep mode. This morning, I ran the backtest and there were no new signals. I re-started WL, and there were seven signals that I did not see yesterday after the first three at 10:30.

Two questions: why did the backtests not detect the signals, and can I expect to somehow set up Strategy Monitor to detect signals throughout the day ?

I also manually ran the strategy backtest around each hour. There were no signals during the day from the backtests.

I kept WL running, with the computer in sleep mode. This morning, I ran the backtest and there were no new signals. I re-started WL, and there were seven signals that I did not see yesterday after the first three at 10:30.

Two questions: why did the backtests not detect the signals, and can I expect to somehow set up Strategy Monitor to detect signals throughout the day ?

Rename

1. How does the Strategy Settings dialog look like (SM)?

2. What is the largest lookback period in this strategy?

2. What is the largest lookback period in this strategy?

The longest lookback is 140 bars.

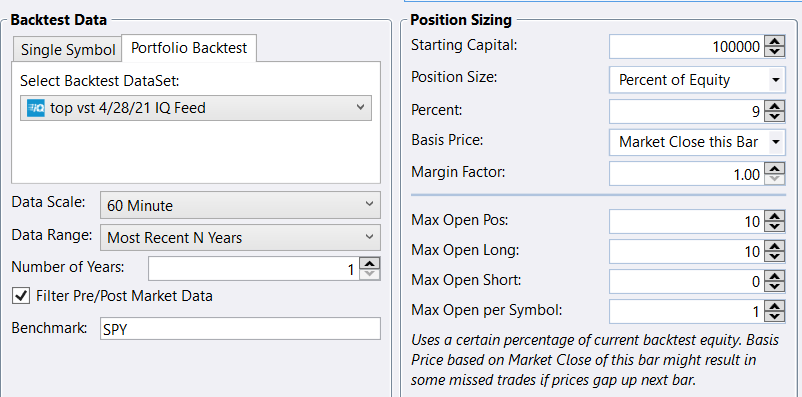

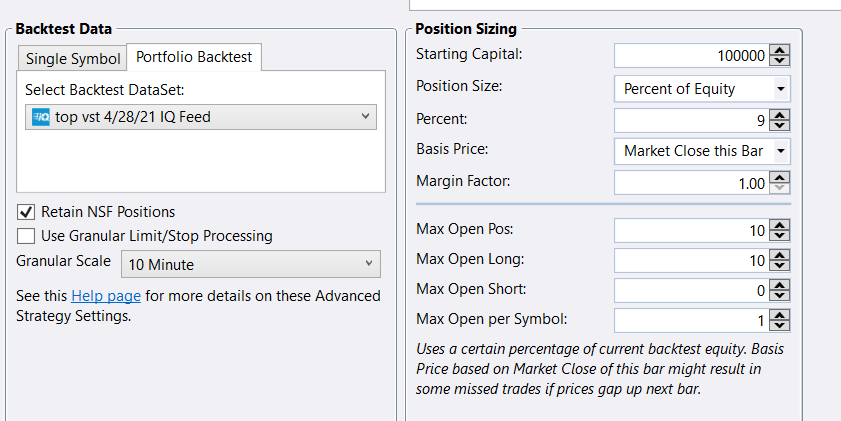

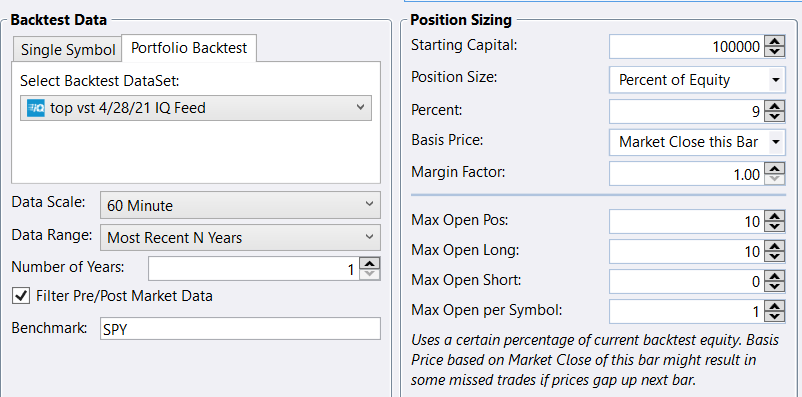

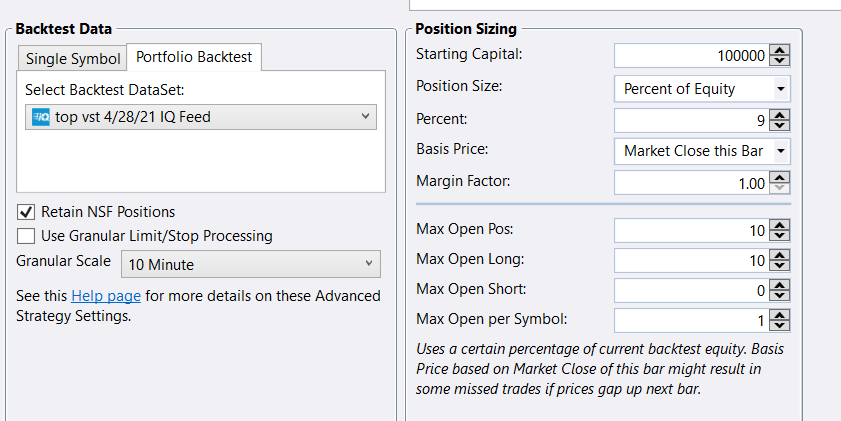

The screenshots of the settings are attached.

The screenshots of the settings are attached.

It could be a subtle error in Strategy coding of some kind. Can you reproduce this behavior using some plain vanilla Blocks strategy?

Another potential pitfall that can cause the set of trades to change is the usage of progressively-calculated indicators which reduce lag at the price of having their initial values unstable. After they stabilize (usually after 3-4 times their lookback period) they're safe to use. Given the 140-period lookback and 1 year of data it's less likely (1800+ hours in a year, enough to stabilize such indicator). However, here I assume you now get the full year of intraday data from IQFeed and the stocks in your DataSet aren't IPOs.

Another potential pitfall that can cause the set of trades to change is the usage of progressively-calculated indicators which reduce lag at the price of having their initial values unstable. After they stabilize (usually after 3-4 times their lookback period) they're safe to use. Given the 140-period lookback and 1 year of data it's less likely (1800+ hours in a year, enough to stabilize such indicator). However, here I assume you now get the full year of intraday data from IQFeed and the stocks in your DataSet aren't IPOs.

Re: 60-min bars.

Are you using the IQFeed Regular Session Open option?

Do you have a picture of the S. Monitor settings?

Are you using the IQFeed Regular Session Open option?

Do you have a picture of the S. Monitor settings?

Your Response

Post

Edit Post

Login is required