Below is a new WL8 community indicator that could be useful in upcoming market situations and/or a top N rotation ranking system.

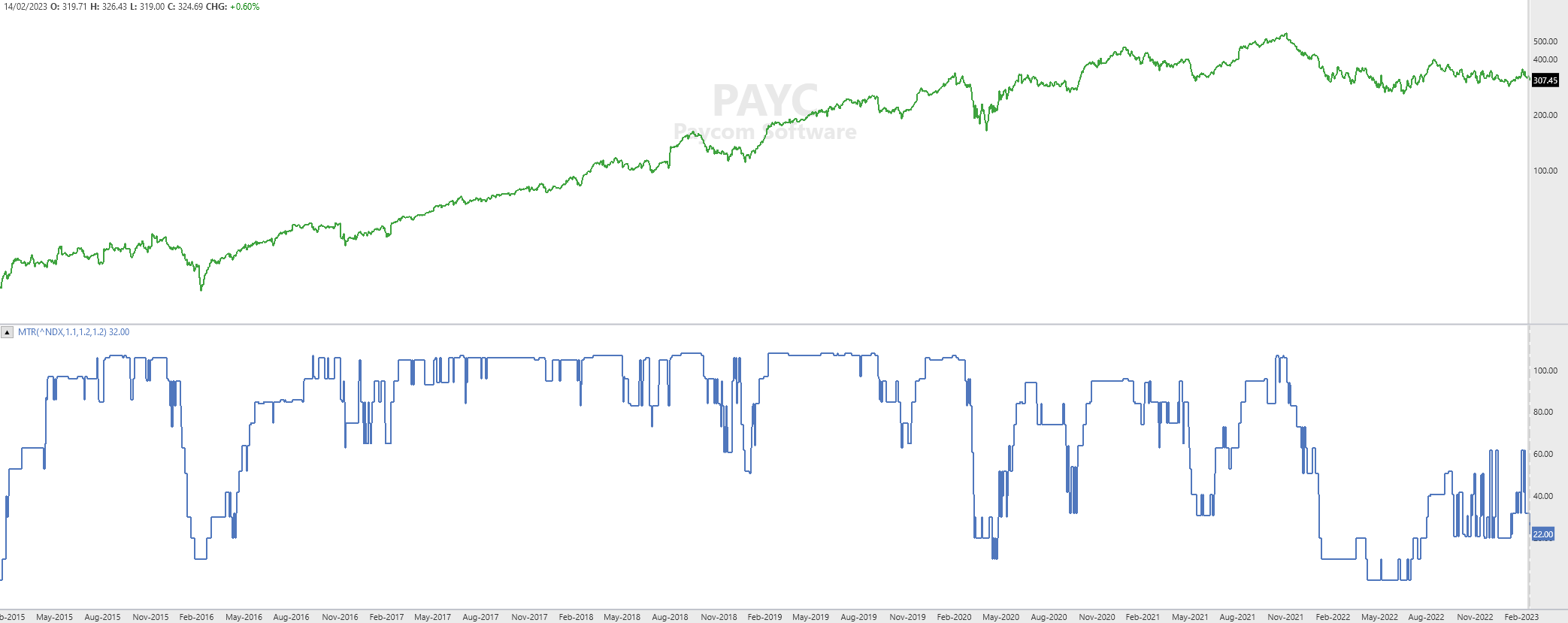

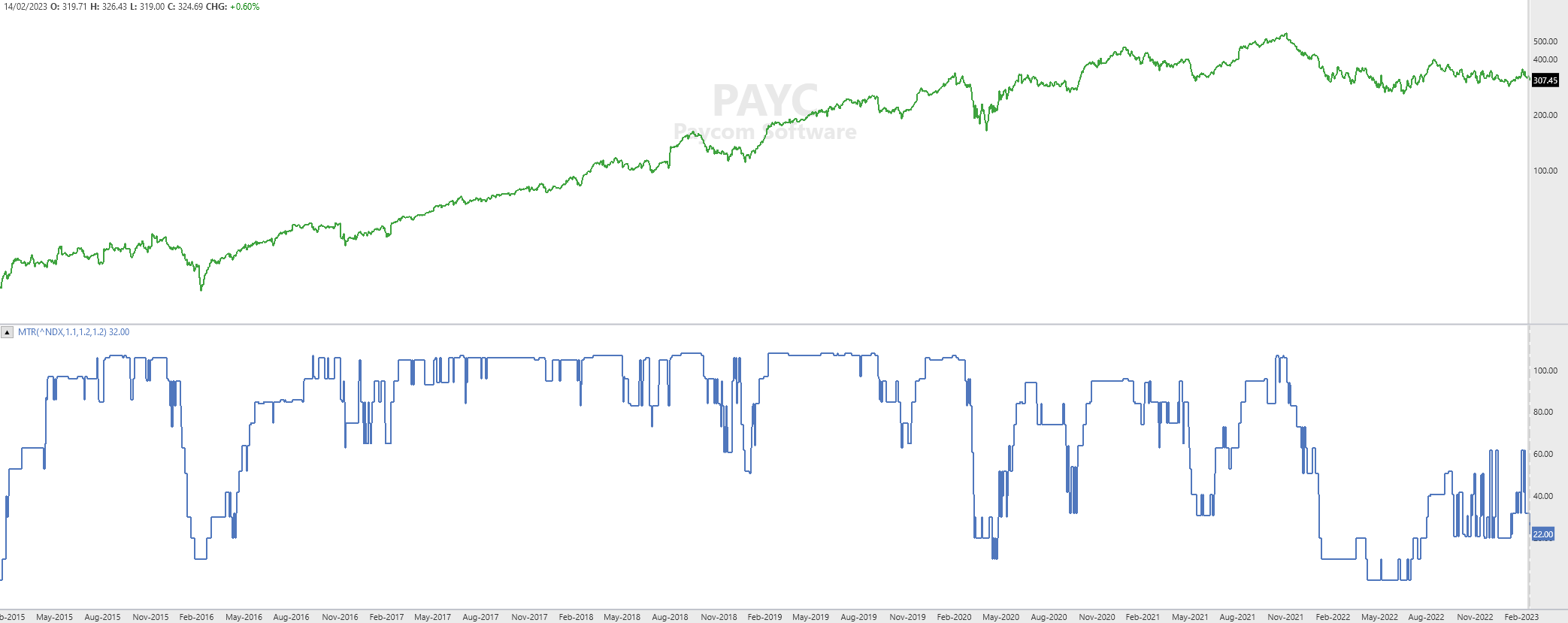

The Minervini Trend Ratio (MTR) combines several moving averages as well as closing prices in relation to the 52-week high / 52-week low and the Mansfield RS to determine a trend direction to show the current potential. A total of 10 criteria are used, which are compared with each other resulting in a ratio. The condition is considered to be met if the ratio is 90 or greater. Strong trends should be greater than 100.

The Minervini Trend Ratio (MTR) combines several moving averages as well as closing prices in relation to the 52-week high / 52-week low and the Mansfield RS to determine a trend direction to show the current potential. A total of 10 criteria are used, which are compared with each other resulting in a ratio. The condition is considered to be met if the ratio is 90 or greater. Strong trends should be greater than 100.

CODE:

using System; using System.Collections.Generic; using System.Drawing; using System.Text; using WealthLab.Core; using WealthLab.Indicators; namespace WealthLab.Indicators { public class MinerviniTrendRatio : IndicatorBase { public MinerviniTrendRatio() : base() { } public MinerviniTrendRatio(BarHistory source, String rsSymbol, double sma200Up5MonthsMultiplier, double priceUp70Pctg52WeekLowMultiplier, double priceWithin25Pctg52WeekHighMultiplier) : base() { Parameters[0].Value = source; Parameters[1].Value = rsSymbol; Parameters[2].Value = sma200Up5MonthsMultiplier; Parameters[3].Value = priceUp70Pctg52WeekLowMultiplier; Parameters[4].Value = priceWithin25Pctg52WeekHighMultiplier; Populate(); } public static MinerviniTrendRatio Series(BarHistory source, String rsSymbol, double sma200Up5MonthsMultiplier, double priceUp70Pctg52WeekLowMultiplier, double priceWithin25Pctg52WeekHighMultiplier) { string key = CacheKey("MinerviniTrendRatio", rsSymbol, sma200Up5MonthsMultiplier, priceUp70Pctg52WeekLowMultiplier, priceWithin25Pctg52WeekHighMultiplier); if (source.Cache.ContainsKey(key)) return (MinerviniTrendRatio)source.Cache[key]; MinerviniTrendRatio mttr = new MinerviniTrendRatio(source, rsSymbol, sma200Up5MonthsMultiplier, priceUp70Pctg52WeekLowMultiplier, priceWithin25Pctg52WeekHighMultiplier); source.Cache[key] = mttr; return mttr; } protected override void GenerateParameters() { AddParameter("Source", ParameterType.BarHistory, PriceComponent.Close); AddParameter("Relative Strength Index", ParameterType.String, "$NDX"); AddParameter("Multiplier: SMA 200 trending up at least 5 months", ParameterType.Double, 1.1); AddParameter("Multiplier: Price at least 70% above 52 Week Low", ParameterType.Double, 1.2); AddParameter("Multiplier: Price within 25% of 52 Week High", ParameterType.Double, 1.2); } public override string Name { get { return "Minervini Trend Ratio"; } } public override string Abbreviation { get { return "MTR"; } } public override string HelpDescription { get { return "The Minervini Trend Ratio combines several moving averages as well as closing prices in relation to the 52-week high / 52-week low and the Mansfield relative strength to determine a trend direction to show the current potential. A total of 10 criteria are used, which are compared with each other resulting in a ratio. The condition is considered to be met if the ratio is 90 or greater. Strong trends should be greater than 100."; } } public override string PaneTag { get { return "Minervini Trend Ratio"; } } public override PlotStyle DefaultPlotStyle { get { return PlotStyle.Line; } } public override WLColor DefaultColor { get { return WLColor.CornflowerBlue; } } public override void Populate() { BarHistory bars = Parameters[0].AsBarHistory; String indexSymbol = Parameters[1].AsString; double sma200Up5MonthsMultiplier = Parameters[2].AsDouble; double priceUp70Pctg52WeekLowMultiplier = Parameters[3].AsDouble; double priceWithin25Pctg52WeekHighMultiplier = Parameters[4].AsDouble; DateTimes = bars.DateTimes; if (bars.Count == 0 || bars.Count < 200) return; BarHistory indexDailyBars = WLHost.Instance.GetHistory(indexSymbol, bars.Scale, DateTime.MinValue, DateTime.MaxValue, bars.Count, null); TimeSeries minerviniRatio = new TimeSeries(bars.DateTimes); TimeSeries mansfieldRs = new TimeSeries(bars.DateTimes); mansfieldRs = SMA.Series(((((bars.Close / indexDailyBars.Close) * 100) / SMA.Series(((bars.Close / indexDailyBars.Close) * 100), 200)) - 1) * 100, 5); Lowest minervini52WeeklsLow = new Lowest(bars.Low, 252); Highest minervini52WeeklsHigh = new Highest(bars.High, 252); SMA minerviniSma20 = new SMA(bars.Close, 20); SMA minerviniSma50 = new SMA(bars.Close, 50); SMA minerviniSma150 = new SMA(bars.Close, 150); SMA minerviniSma200 = new SMA(bars.Close, 200); ConsecUp minerviniConsecUpSma200 = new ConsecUp(minerviniSma200, 1); for (int idx = 0; idx < bars.Count; idx++) { bool condition1 = bars.Close[idx] > minerviniSma150[idx] && bars.Close[idx] > minerviniSma200[idx]; bool condition2 = minerviniSma150[idx] > minerviniSma200[idx]; bool condition3 = minerviniConsecUpSma200[idx] >= 21; bool condition4 = minerviniConsecUpSma200[idx] >= (5 * 21); bool condition5 = minerviniSma50[idx] > minerviniSma150[idx] && minerviniSma50[idx] > minerviniSma200[idx]; bool condition6 = bars.Close[idx] > minerviniSma50[idx]; bool condition7 = idx - 252 >= 0 && (bars.Close[idx] > minervini52WeeklsLow[idx] * (1.0 + (30.00 / 100.0))); bool condition8 = idx - 252 >= 0 && (bars.Close[idx] > minervini52WeeklsLow[idx] * (1.0 + (70.00 / 100.0))); bool condition9 = bars.Close[idx] >= (0.75 * minervini52WeeklsHigh[idx]); double cumulatedRatio = 0; int conditionCount = 10; cumulatedRatio += condition1 ? (100 / conditionCount) : 0; cumulatedRatio += condition2 ? (100 / conditionCount) : 0; cumulatedRatio += condition3 ? (100 / conditionCount) : 0; cumulatedRatio += condition4 ? (100 / conditionCount) * sma200Up5MonthsMultiplier : 0; cumulatedRatio += condition5 ? (100 / conditionCount) : 0; cumulatedRatio += condition6 ? (100 / conditionCount) : 0; cumulatedRatio += condition7 ? (100 / conditionCount) : 0; cumulatedRatio += condition8 ? (100 / conditionCount) * priceUp70Pctg52WeekLowMultiplier : 0; cumulatedRatio += condition9 ? (100 / conditionCount) * priceWithin25Pctg52WeekHighMultiplier : 0; double mrsRatio = mansfieldRs[idx] > 30 ? (100 / 10) * 1.3 : mansfieldRs[idx] > 20 ? (100 / 10) * 1.2 : mansfieldRs[idx] > 10 ? (100 / 10) * 1.1 : mansfieldRs[idx] > 0 ? (100 / 10) : 0; cumulatedRatio += mrsRatio; Values[idx] = cumulatedRatio; } } } }

Rename

It's added to WL8ExtensionDemos (and soon to be included in B33):

https://github.com/LucidDion/WL8ExtensionDemos/commits/master

Many thanks for sharing your work with the community!

https://github.com/LucidDion/WL8ExtensionDemos/commits/master

Many thanks for sharing your work with the community!

Please add to Community Indicators also.

fwiw, there's a [lack of] synchronization error in the code above.

Anyone else getting "Could not compile" when trying to use MTR in a system test?

When scrolling down through the available indicators using the block method MTR shows up twice.

The indicator works fine on an individual chart but not in a system as a filter.

When scrolling down through the available indicators using the block method MTR shows up twice.

The indicator works fine on an individual chart but not in a system as a filter.

It's duplicated on your PC, perhaps you saved it as a custom indicator.

Your Response

Post

Edit Post

Login is required