When I use the same-date scramble in the Monte Carlo Analysis, what is that actually doing? Is that taking NSF positions and putting them in the backtest? Basically mixing up which positions are taken and which are not?

Does it matter if I have a transaction weight assigned?

Does it matter if I have a transaction weight assigned?

Rename

QUOTE:

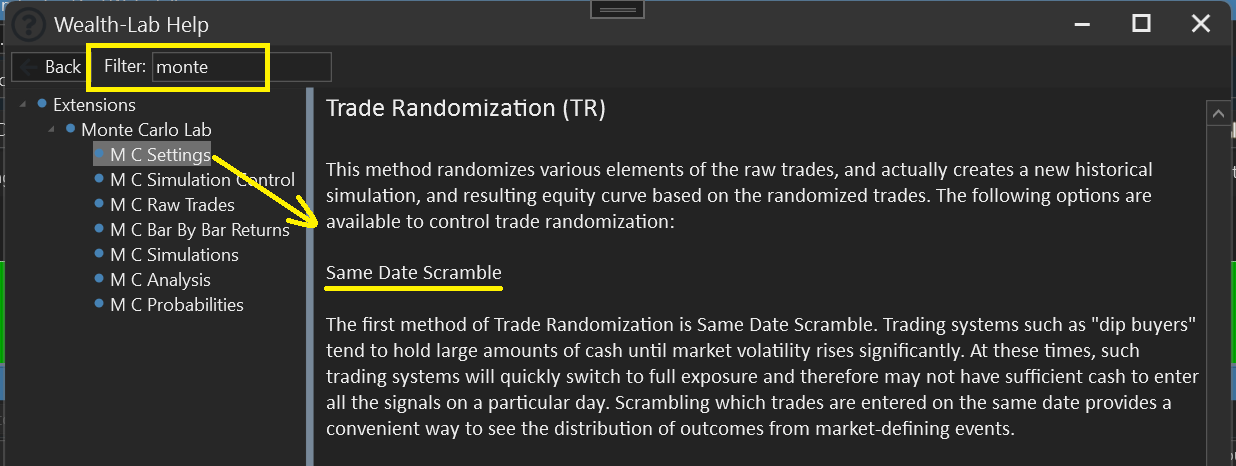

When I use the same-date scramble in the Monte Carlo Analysis, what is that actually doing? Is that taking NSF positions and putting them in the backtest?

At the beginning of this section, it's stated:

Important!

Monte Carlo works with the list of raw trades generated by a backtest. To feed Monte Carlo with the most possible sample trades, make sure to run the baseline backtest with Retain NSF Position checked in Advanced Strategy Settings. This will ensure that even the trades that were rejected by the baseline simulation are used for Trade Randomizations.

QUOTE:No.

Does it matter if I have a transaction weight assigned?

The Same Date scramble is "usually" equivalent to NOT assigning Transaction weight and hitting "Run Strategy" hundreds of times. "Usually" because a strategy's logic could also change depending on the specific trades it takes.

This is very useful as for some dip buying strategies there are many signals and most are not taken.

Interestingly when I tested this on a sample strategy - 17 liner - the best performance was way below the back test.

Does this suggest weighting in 17 liner is actually working well?

Interestingly when I tested this on a sample strategy - 17 liner - the best performance was way below the back test.

Does this suggest weighting in 17 liner is actually working well?

Same date scramble isn't the right choice for the Seventeen Liner that uses Market orders - and even many of them for the same symbol on the same date. A major part of the strategy logic is prioritizing the signals by weight based on an esoteric combination of indicators.

Use Same-Date scramble for Limit/Stop strategies whose backtest have a high NSF count.

Use Same-Date scramble for Limit/Stop strategies whose backtest have a high NSF count.

Thanks Cone

Just for clarity - are you saying that Same Date Scramble should not be used for a system with market orders in a more general sense?

What about a system that produces a lot of daily trade signals (different symbols)for market orders, next bar at open. where there is a high NSF count?

Just for clarity - are you saying that Same Date Scramble should not be used for a system with market orders in a more general sense?

What about a system that produces a lot of daily trade signals (different symbols)for market orders, next bar at open. where there is a high NSF count?

All Stop/Limit entry orders are "possible" candidates at the beginning of the day, and there's no way to know which ones will eventually be marketable*. That's far different than a Market order strategy.

*The exception are those that will execute on the open. You can often determine those by monitoring premarket activity.

You should use Transaction.Weight for strategies that use Market orders. There is no other way to trade it. It's deterministic (not random) that way, but you can certainly run MonteCarlo on all the possibilities to get a sense of a median return.

*The exception are those that will execute on the open. You can often determine those by monitoring premarket activity.

You should use Transaction.Weight for strategies that use Market orders. There is no other way to trade it. It's deterministic (not random) that way, but you can certainly run MonteCarlo on all the possibilities to get a sense of a median return.

Your Response

Post

Edit Post

Login is required