Hello fellow Wealthlabers!

What if We create and keep a space of discussion about "Strategy (signals) Filters"?

Filtering signals is a key, dynamic and complex step for both professional and newbies, in order to make a strategy profitable.

The idea is to share ideas that could help us to create better strategies upon our creativity and mutual support, also sharing problems related to filtering signals.

If you like the idea. I will be enthusiast on sharing my ideas and of course learning from the experts!

What if We create and keep a space of discussion about "Strategy (signals) Filters"?

Filtering signals is a key, dynamic and complex step for both professional and newbies, in order to make a strategy profitable.

The idea is to share ideas that could help us to create better strategies upon our creativity and mutual support, also sharing problems related to filtering signals.

If you like the idea. I will be enthusiast on sharing my ideas and of course learning from the experts!

Rename

You mean to say a new Tag? (We don't need more forums than we have).

Anything to get this discussion forum transformed into something more than a "bug report" board :) I'm eager to hear your signal ideas, we can discuss here using the #Strategy tag.

Humans have sentiment (some of them don't)....

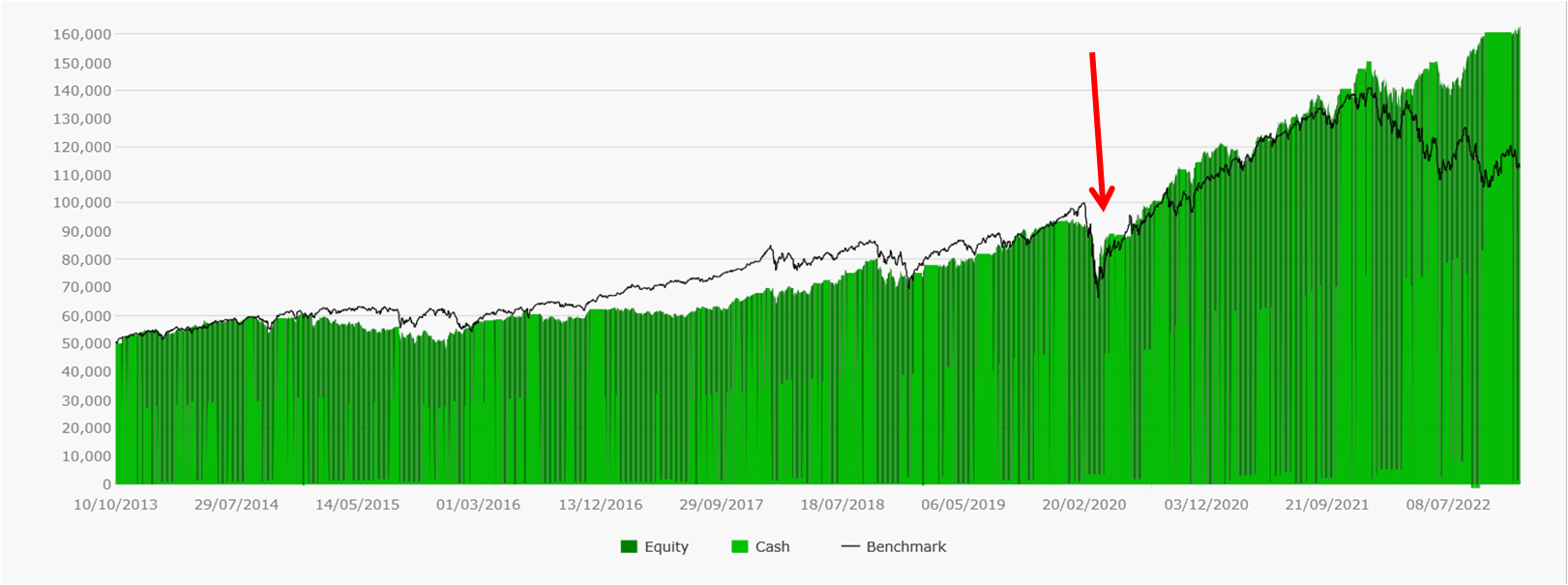

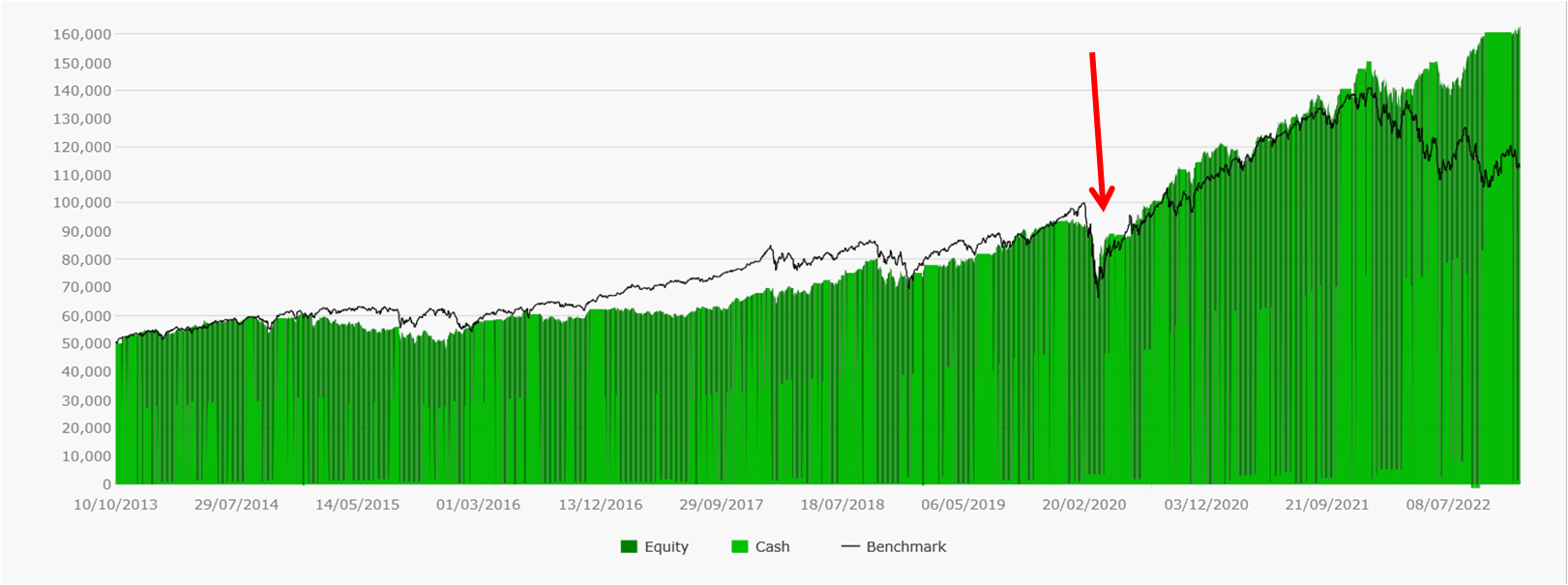

I am running a trend following swing strategy. How could I filter an event such of March 2020?

Market Sentiment compares advancing with declining issues and behaves as an oscillator. All the filter idea is based on comparing this indicator with its Moving Average (indicator of indicator) in order to filter periods when sentiment is low thus the possibilities of "long" success is low.

Next is the result of applying this technique over previous trend following strategy.

It's a very simple idea and probably you are using it, but the purpose of this theme is to use this space to share and asking questions that could help us to learn and improve our profitable strategies.

Feel free to share your way to apply this indicator or any other. Filtering signals is very important, and I want to learn from you and read about different ways to do things.

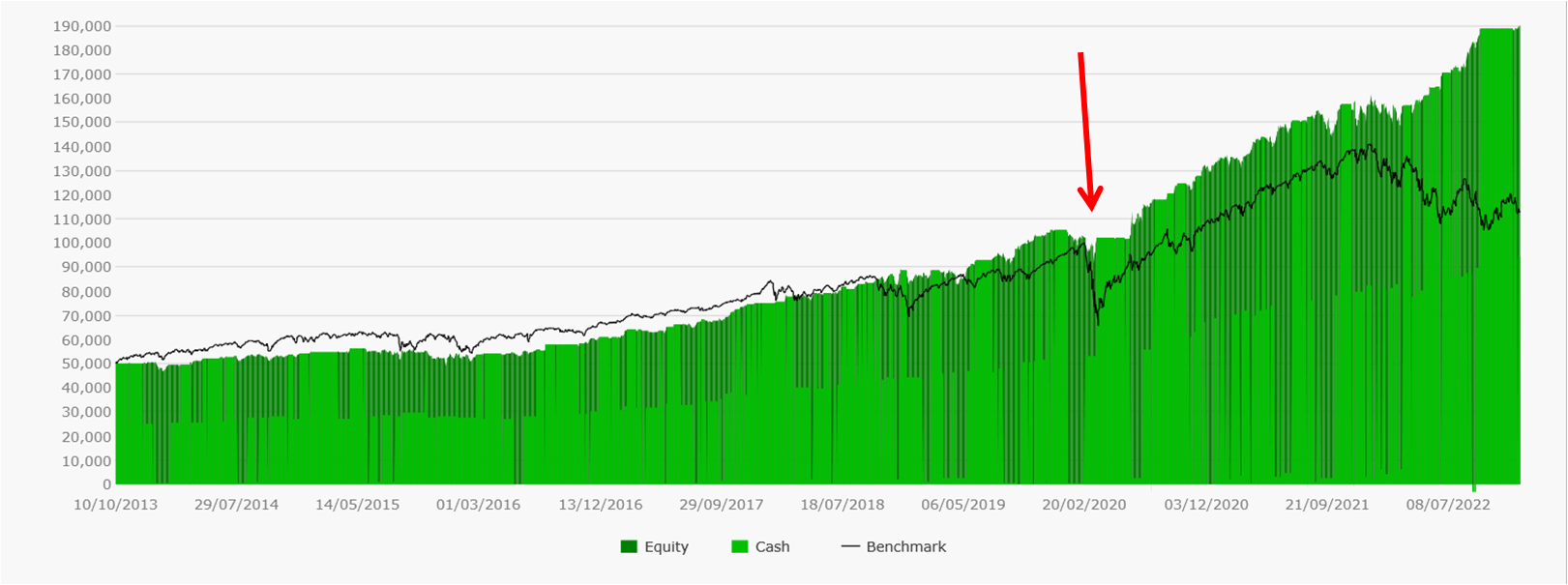

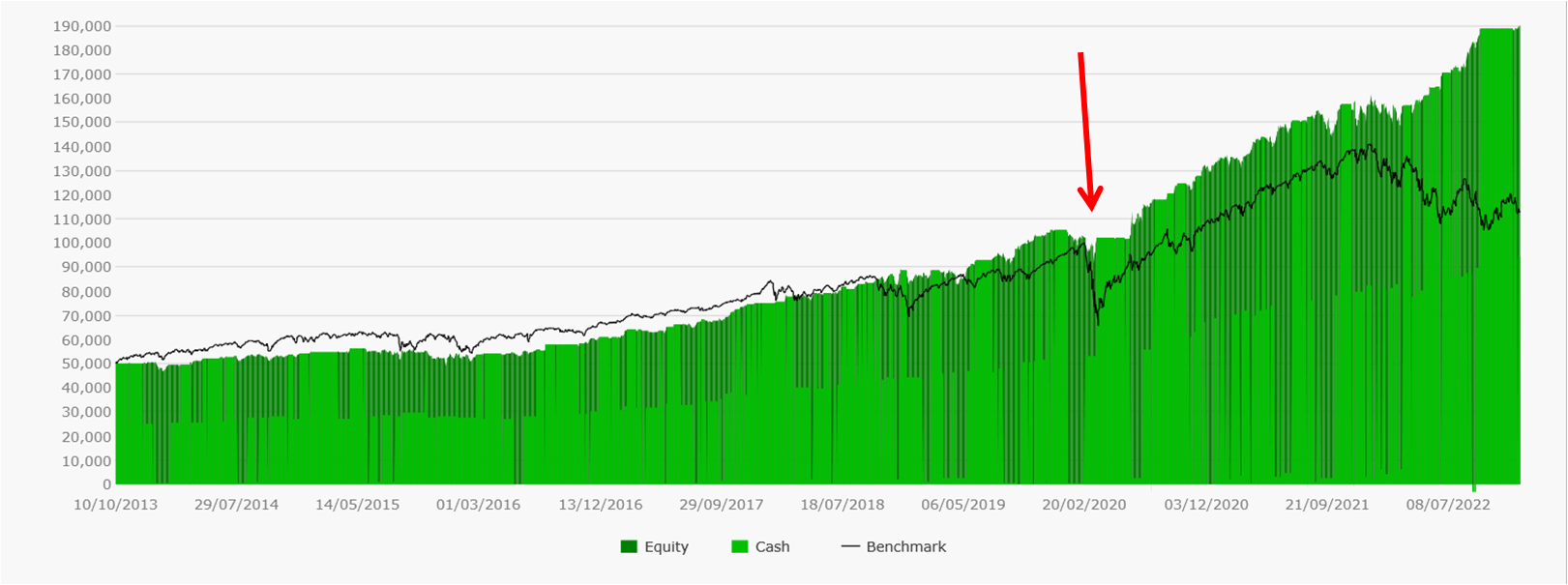

I am running a trend following swing strategy. How could I filter an event such of March 2020?

Market Sentiment compares advancing with declining issues and behaves as an oscillator. All the filter idea is based on comparing this indicator with its Moving Average (indicator of indicator) in order to filter periods when sentiment is low thus the possibilities of "long" success is low.

Next is the result of applying this technique over previous trend following strategy.

It's a very simple idea and probably you are using it, but the purpose of this theme is to use this space to share and asking questions that could help us to learn and improve our profitable strategies.

Feel free to share your way to apply this indicator or any other. Filtering signals is very important, and I want to learn from you and read about different ways to do things.

Great, I recall it was discussed in Avoiding April 2020 DD - still don't see the need in any new forums.

Indeed this was already mentioned some time ago. At the time, I didn’t contribute much because I agree with what DrKoch wrote: a posteriori, you can always find some filter that would have taken you out of a jam; only for it to let you down when the next catastrophic drop happens.

The best is definitely to keep the leverage down. The problem of doing so is that it prevents the strategy from working at its potential, when things are safer (the other 80-90% of the time).

One thing that I want to try, is to play with advanced position sizers that will size the position depending on the VIX index. This past year, I did quite a few trades (both long and short) with the VIX futures; and some things seem evident:

- when it is too low (lately that would be around 20 or less), then the market participants are getting to complacent and a sharp drop will eventually happen soon; during this time, I would then start deleveraging.

- when it start rising fast: if you only bet on the long side, it’s usually better to stay away!

- when it is too high (lately that would be 30+), then a lot of market participants are already panicking; usually this can be a good time to buy (when everyone else is selling); however the VIX history shows us that it can get very extreme (even 70)…

- when it is falling quickly, it’s usually time to start adding up.

Like I said, I want to play with it; but didn’t yet had the chance; so it could very well be that this is just another seemingly good idea that is not proven when doing a proper backtesting - and that’s what Wealth-Lab is for!

The best is definitely to keep the leverage down. The problem of doing so is that it prevents the strategy from working at its potential, when things are safer (the other 80-90% of the time).

One thing that I want to try, is to play with advanced position sizers that will size the position depending on the VIX index. This past year, I did quite a few trades (both long and short) with the VIX futures; and some things seem evident:

- when it is too low (lately that would be around 20 or less), then the market participants are getting to complacent and a sharp drop will eventually happen soon; during this time, I would then start deleveraging.

- when it start rising fast: if you only bet on the long side, it’s usually better to stay away!

- when it is too high (lately that would be 30+), then a lot of market participants are already panicking; usually this can be a good time to buy (when everyone else is selling); however the VIX history shows us that it can get very extreme (even 70)…

- when it is falling quickly, it’s usually time to start adding up.

Like I said, I want to play with it; but didn’t yet had the chance; so it could very well be that this is just another seemingly good idea that is not proven when doing a proper backtesting - and that’s what Wealth-Lab is for!

From my experience filters (Indicators used in conditions) are the single most important ingredient which turn a trading strategy form "nice" to "very good".

These filters can be used in various places of a trading strategy:

1) Entry filters: Issue an entry order only if an indicator is above/below some threshold value

2) Entry Weights (A WL-special): a carefully choosen weight (based on some indicator values) can improve performance dramatically. (See the OnNight family of pubished trading strategies and the WL ranking)

3) Position-Sizing: Make your position size/risk dependent on some indicator. This can make the strategies equity curve much smoother.

4) Exits: Choose among various exits based on indicator values and/or postpone an exit until some conditions are met.

5) Crashes: (see Post #3): Try to predict or recognize a crash and stop trading until the storm is over.

I have plenty ideas and working software (yes, there is an upcoming extension) for 1), 2) and 3).

But I am rather clueless with 4) and 5).

Are there any hints or ideas?

These filters can be used in various places of a trading strategy:

1) Entry filters: Issue an entry order only if an indicator is above/below some threshold value

2) Entry Weights (A WL-special): a carefully choosen weight (based on some indicator values) can improve performance dramatically. (See the OnNight family of pubished trading strategies and the WL ranking)

3) Position-Sizing: Make your position size/risk dependent on some indicator. This can make the strategies equity curve much smoother.

4) Exits: Choose among various exits based on indicator values and/or postpone an exit until some conditions are met.

5) Crashes: (see Post #3): Try to predict or recognize a crash and stop trading until the storm is over.

I have plenty ideas and working software (yes, there is an upcoming extension) for 1), 2) and 3).

But I am rather clueless with 4) and 5).

Are there any hints or ideas?

Your Response

Post

Edit Post

Login is required