Hello guys.

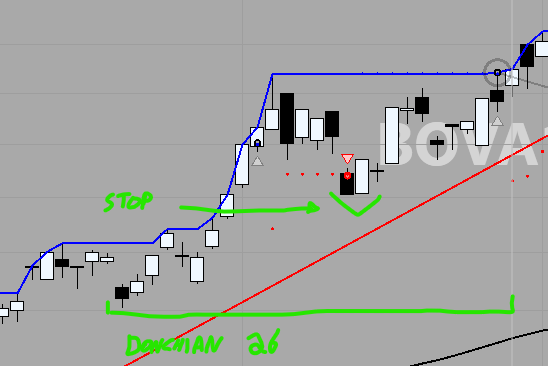

I have a system where I buy when prices break a donchian upper after a pullback and the stop is set right under the bottom of this pullback.

Is there any way to implement this? Because, let's say my donchian upper is 30 periods. The pullback can be 2 bars, 5 bars, 28 bars... and in this variable period, I should use the lowest value, but only the lowest value of the pullback.

Thanks in advance.

I have a system where I buy when prices break a donchian upper after a pullback and the stop is set right under the bottom of this pullback.

Is there any way to implement this? Because, let's say my donchian upper is 30 periods. The pullback can be 2 bars, 5 bars, 28 bars... and in this variable period, I should use the lowest value, but only the lowest value of the pullback.

Thanks in advance.

Rename

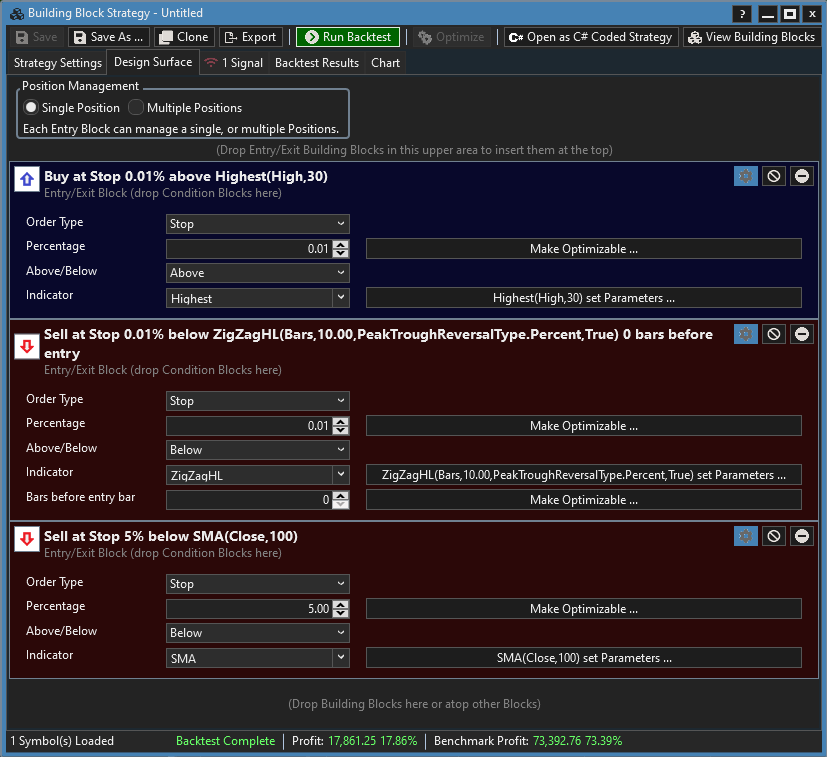

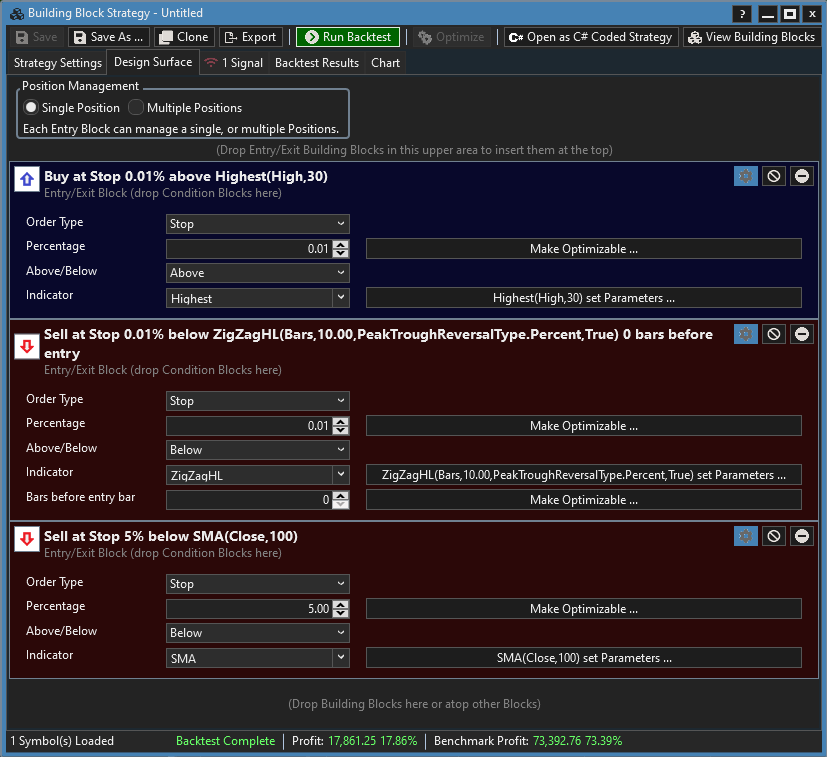

You can ALMOST do it like this with blocks... (this has an exit below a moving average for a profit/stop.)

The problem is that the ZigZigHL indicator only returns values for the bars at peaks and troughs. (We should add an option to change that for building block strategies.)

Anyway, you can make it work like this:

1. Click Open as a C# Strategy

2. Add this to the end of the Initialize()

You'll need to work on your other exit(s) in the blocks, so do that first, add the SellAtStop ZigZagHL rule last, and finally open as C# to modify the code.

The problem is that the ZigZigHL indicator only returns values for the bars at peaks and troughs. (We should add an option to change that for building block strategies.)

Anyway, you can make it work like this:

1. Click Open as a C# Strategy

2. Add this to the end of the Initialize()

CODE:

// where source2 is the variable assign to the ZigZagHL indicator for (int n = 1; n < bars.Count; n++) { if (source2[n] == Double.NaN) source2[n] = source2[n - 1]; }

You'll need to work on your other exit(s) in the blocks, so do that first, add the SellAtStop ZigZagHL rule last, and finally open as C# to modify the code.

Hi Cone, thanks for your help!

Just let me understand what is going wrong here.

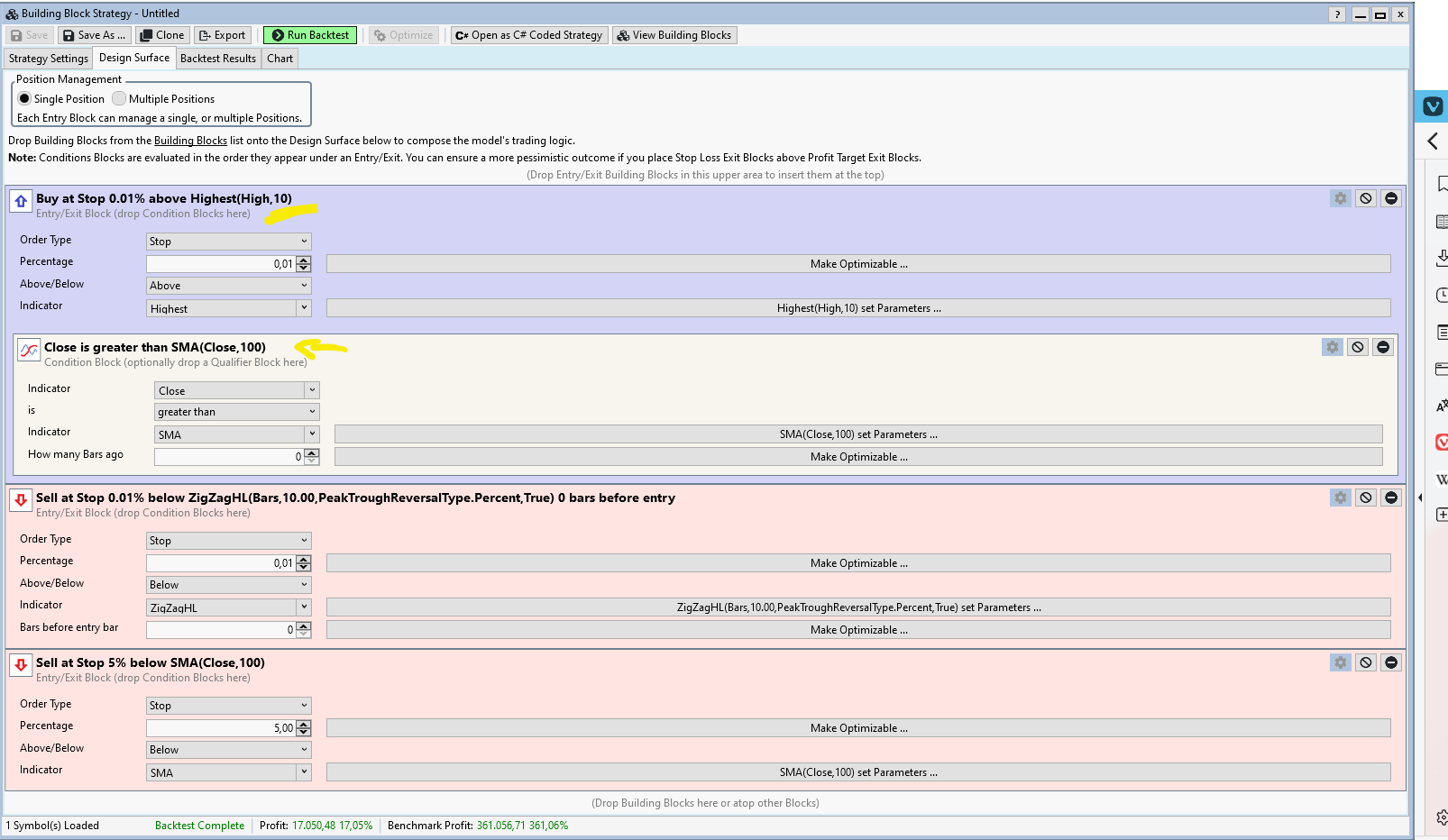

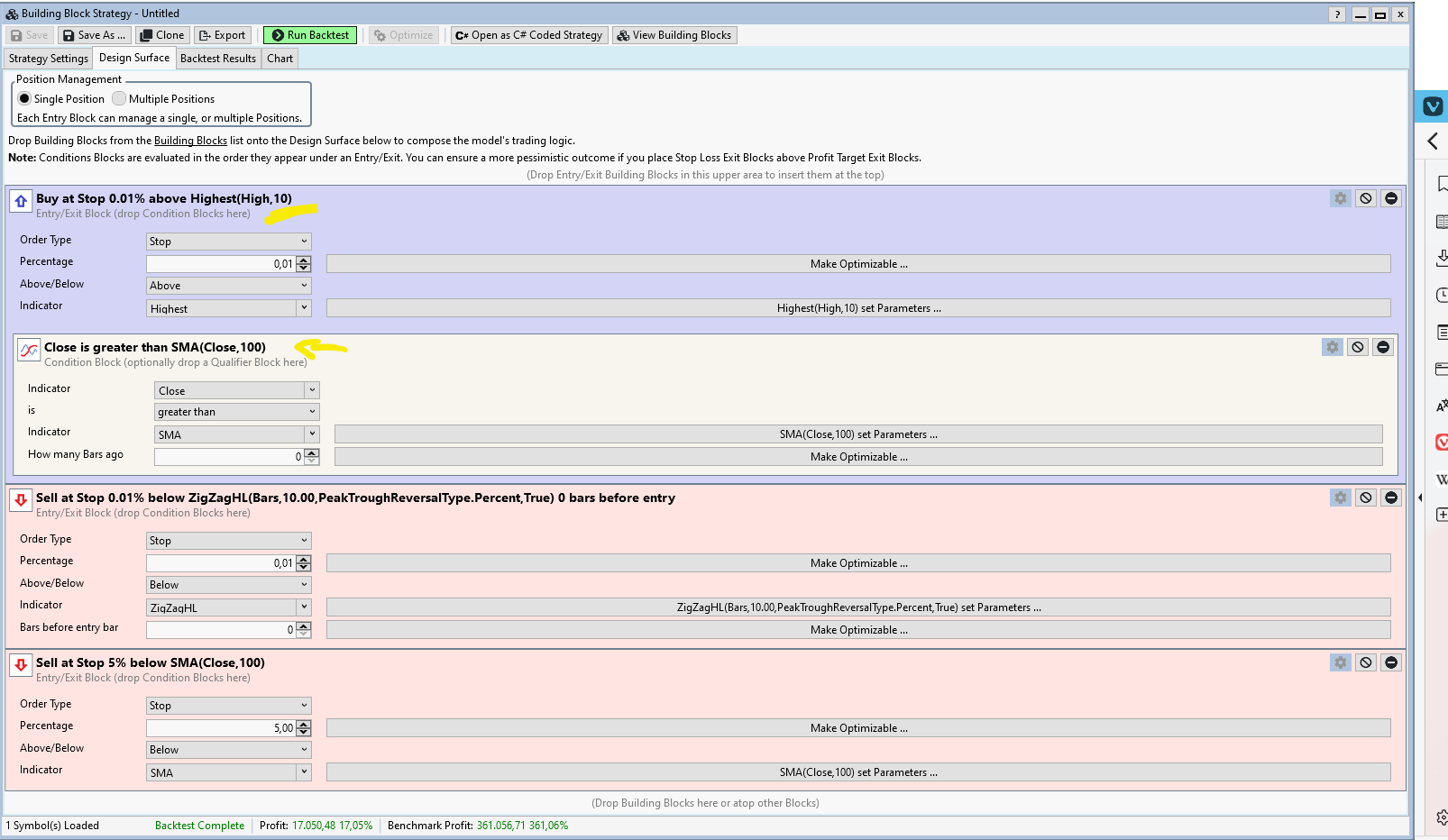

I did what you said, first adjusting the building blocks as below (just to analyse the results in a fast way, I added a buy condition - close above SMA100 - and reduced Donchian period to 10):

Then, I inserted the code that you said in initialize

But I have the following problem:

The bottom of Donchian period should be my stop and it's not working apparently.

Can you help to find what's wrong?

Just let me understand what is going wrong here.

I did what you said, first adjusting the building blocks as below (just to analyse the results in a fast way, I added a buy condition - close above SMA100 - and reduced Donchian period to 10):

Then, I inserted the code that you said in initialize

QUOTE:

Anyway, you can make it work like this:

1. Click Open as a C# Strategy

2. Add this to the end of the Initialize()

CODE:

// where source2 is the variable assign to the ZigZagHL indicator

for (int n = 1; n < bars.Count; n++)

{

if (source2[n] == Double.NaN)

source2[n] = source2[n - 1];

}

But I have the following problem:

The bottom of Donchian period should be my stop and it's not working apparently.

Can you help to find what's wrong?

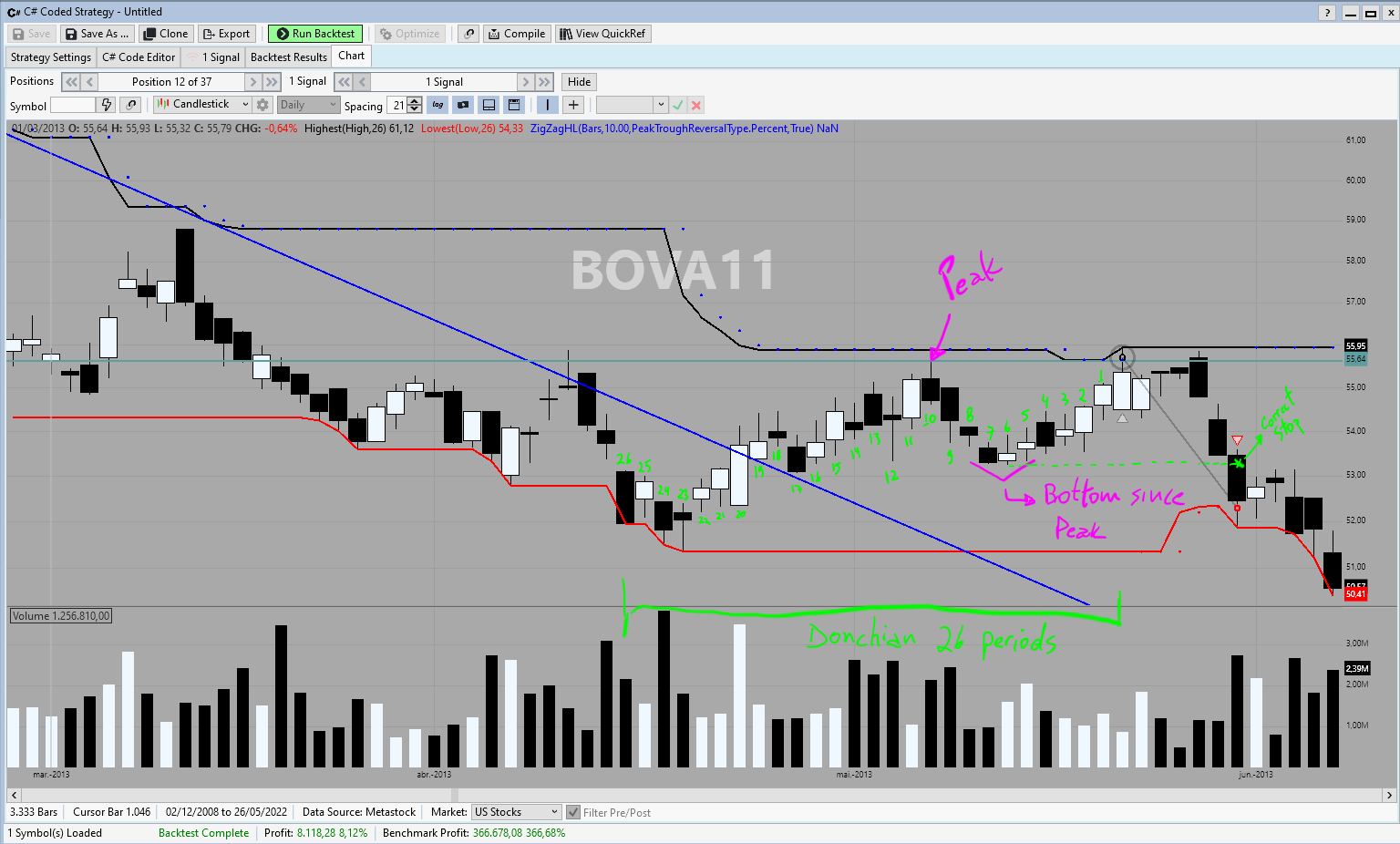

Additionaly, even if I have a donchian of, let's say, 26 periods, my stop should be placed at the bottom since the highest value, not at the bottom of all period. I think I did not expressed it well.

Go back to the blocks and change the Sell at Stop 5% below SMA rule to Sell at Stop 0.1% below the Lowest Low of your channel period. You'll have to reinsert the Initialize() code again.

Thanks Cone, your solution is pretty good and cover almost any case.

But in this case below, the highest high of Donchian(26) occurs in bar 10, while the bottom of Donchian(26) occurs in bar 23.

What I'm trying to do is, in this situation above, the stop be set at the bottom since the bar with the highest high value inside Donchian(26) - this occurs in bar 6.

So, I must pick the bottom since bar 10, not since bar 26.

But in this case below, the highest high of Donchian(26) occurs in bar 10, while the bottom of Donchian(26) occurs in bar 23.

What I'm trying to do is, in this situation above, the stop be set at the bottom since the bar with the highest high value inside Donchian(26) - this occurs in bar 6.

So, I must pick the bottom since bar 10, not since bar 26.

Here's some code I came up with to accomplish this, it's a bit tricky because you need to make sure that there was a pullback, which I solved by making sure the channel high is at least 5 bars long.

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript1 { public class MyStrategy : UserStrategyBase { //constructor, paramete generation public MyStrategy() { AddParameter("Period", ParameterType.Int32, 30, 10, 50, 5); AddParameter("%profit target", ParameterType.Double, 5.0, 5.0, 50.0, 5.0); //corrected code //AddParameter("Exit Period", ParameterType.Int32, 5, 5, 50, 5); old code } //create indicators and other objects here, this is executed prior to the main trading loop public override void Initialize(BarHistory bars) { int period = Parameters[0].AsInt; channel = Highest.Series(bars.High, period) >> 1; PlotTimeSeries(channel, "Highest(" + period + ")", "Price", WLColor.Aqua); PlotStopsAndLimits(); StartIndex = 1; } //execute the strategy rules here, this is executed once for each bar in the backtest history public override void Execute(BarHistory bars, int idx) { if (!HasOpenPosition(bars, PositionType.Long)) { //current channel must be at least 5 bars long if (channel[idx] == channel[idx - 1]) channelLength++; else channelLength = 1; if (channelLength < 5) return; //look for a close above the channel if (bars.Close[idx] > channel[idx]) { PlaceTrade(bars, TransactionType.Buy, OrderType.Market); //get lowest price between now and channel start stop = Double.MaxValue; for (int n = idx - 1; n >= 1; n--) { if (bars.Low[n] < stop && bars.Low[n] < bars.Low[n - 1]) { stop = bars.Low[n]; } if (bars.High[n] == channel[idx]) break; } } } else { //sell at a profit target or at the channel trough channelLength = 0; double target = Parameters[1].AsDouble; target = target / 100.0 + 1.0; target = LastPosition.EntryPrice * target; PlaceTrade(bars, TransactionType.Sell, OrderType.Stop, stop); PlaceTrade(bars, TransactionType.Sell, OrderType.Limit, target); } } //declare private variables below private TimeSeries channel; private double stop; private int channelLength = 0; } }

Nice, sounds very promising!

I'll try it tomorrow, thank you both!

I'll try it tomorrow, thank you both!

Hi,

Just to update, the solution proposed by Glitch worked like a charm!

Many thanks.

Just to update, the solution proposed by Glitch worked like a charm!

Many thanks.

There's an obvious correction:

CODE:Initially I was confused how you got the red dots plotted for the limit and stop orders. Then I realized you added ... to the code in Initialize().

AddParameter("%profit target", ParameterType.Double, 5.0, 5.0, 50.0, 5.0); //corrected code //AddParameter("Exit Period", ParameterType.Int32, 5, 5, 50, 5); old code

CODE:Thanks very much for this code. The detection of the pullback (5 bars channel minimum) is ingenious.

PlotStopsAndLimits();

Code above updated, thanks for the heads-up.

Your Response

Post

Edit Post

Login is required