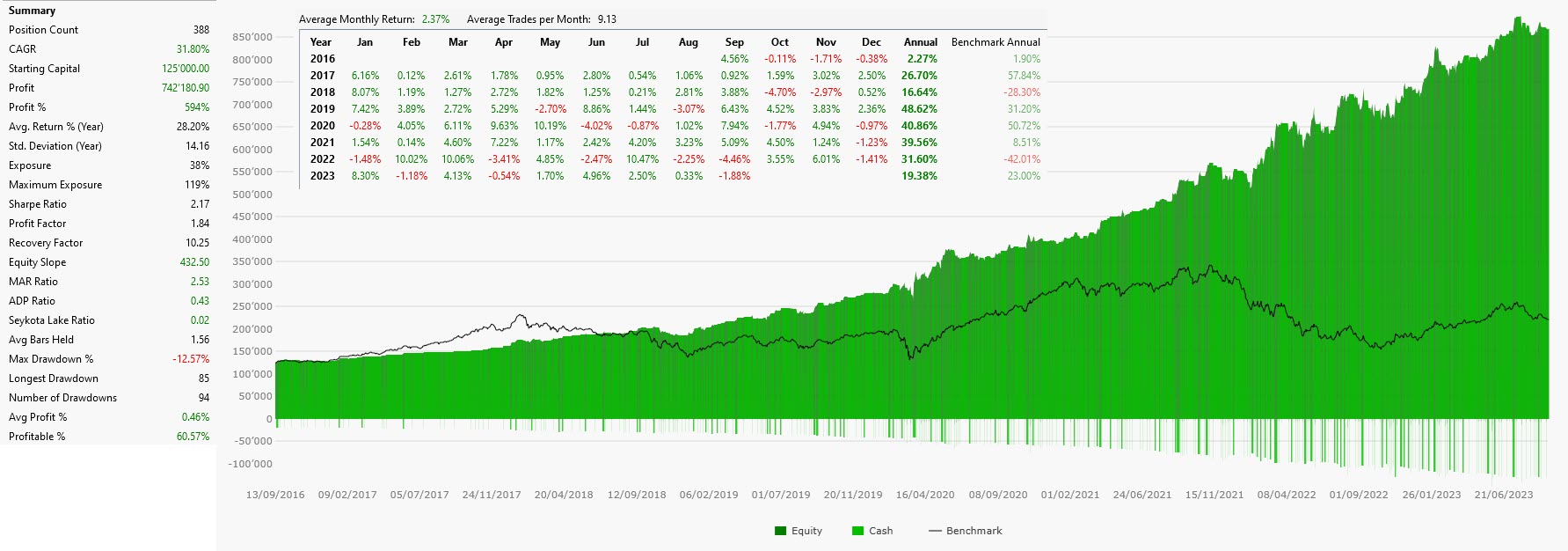

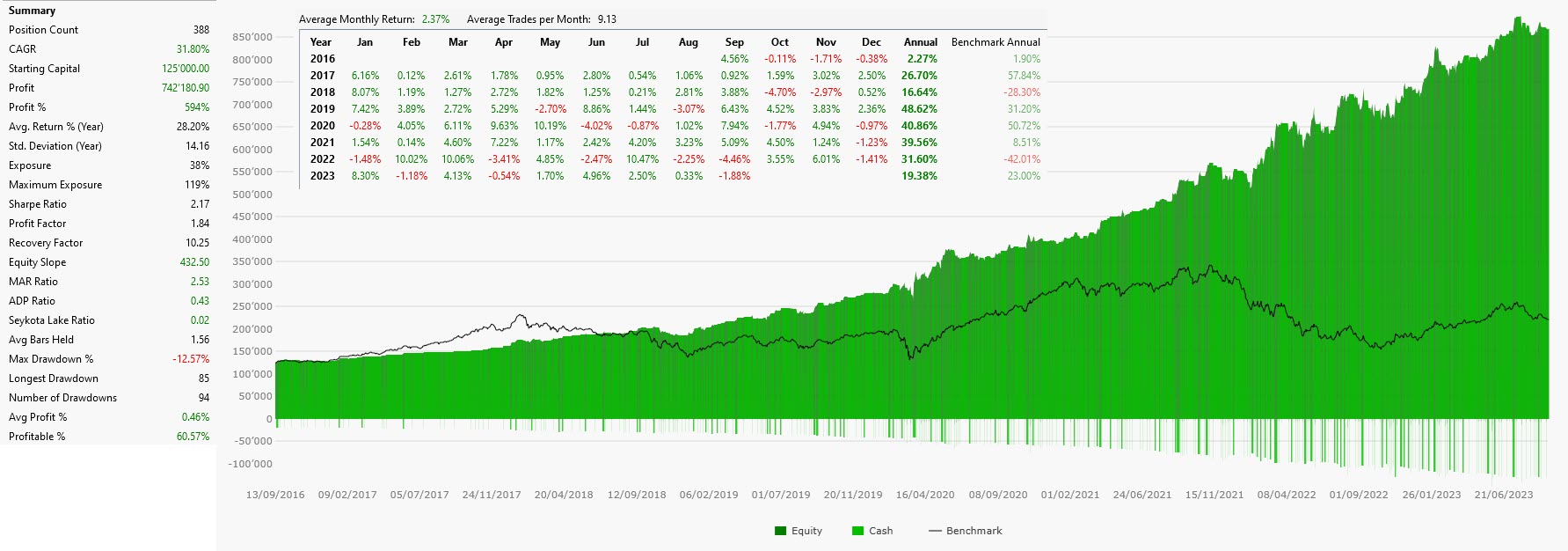

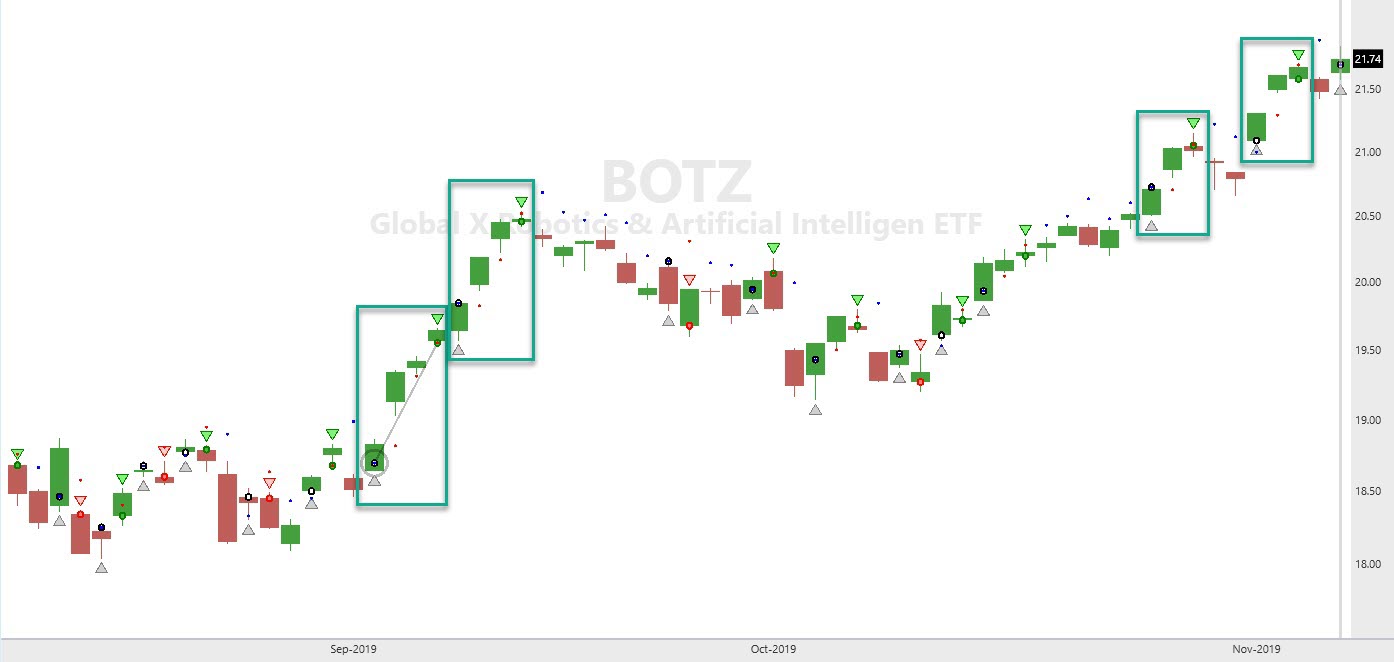

I have just published a new sample system on the ETF BOTZ (AI & Robotics). The approach comes 1:1 and without optimization from the Strategy Evolver and has a very attractive risk-return profile. Comments are always welcome...

Rename

Looks great!

But if it only works on BOTZ, then it's kind of optimized :)

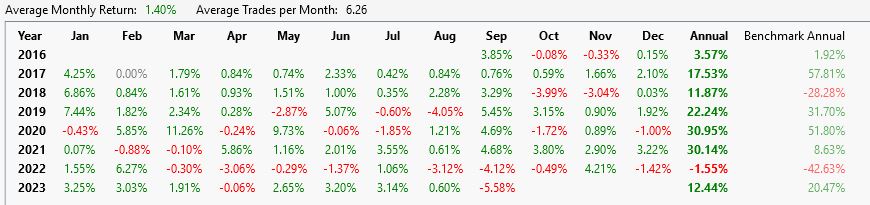

With the ups and downs that BOTZ has had, it must do even better on index ETFs like QQQ or SPY? .. unless it's shorting too?

But if it only works on BOTZ, then it's kind of optimized :)

With the ups and downs that BOTZ has had, it must do even better on index ETFs like QQQ or SPY? .. unless it's shorting too?

Nice...Works well on XSD too.

QUOTE:

But if it only works on BOTZ, then it's kind of optimized :)

How big is this risk? I noticed that profitable strategies are now tied to the instrument since every stock behaves differently

QUOTE:

Nice...Works well on XSD too.

Due to poor liquidity, I wouldn't trade SPDR ETFs . There are just under a dozen of ETFs that can be considered tradable.

QUOTE:

But if it only works on BOTZ, then it's kind of optimized :)

In most cases, an ETF is nothing more than an index (or a sector), which takes the survivorship bias into account. I'm not clear on Cone's statement either, as I've been trading ETF's in a similar fashion since 2016. But it is possible that the Strategy Evolver follows an optimization principle, where a too positive bias arises?

Aren’t we looking for outliers with big tails, while we get little nicks and gains?

QUOTE:

Aren’t we looking for outliers with big tails, while we get little nicks and gains?

There are 5% positive outliers, but in this case they are ok, because they follow the principle "let the trade run".

Such result when the margin is 1 and 100% of equity. Why are the results for 2022 so different if the strategy can only hold one active position anyway?

QUOTE:

Why are the results for 2022 so different if the strategy can only hold one active position anyway?

Just compare the metrics then you'll realize a unusual high NSF Count. In 2022 and with your setup, 35% fewer trades were executed.

QUOTE:That would make sense if the margin was 2.0, because at 1.5 you can't open another 100% equity position. In any case only 1 traded symbol and a maximum of 1 open position.

Just compare the metrics then you'll realize a unusual high NSF Count. In 2022 and with your setup, 35% fewer trades were executed.

ww5, you missed the point about NSF positions. Without including some margin you missed up to 22 of the best trades in 2022. These are identified as "NSF Positions".

In other words, positions are sized for 1% above the close. A gap Open higher than that price will result in a NSF position when using 100% of Equity sizing because you didn't allow any margin to cover the difference in Buying Power required for the trade.

In other words, positions are sized for 1% above the close. A gap Open higher than that price will result in a NSF position when using 100% of Equity sizing because you didn't allow any margin to cover the difference in Buying Power required for the trade.

As I start to SIM trade some of the available strategies, How would I determine bar size? By appearances, I would put this particular strategy on a daily bar for testing and then on a daily bar to autostrade, but asking to confirm on it.

I have been using a very similar strategy for URNM as well as part of my meta strategy. URNM works well here too! :)

I am trying to understand the system. What is the meaning of when authors says the approach comes 1:1 and then without optimization from evolver, i did not know that eveolver can be used to optimize the preexisting strategy.

Now onto the strategy. It look like there are only two rules

buy at limit 1% above close

sell at stop 0.95% above open

115% of position size.

I must be doing something wrong as I can not reproduce the results. Can someone post screenshot of building blocks. Thx

Now onto the strategy. It look like there are only two rules

buy at limit 1% above close

sell at stop 0.95% above open

115% of position size.

I must be doing something wrong as I can not reproduce the results. Can someone post screenshot of building blocks. Thx

Look in the WL.COM Published strategies area or on the website here...

https://www.wealth-lab.com/Strategy/DesignPublished?strategyID=73

https://www.wealth-lab.com/Strategy/DesignPublished?strategyID=73

According to the author the posted results are from running the strategy on the symbol BOTZ. Is that what you used?

Yes I used BOTZ and looked on the web site which list only two rules for trading.

Did you try opening/looking at it direct from the saved strategies that come pre-loaded in the system? Thats where I initially pulled it successfully.

If you did, there is probably something amiss in your preferences.

If you did, there is probably something amiss in your preferences.

That did the trick. I loaded it from inside WL. Even though I had same building blocks but I guess there was something else wrong in my setup. Thanks for kind help.

Your Response

Post

Edit Post

Login is required