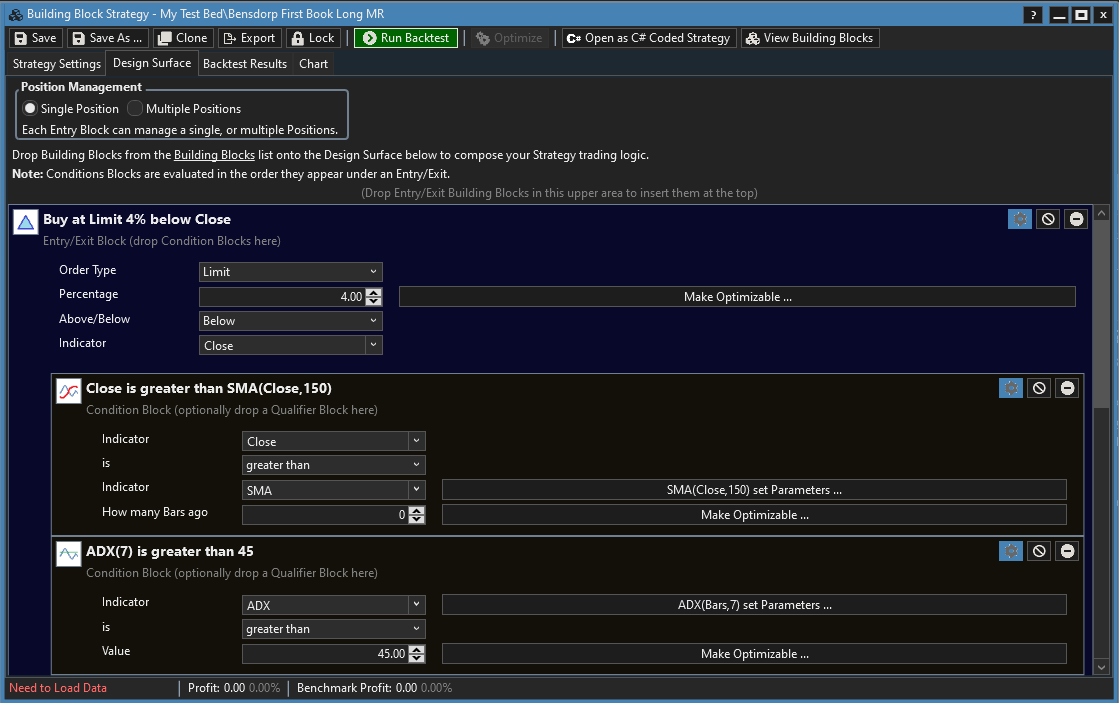

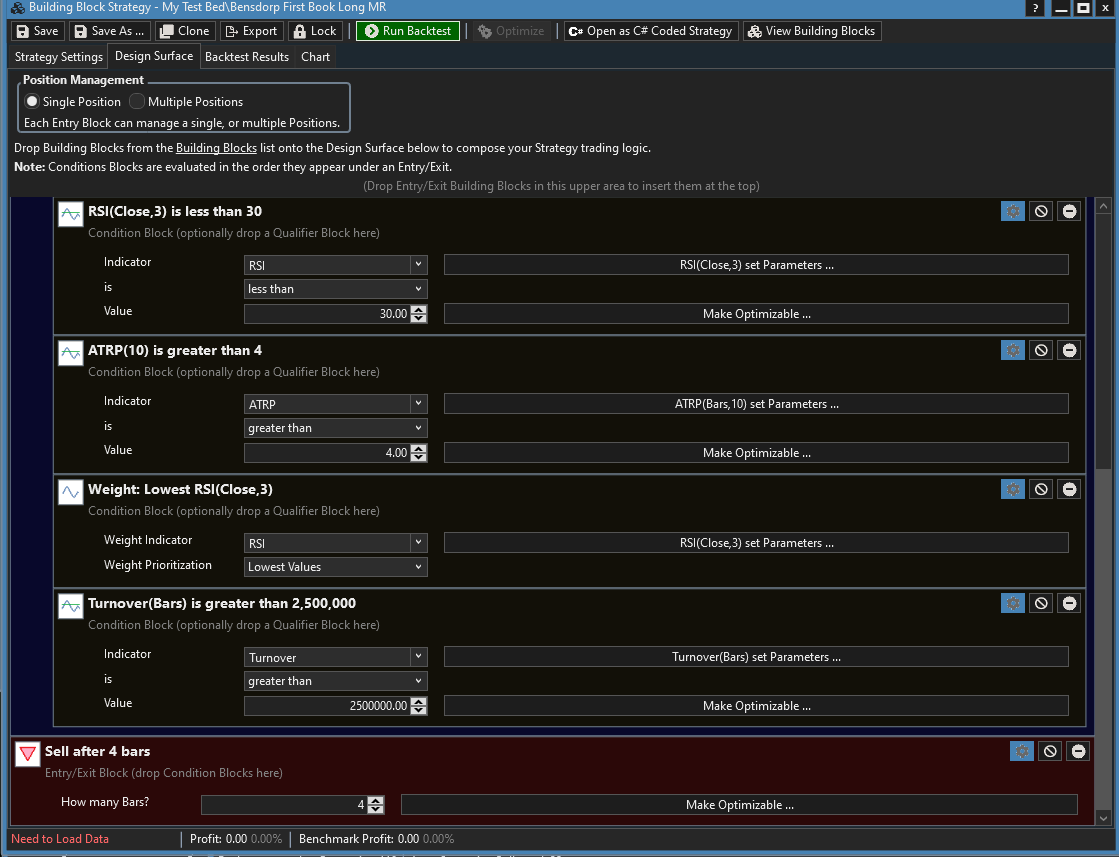

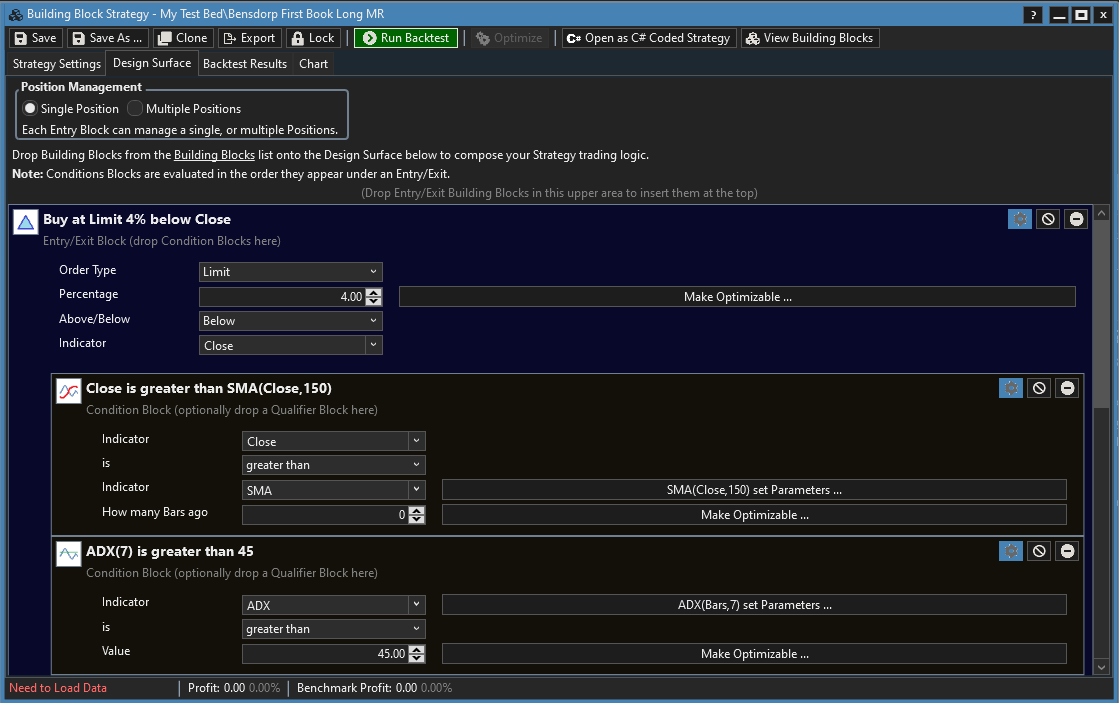

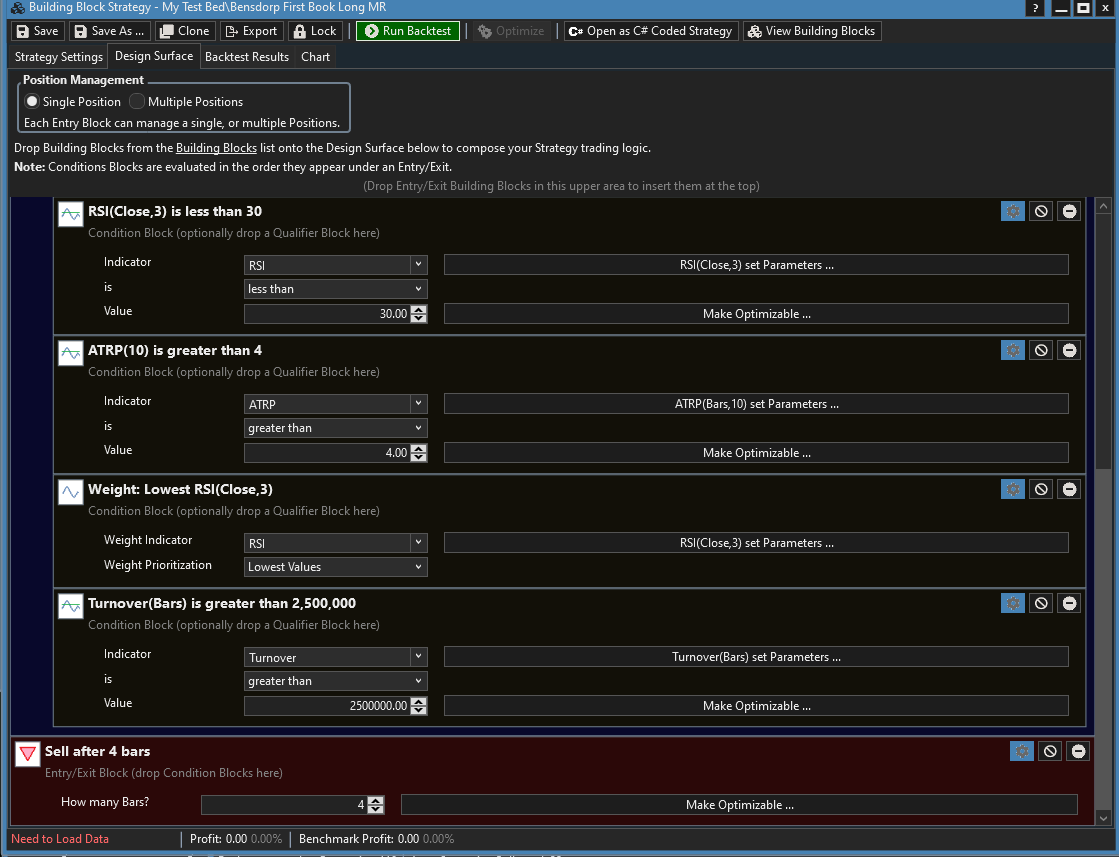

I am trying to create building blocks strategies from Bensdorp first book as my c# skills are zero. This is long menan reversion, I can do most of the criterias except following

(1) ATR% of last 10 days > 4%. I see there is ATRP indicator but not sure if it is the right one

(2) MinimumAverage volume of last 50 days > 500000

(3) Stoploss 2.5 X 10 days ATR

(4) Dollar volume > 2500000

(5) Position sizing=Fixed fractional risk 2 percent

He also rank the candidates by lowest 3 days RSI and buys 4% below the close but reading wl help and forums I am not sure if we need to use transaction weights on limit orders as we dont know which limit orders going to be filled. Thanks for any help

(1) ATR% of last 10 days > 4%. I see there is ATRP indicator but not sure if it is the right one

(2) MinimumAverage volume of last 50 days > 500000

(3) Stoploss 2.5 X 10 days ATR

(4) Dollar volume > 2500000

(5) Position sizing=Fixed fractional risk 2 percent

He also rank the candidates by lowest 3 days RSI and buys 4% below the close but reading wl help and forums I am not sure if we need to use transaction weights on limit orders as we dont know which limit orders going to be filled. Thanks for any help

Rename

By the cryptic "FIRST BOOK" in the topic title you meant (and would better have identified it as such) "The 30 Minute Stock Trader" book. This is the formal title so everyone could know what you mean and refer to. Corrected.

Anyway, I just wonder if this long mean reversion strategy is any different from what DrKoch's carefully coded? Laurens Bensdorp's Automated Stock Trading Systems

Anyway, I just wonder if this long mean reversion strategy is any different from what DrKoch's carefully coded? Laurens Bensdorp's Automated Stock Trading Systems

Yes it is his 30 minutes trader book

My reason to replicate his startegies in blocks is to hone my skills in blocks startegies and this particular strategy was revealed about 7 years ago so it will be intresting to see out of sample performance, drkoch strategy may very well be the same or a knock off of the first, since I can not read c# code but by reading the code I can see sma used is 100 while in first iteration it was 150 and limit% is 3 in current while first one was 4%, so there may be some minor differences, therefore I am curious to know why he changed.

My reason to replicate his startegies in blocks is to hone my skills in blocks startegies and this particular strategy was revealed about 7 years ago so it will be intresting to see out of sample performance, drkoch strategy may very well be the same or a knock off of the first, since I can not read c# code but by reading the code I can see sma used is 100 while in first iteration it was 150 and limit% is 3 in current while first one was 4%, so there may be some minor differences, therefore I am curious to know why he changed.

I'd be interested to see any screenshots of what you came up with if you care to share.

see below for screenshots

Your Response

Post

Edit Post

Login is required