I do not the know-how to create an indicator. Fidelity's ATP has an indicator called Money Flow Index that seems to be of value. Would you please consider adding it to WL? Its description follows and is from https://www.fidelity.com/learning-center/trading-investing/technical-analysis/technical-indicator-guide/MFI:. Thank you.

Money Flow Index (MFI)

Momentum Oscillator

Description

The Money Flow Index (MFI) is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. It is related to the Relative Strength Index (RSI) but incorporates volume, whereas the RSI only considers price. The MFI is calculated by accumulating positive and negative Money Flow values (see Money Flow), then creating a Money Ratio. The Money Ratio is then normalized into the MFI oscillator form.

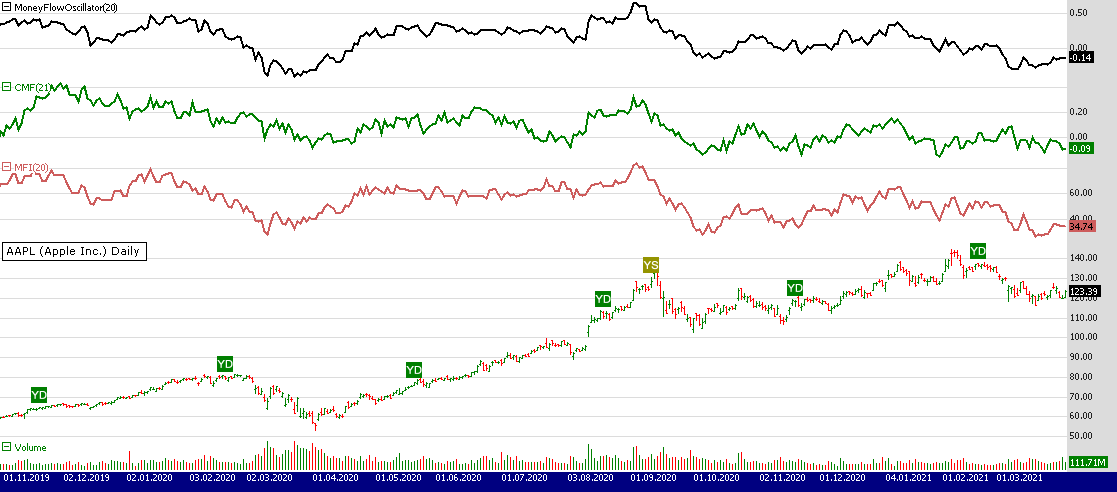

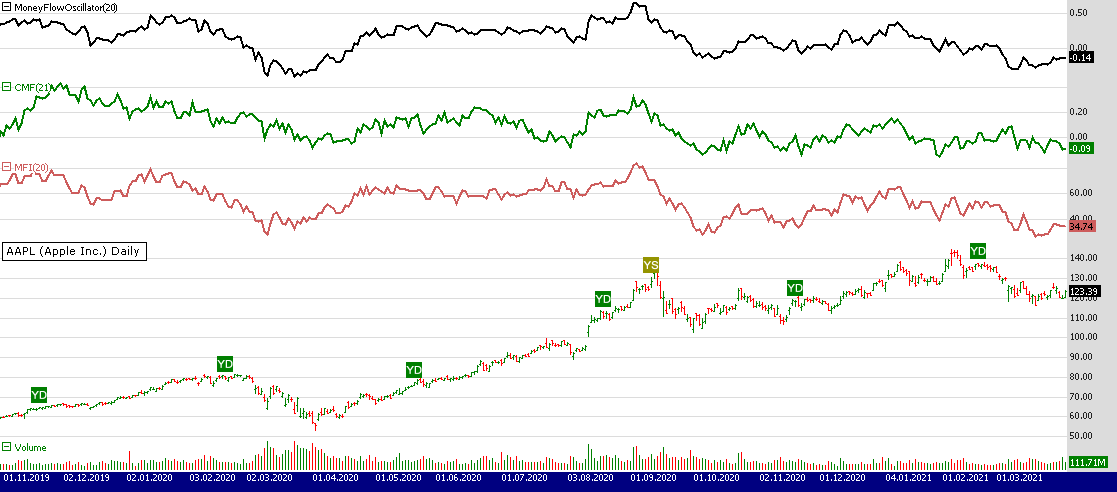

Chart: Money Flow Index

How this indicator works

Oversold levels typically occur below 20 and overbought levels typically occur above 80. These levels may change depending on market conditions. Level lines should cut across the highest peaks and the lowest troughs. Oversold/Overbought levels are generally not reason enough to buy/sell; and traders should consider additional technical analysis or research to confirm the security's turning point. Keep in mind, during strong trends, the MFI may remain overbought or oversold for extended periods.

If the underlying price makes a new high or low that isn't confirmed by the MFI, this divergence can signal a price reversal.

Calculation

The Money Flow Index requires a series of calculations.

First, the period's Typical Price is calculated.

Typical Price = (High + Low + Close)/3

Next, Money Flow (not the Money Flow Index) is calculated by multiplying the period's Typical Price by the volume.

Money Flow = Typical Price * Volume

If today's Typical Price is greater than yesterday's Typical Price, it is considered Positive Money Flow. If today's price is less, it is considered Negative Money Flow.

Positive Money Flow is the sum of the Positive Money over the specified number of periods.

Negative Money Flow is the sum of the Negative Money over the specified number of periods.

The Money Ratio is then calculated by dividing the Positive Money Flow by the Negative Money Flow.

Money Ratio = Positive Money Flow / Negative Money Flow

Finally, the Money Flow Index is calculated using the Money Ratio.

Money Flow Index (MFI)

Momentum Oscillator

Description

The Money Flow Index (MFI) is a momentum indicator that measures the flow of money into and out of a security over a specified period of time. It is related to the Relative Strength Index (RSI) but incorporates volume, whereas the RSI only considers price. The MFI is calculated by accumulating positive and negative Money Flow values (see Money Flow), then creating a Money Ratio. The Money Ratio is then normalized into the MFI oscillator form.

Chart: Money Flow Index

How this indicator works

Oversold levels typically occur below 20 and overbought levels typically occur above 80. These levels may change depending on market conditions. Level lines should cut across the highest peaks and the lowest troughs. Oversold/Overbought levels are generally not reason enough to buy/sell; and traders should consider additional technical analysis or research to confirm the security's turning point. Keep in mind, during strong trends, the MFI may remain overbought or oversold for extended periods.

If the underlying price makes a new high or low that isn't confirmed by the MFI, this divergence can signal a price reversal.

Calculation

The Money Flow Index requires a series of calculations.

First, the period's Typical Price is calculated.

Typical Price = (High + Low + Close)/3

Next, Money Flow (not the Money Flow Index) is calculated by multiplying the period's Typical Price by the volume.

Money Flow = Typical Price * Volume

If today's Typical Price is greater than yesterday's Typical Price, it is considered Positive Money Flow. If today's price is less, it is considered Negative Money Flow.

Positive Money Flow is the sum of the Positive Money over the specified number of periods.

Negative Money Flow is the sum of the Negative Money over the specified number of periods.

The Money Ratio is then calculated by dividing the Positive Money Flow by the Negative Money Flow.

Money Ratio = Positive Money Flow / Negative Money Flow

Finally, the Money Flow Index is calculated using the Money Ratio.

Rename

We have the Money Flow Oscillator which is a more recent development which improves the concept:

https://tlc.thinkorswim.com/center/reference/Tech-Indicators/studies-library/M-N/MoneyFlowOscillator.html

Also there is CMF (Chaikin Money Flow).

https://tlc.thinkorswim.com/center/reference/Tech-Indicators/studies-library/M-N/MoneyFlowOscillator.html

Also there is CMF (Chaikin Money Flow).

As you can see on screenshot from WL6 below, once they stabilize the three are basically similar. The MFO is the most smooth of them. I believe it's good to keep the list of indicators manageable.

I agree that they're similar, but MFI is a pretty standard indicator that I think just slipped by! Besides, we have things like Alligator, CMCSuperTrend, and McGinleyDynamic in the Standard Indicators list, so who's judging what is manageable? I think we can include the old classic MFI, especially since there's a user request!

I'll add it to Build 4.

I'll add it to Build 4.

Is the CADO (Chaikin Advance Decline Oscillator) in WL6 now ChaikinOsc in WL7?

What we need in the WL7 help documentation is something like

ChaikinOsc = CADO (WL6) ... Who would have guessed?

- or -

ChaikinOsc = Chaikin Advance Decline Oscillator

in the help documentation. The nomenclature is so terse along with its sparse documentation that I'm having trouble seeing the trees from the forest.

Thanks for the link about the Money Flow Oscillator. I didn't know about that one.

What we need in the WL7 help documentation is something like

ChaikinOsc = CADO (WL6) ... Who would have guessed?

- or -

ChaikinOsc = Chaikin Advance Decline Oscillator

in the help documentation. The nomenclature is so terse along with its sparse documentation that I'm having trouble seeing the trees from the forest.

Thanks for the link about the Money Flow Oscillator. I didn't know about that one.

Thank you, Glitch.

@superticker

Thanks, good idea.

If I type in "Chaikin" in the Filter field in Indicators, the description suggests: "Expresses accumulation distribution in the form of an oscillator." So the two must be equivalents.

@Glitch

Makes sense. I removed McGinleyDynamic for build 4 since it isn't popular and would hardly ever get. Plus, it's too simplistic to have slipped in. Being trailing exits, the SuperTrends did have some following on the community forums so let's have them.

https://wl6.wealth-lab.com/Forum/Posts/Supertrend-Indicator-31157

QUOTE:

What we need in the WL7 help documentation is something like

Thanks, good idea.

QUOTE:

Is the CADO (Chaikin Advance Decline Oscillator) in WL6 now ChaikinOsc in WL7?

If I type in "Chaikin" in the Filter field in Indicators, the description suggests: "Expresses accumulation distribution in the form of an oscillator." So the two must be equivalents.

@Glitch

QUOTE:

Besides, we have things like Alligator, CMCSuperTrend, and McGinleyDynamic in the Standard Indicators list, so who's judging what is manageable?

Makes sense. I removed McGinleyDynamic for build 4 since it isn't popular and would hardly ever get. Plus, it's too simplistic to have slipped in. Being trailing exits, the SuperTrends did have some following on the community forums so let's have them.

https://wl6.wealth-lab.com/Forum/Posts/Supertrend-Indicator-31157

QUOTE:I wouldn't assume that. I'm looking for words like Advance and Decline, not Accumulation and Distribution. That's part of the problem.

If I type in "Chaikin" in the Filter field in Indicators, the description suggests: "Expresses accumulation distribution in the form of an oscillator." So the two must be equivalents.

And a newbie wouldn't have a clue, which is bad. The description for both WL6 and WL7 should be in the help documentation so we aren't asking about what "might" be equivalent or not here.

I would even go one step further to group the indicators by functionality and place the newest within a grouping at the top of the group. In other words, sort the groupings such that latest is first. I'm not suggesting the newest indicators will always be the best (and the oldest the poorest), but I would start with the newest ones and work down the list.

Just double checked and Chaikin A/D = CADO = a.k.a. ChaikinOsc:

https://tradesoftheday.com/how-to-use-chaikin-a-d-oscillator-to-make-better-trades/

http://www2.wealth-lab.com/WL5WIKI/CADO.ashx

https://www.investopedia.com/terms/c/chaikinoscillator.asp

https://tradesoftheday.com/how-to-use-chaikin-a-d-oscillator-to-make-better-trades/

http://www2.wealth-lab.com/WL5WIKI/CADO.ashx

https://www.investopedia.com/terms/c/chaikinoscillator.asp

Glitch. Thanks for MFI addition.

Your Response

Post

Edit Post

Login is required