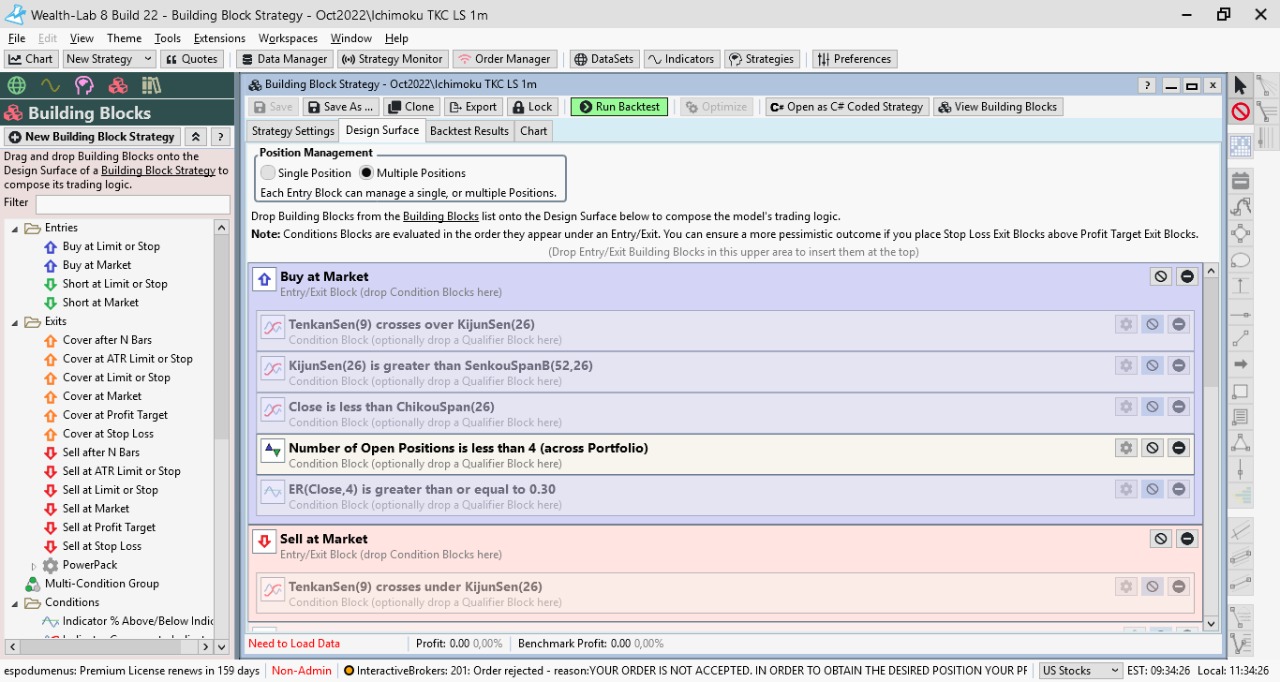

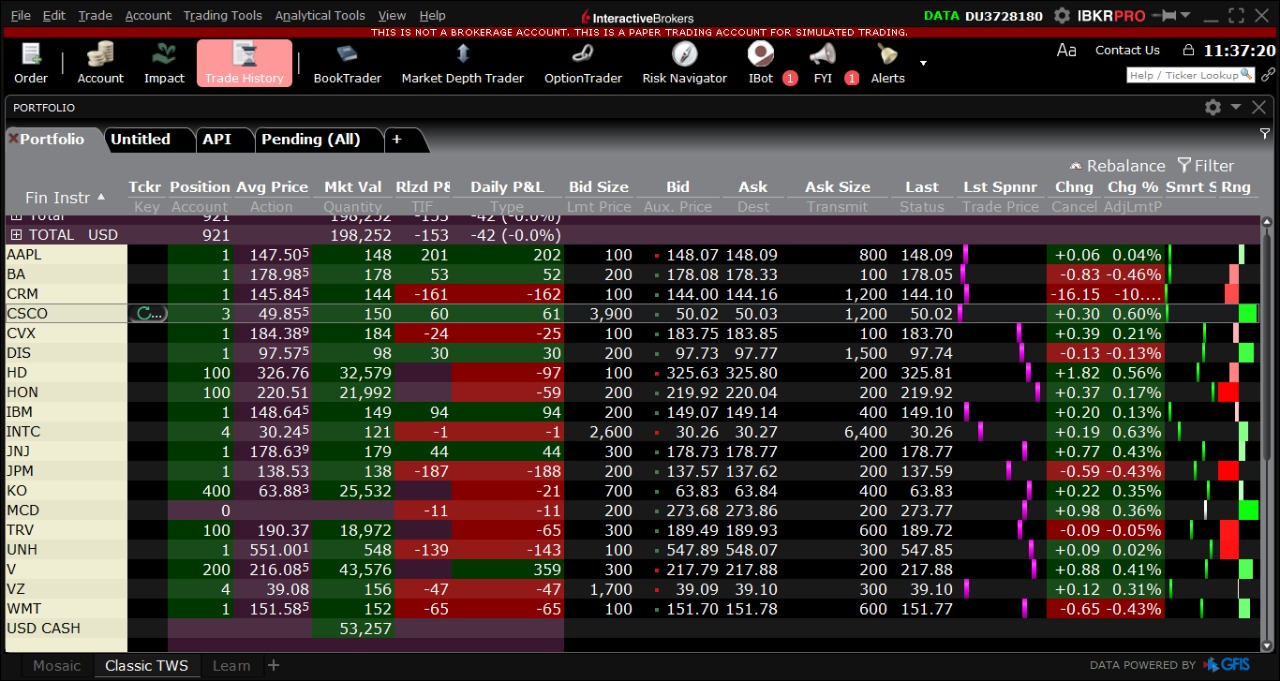

Hello. Yesterday my 1-minute long and short Ichimoku cloud strategy provided no entry signals but lots of buy to cover and also sell. Today I decided to experiment in order to see "why my turtle ran away". I still not find why, because I turned off all conditions to open but "number of open positions (across portfolio) is less than 4". This time it opened 19 position and triggered a margin call on my paper account.

I need, please, that someone help me to understand why it opened so many positions even to the only condition was that "open positions across portfolio are less than 4".

Thank you in advance!

I need, please, that someone help me to understand why it opened so many positions even to the only condition was that "open positions across portfolio are less than 4".

Thank you in advance!

Rename

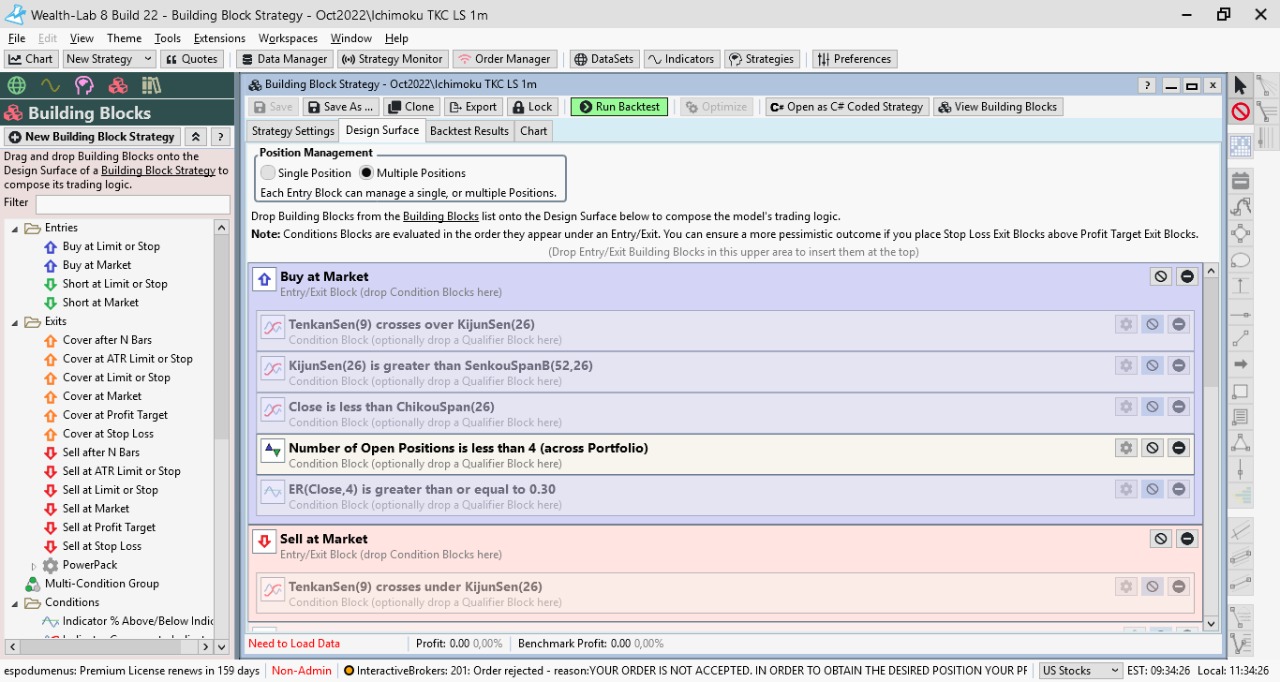

I added the 4 for maximum open positions and maximum number of longs, to the Strategy Settings but it still opens tens of positions. I don't want to use "Max Entries per bar" in Position Sizing because I would lose some risk management capacity.

I changed Position Management to "single position" but no way, it's worse than my ex-wife in the mall....

I changed Position Sizing to "Max entries per bar" and limited to 4 but it keeps opening and opening and opening afer each bar. I think that it's because I set it to Single Position Now.

Please, when trading a multiple symbols dataset such as DOW30, how can I prevent it to open more than 4 positions? Now I rely 100% on your knowledge, I tried everything without success. It keeps opening and opening...

Please, when trading a multiple symbols dataset such as DOW30, how can I prevent it to open more than 4 positions? Now I rely 100% on your knowledge, I tried everything without success. It keeps opening and opening...

It looks like it's closing after every bar because you've disabled the Condition Block that's attached to the Sell Block.

QUOTE:You can't. The rule prevents placing new trades only if the backtest portfolio already has more than n Positions.

Please, when trading a multiple symbols dataset such as DOW30, how can I prevent it to open more than 4 positions?

So, if the backtest (which ideally is synchronized to your account) has less than 4 positions, but the strategy triggers 10 trades, you're going to get 10 signals, which can turn into 10 positions if you have the buying power for it.

In a C# custom-coded strategy you could limit the number of signals too, but it's not possible with blocks. Example - if the backtest had 1 position and there were 10 signals, you could prioritize those signals and send out only 3 of them.

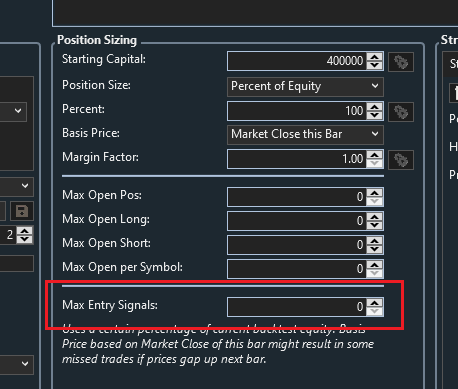

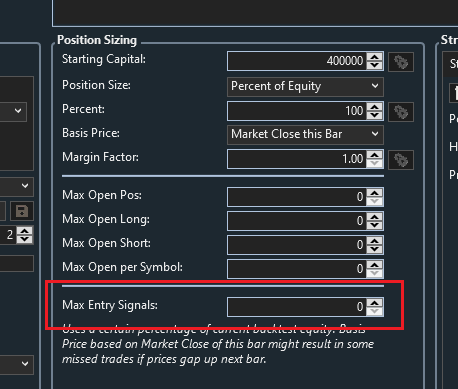

You can limit the number of entry SIGNALS here:

The cavalry has arrived!! :D thank you Glitch and Cone!

Glitch: Does "Max Entry Signals" limits for the day or for each bar?

Glitch: Does "Max Entry Signals" limits for the day or for each bar?

Glitch: I tried "Max Entry Signals" and it keeps opening unlimited positions (it closes the next bar because it's just a test).

QUOTE:

So, if the backtest (which ideally is synchronized to your account) has less than 4 positions, but the strategy triggers 10 trades, you're going to get 10 signals, which can turn into 10 positions if you have the buying power for it.

I thought the same but even with 4 positions already open the next bar it keeps opening more and more..

OK, sometimes you can't see the tree even in the forest :)

Have you tried this?

Have you tried this?

Yes Glitch, I tried it, it didn't work.

Luckily, I was able to debug my own original strategy and I will share my conclusions in other post.

Back to the "open positions" topic. I would really love to control this. Of course, on a complete strategy the number of openings is controlled by each and all the conditions, but it would be good to be able to limit how many trades we can do.

Example: to make that on a simple strategy such as Buy at Market if Open Positions (across portfolio) is less than 4, it trades no more than 4 simultaneous positions.

Luckily, I was able to debug my own original strategy and I will share my conclusions in other post.

Back to the "open positions" topic. I would really love to control this. Of course, on a complete strategy the number of openings is controlled by each and all the conditions, but it would be good to be able to limit how many trades we can do.

Example: to make that on a simple strategy such as Buy at Market if Open Positions (across portfolio) is less than 4, it trades no more than 4 simultaneous positions.

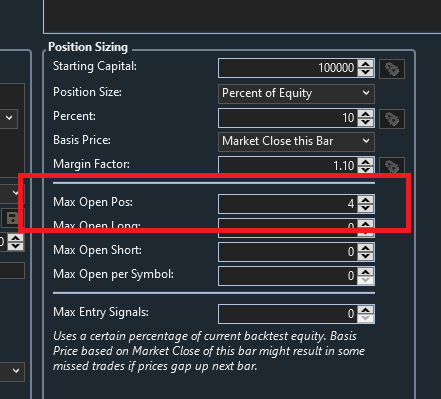

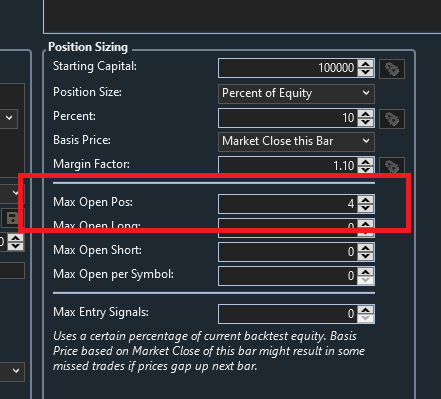

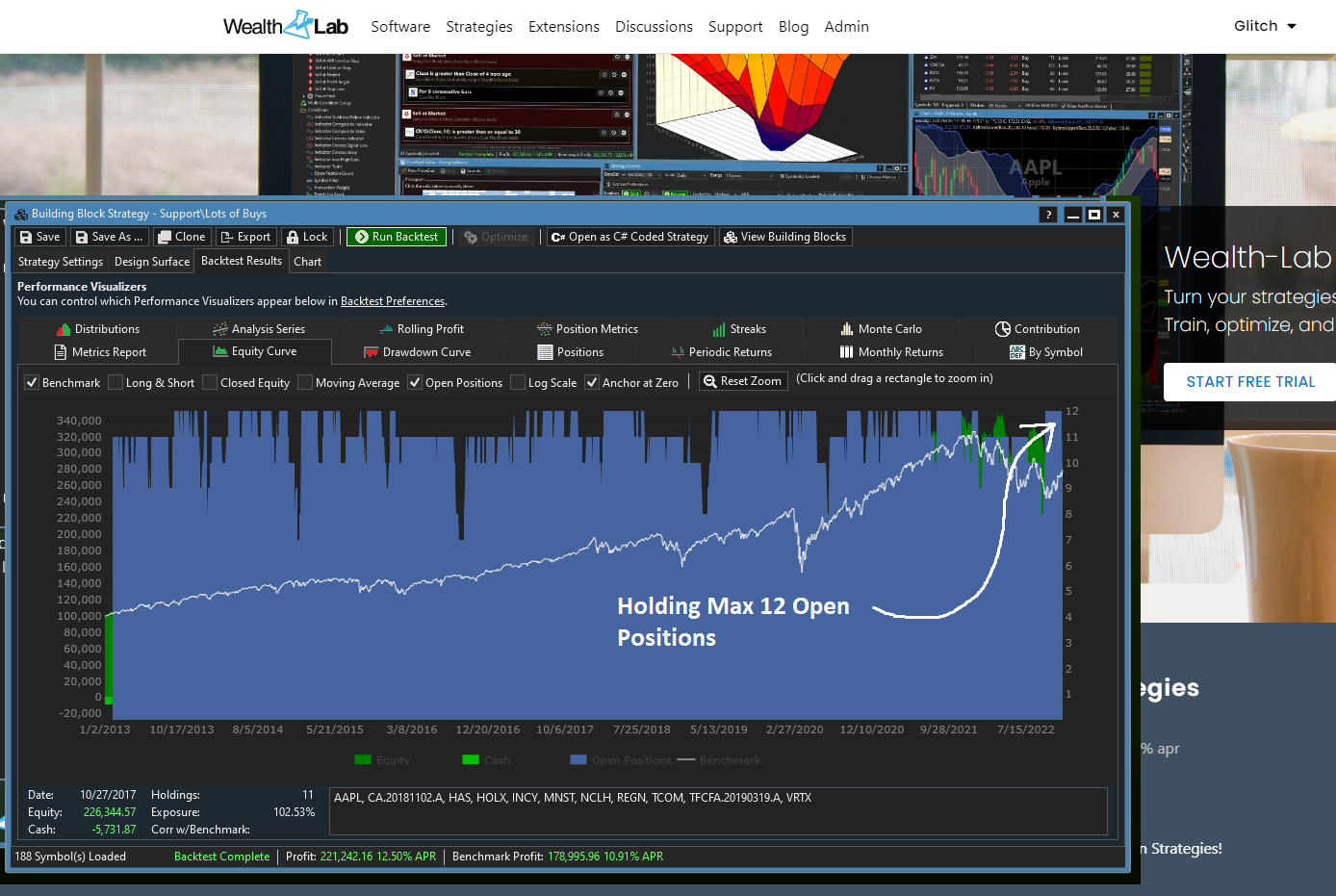

But it does work. Let's take this sample Strategy that just buys when RSI is below 50 and sells when it is above 70, it will generate alot of positions. Position size is 10% of equity with margin set to 1.1:1. Here it is on the Nasdaq 100 WITHOUT the option enabled, note the number of open positions:

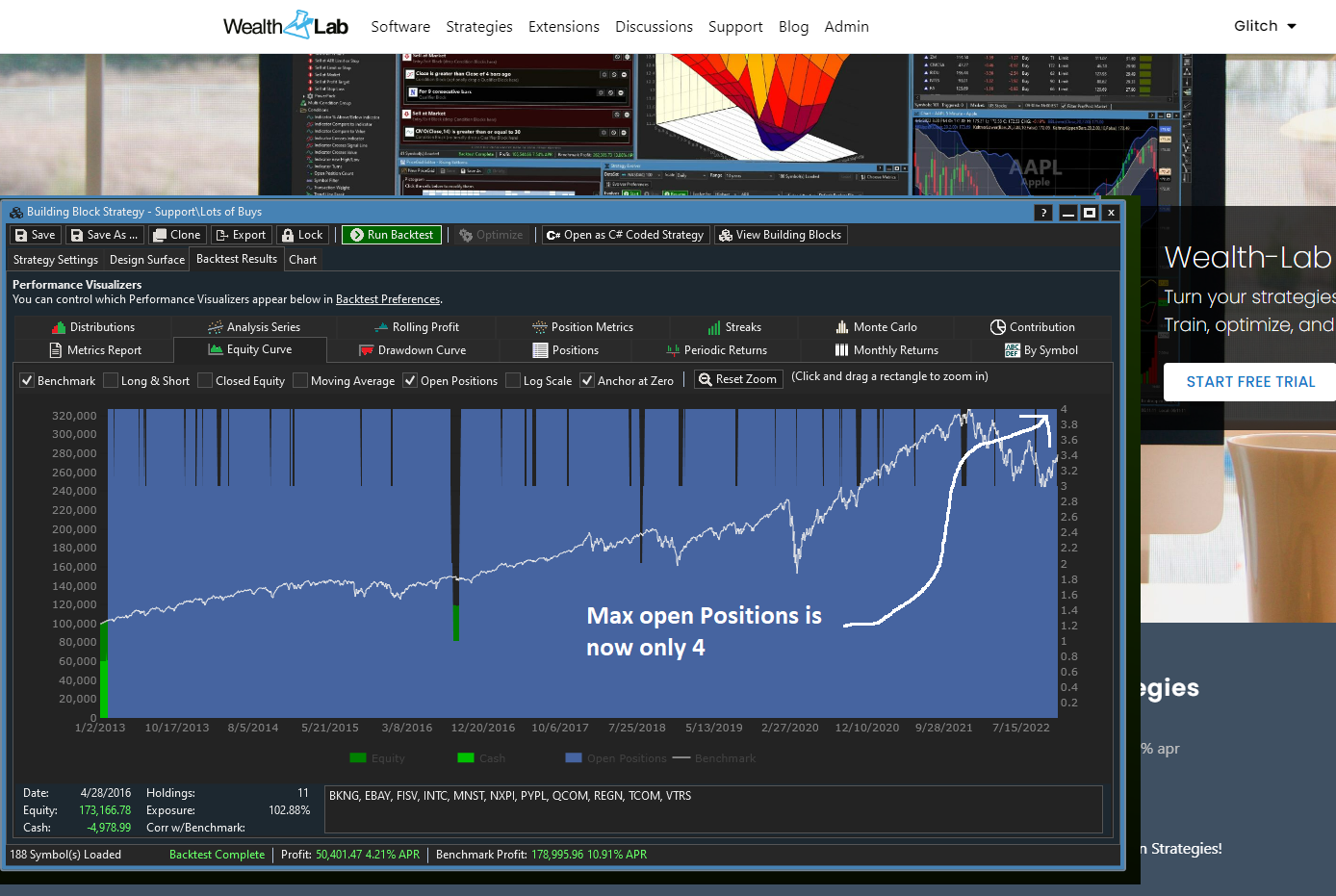

Now, here it is with the Max Open Pos set to 4 (and Max Entry Signals set to 4)

Now, here it is with the Max Open Pos set to 4 (and Max Entry Signals set to 4)

But I think the piece we're missing is the Signals, for example, if you currently have 3 open positions, you only want at most 1 entry signals.

There's no way to currently account for that, maybe we can add that option.

There's no way to currently account for that, maybe we can add that option.

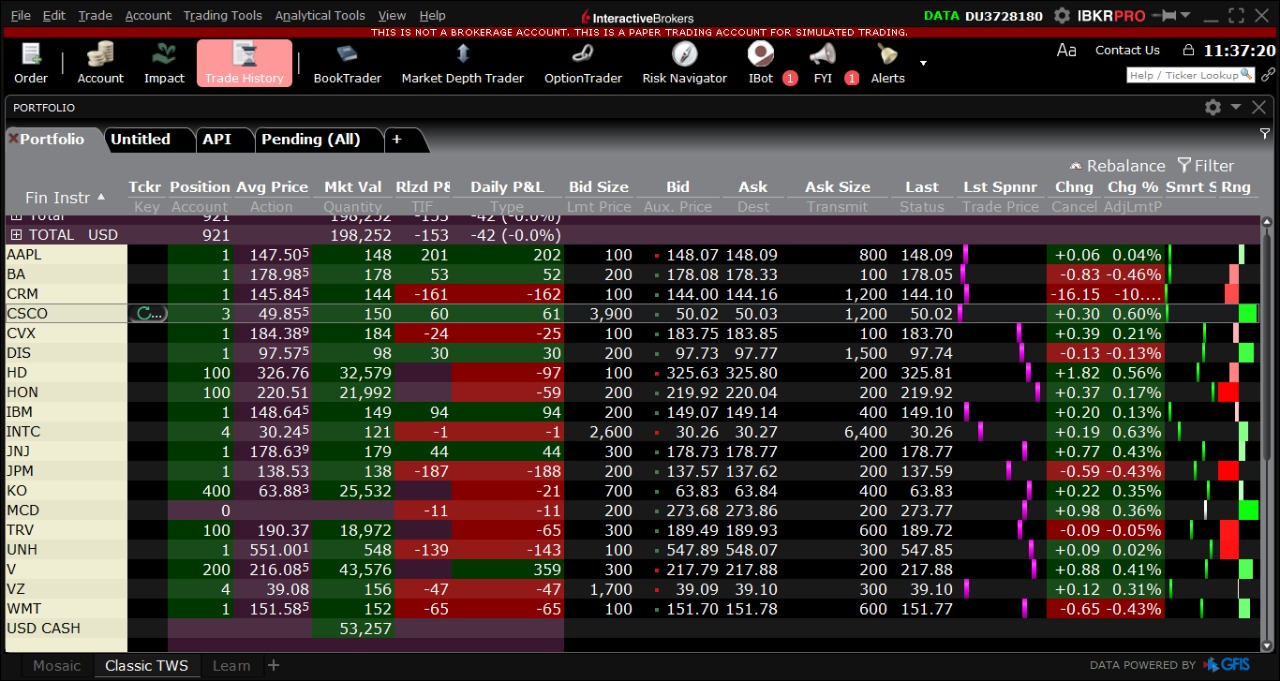

Thank you Glitch. I had the same results in the backtests, it works there, but it didn't limit signals and openings during auto-trading my paper account (using Strategy Monitor and IBKR).

With IBKR, the number of open positions is not really a practical limitation so much, as long as one is using a margin account. I believe they allow a 4:1 intraday margin for stocks. Therefore if, for example, we want to keep up to 5 open positions; and even though WL currently can be limited to not give you more than those 5 signals, but doesn’t yet consider the number or carried over positions; eventually in practice some will be exited on the same day; and that 4:1 margin can be used to absorb the temporary excess.

Still, as was being discussed in another topic, this reduces the determinism of the back-test. Also, as interest rates rose, borrowing on margin isn’t close to free anymore and its cost must be factored in.

Still, as was being discussed in another topic, this reduces the determinism of the back-test. Also, as interest rates rose, borrowing on margin isn’t close to free anymore and its cost must be factored in.

It seems like we only need to ensure that Max Open Pos setting is also being applied to next-bar Signals. That should solve it.

QUOTE:

It seems like we only need to ensure that Max Open Pos setting is also being applied to next-bar Signals. That should solve it.

I hope so

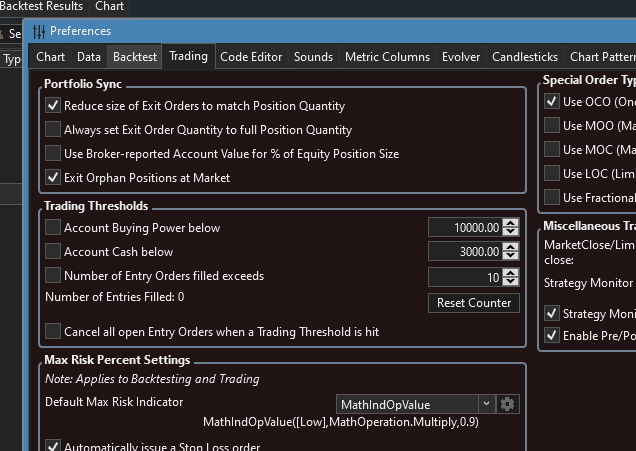

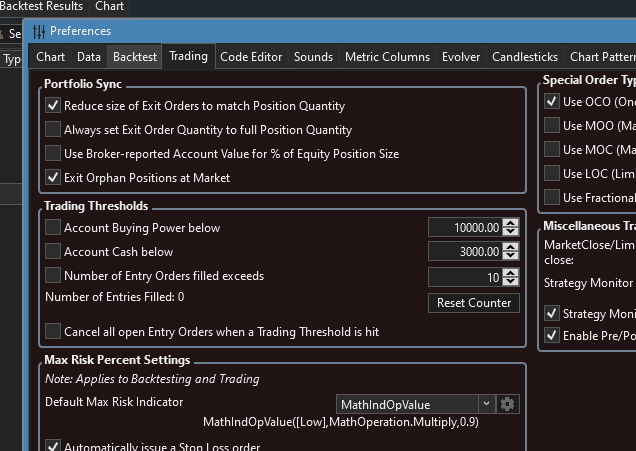

Thinking more, you're probably more concerned about not placing the orders based on the number of broker positions, rather than theoretical. If so, then probably a new Trading Threshold for Open Position Count might be better. It would go in the Trading Thresholds here:

Your Response

Post

Edit Post

Login is required