Hello:

I've been using Wealthlab for about 10 weeks. I have used some strategies of my own. I"m noticing one flaw and I can't seem to fix it:

1. None of my strategies will "buy"

2. They all sell appropriately

3. I use IBKR

4. I can manually buy thru wealth lab or IBKR; I can manually sell, as well.

5. II get tons of connection and exception logs YELLOW

And finally: My most annoying problem that I don't know how to fix.

1. My stock from Chinook (KDNY) was bought by company that gave me a cash payout

2. Where my stock ticker is is: KDNY.cvs and everytime they hit a target, I get paid another 4.00 a share. So, I had 80 sheres. They paid me cash. Now I will make: $320 every time they reach a new target.

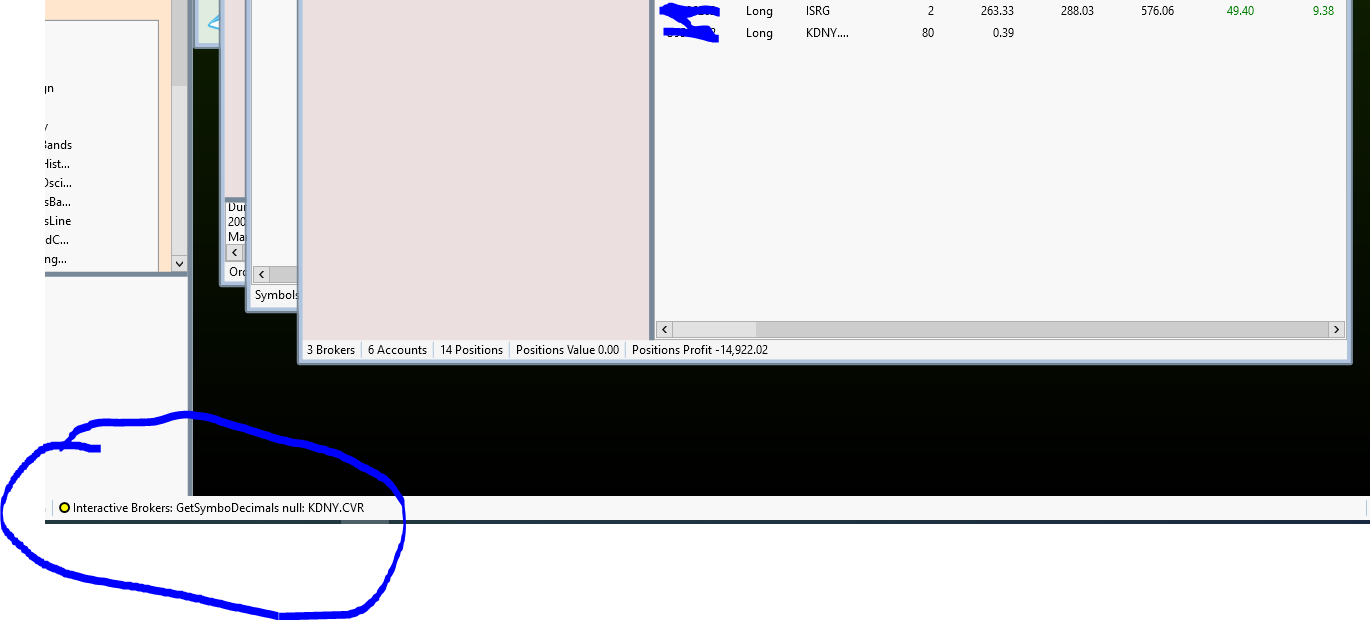

3. This stock symbol, kdny.cvs - kicks me out of wealth lab when I run my "accounts" under the "tools drop down", I select "accounts" and it always throws an error for kdny.cvs and kicks me out.

Today - of course I am restarting everything because of the update, but I get I want to know why these things are so glitchy. I know it is probably me. I had read a lot of threads thru this site, reddit and using ai. I just can't figure out what I'm doing wrong.

I can attach screen shots, if you need.

I've been using Wealthlab for about 10 weeks. I have used some strategies of my own. I"m noticing one flaw and I can't seem to fix it:

1. None of my strategies will "buy"

2. They all sell appropriately

3. I use IBKR

4. I can manually buy thru wealth lab or IBKR; I can manually sell, as well.

5. II get tons of connection and exception logs YELLOW

And finally: My most annoying problem that I don't know how to fix.

1. My stock from Chinook (KDNY) was bought by company that gave me a cash payout

2. Where my stock ticker is is: KDNY.cvs and everytime they hit a target, I get paid another 4.00 a share. So, I had 80 sheres. They paid me cash. Now I will make: $320 every time they reach a new target.

3. This stock symbol, kdny.cvs - kicks me out of wealth lab when I run my "accounts" under the "tools drop down", I select "accounts" and it always throws an error for kdny.cvs and kicks me out.

Today - of course I am restarting everything because of the update, but I get I want to know why these things are so glitchy. I know it is probably me. I had read a lot of threads thru this site, reddit and using ai. I just can't figure out what I'm doing wrong.

I can attach screen shots, if you need.

Rename

"Not buying" seems like an easy one to fix if you can show us your strategy code. If it's blocks, just export to C# code, copy, and paste it here between CODE tags.

Re: KDNY.cvs

I don't know what to make of that one. I'm not familiar with that kind of instrument, and it sounds like the code doesn't like what it doesn't expect. What asset class is that? I can't find that .cvs ticker in IB TWS.

TRY THIS - in TWS, if you have a ticker for KDNY.csv on a quotes page (try the Portfolio page), double click it, copy and paste that image with the details.

Re: tons of connection and exception logs YELLOW

It would help to have the details of some of these.. especially if it mentions KDNY.csv.

Re: KDNY.cvs

I don't know what to make of that one. I'm not familiar with that kind of instrument, and it sounds like the code doesn't like what it doesn't expect. What asset class is that? I can't find that .cvs ticker in IB TWS.

TRY THIS - in TWS, if you have a ticker for KDNY.csv on a quotes page (try the Portfolio page), double click it, copy and paste that image with the details.

Re: tons of connection and exception logs YELLOW

It would help to have the details of some of these.. especially if it mentions KDNY.csv.

This is knife juggler, basically. When I set it up, back tested, and reconfigured, and placed in the strategy monitor. I activated and set it up to place. It threw a signal, and then never bought

I have another one, for tqqq, you can peak at that in my profile account, but i promised my buddy not to put it public.

I'll also try your kdny.cvs instructions and I'll send you a link to the deal they made when buying chinook....I am still maybe at a third grade level here, so I may not be doing this KDNY thing justice......

I have another one, for tqqq, you can peak at that in my profile account, but i promised my buddy not to put it public.

I'll also try your kdny.cvs instructions and I'll send you a link to the deal they made when buying chinook....I am still maybe at a third grade level here, so I may not be doing this KDNY thing justice......

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Data; using WealthLab.Indicators; using System.Collections.Generic; /// <summary> /// Tweaked knife juggler for dip buying soxl /// </summary> namespace WealthScript1 { public class MyStrategy : UserStrategyBase { public MyStrategy() : base() { AddParameter("Percentage", ParameterType.Double, 3, 1, 10, 1); AddParameter("How many Bars?", ParameterType.Int32, 2, 1, 10, 1); AddParameter("Profit Target", ParameterType.Double, 3, 1, 25, 1); StartIndex = 20; } public override void Initialize(BarHistory bars) { source = bars.Close; pct = Parameters[0].AsDouble; pct = (100.0 - pct) / 100.0; multSource = source * pct; PlotStopsAndLimits(3); PlotStopsAndLimits(3); foreach(IndicatorBase ib in _startIndexList) if (ib.FirstValidIndex > StartIndex) StartIndex = ib.FirstValidIndex; } public override void Execute(BarHistory bars, int idx) { int index = idx; Position foundPosition0 = FindOpenPosition(0); bool condition0; if (foundPosition0 == null) { condition0 = false; { condition0 = true; } if (condition0) { val = multSource[idx]; _transaction = PlaceTrade(bars, TransactionType.Buy, OrderType.Limit, val, 0,"Buy at Limit 2% below Close"); } } else { condition0 = false; { condition0 = true; } if (condition0) { Backtester.CancelationCode = 74; if (idx - foundPosition0.EntryBar + 1 >= Parameters[1].AsInt) { ClosePosition(foundPosition0, OrderType.Market, 0,"Sell after 2 bars"); } } condition0 = false; { condition0 = true; } if (condition0) { Backtester.CancelationCode = 74; value = (Parameters[2].AsDouble / 100.0) + 1.0; ClosePosition(foundPosition0, OrderType.Limit, foundPosition0.EntryPrice * value, "Sell at 2% profit target"); } } } public override void NewWFOInterval(BarHistory bars) { source = bars.Close; } private double pct; private double val; private TimeSeries source; private TimeSeries multSource; private double value; private Transaction _transaction; private List<IndicatorBase> _startIndexList = new List<IndicatorBase>(); } }

KDNY.cvr OMG - type-o.

The sale has occurred. The stocks have been paid out. And the remaining stock ticker changed to KDNY.cvr with .39 cents. I'm afraid if I delete it, it will not pay me my extra fun "shoes" account. Another $4.00 per share is $320? Why not take it. I only had 80 shares. I bought some at 10 or 11 bucks a few years ago through robinhood. and then I watched a steady increase, so i bought more. Some I bought at 10$ per share and I paid as high as $37.00 per share. In the end, I had 80 share, they paid cash of $40.00 per share.

https://investors.chinooktx.com/news-releases/news-release-details/chinook-therapeutics-enters-agreement-be-acquired-novartis-ag

Under the transactions section, it reads:

Under the terms of the merger agreement, Novartis will acquire all of the outstanding shares of Chinook through a subsidiary for a price of $40 per share in cash at closing. The CVRs to be issued to Chinook shareholders will provide for payments of up to an additional $4 per share with respect to specific regulatory approvals for atrasentan, $2 of which is related to IgA nephropathy and $2 of which is related to focal segmental glomerulosclerosis. The closing of the proposed transaction is subject to certain conditions, including approval by Chinook’s stockholders, the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary conditions. A copy of the merger agreement will be filed with the Securities and Exchange Commission (“SEC”) and will be publicly available.

The sale has occurred. The stocks have been paid out. And the remaining stock ticker changed to KDNY.cvr with .39 cents. I'm afraid if I delete it, it will not pay me my extra fun "shoes" account. Another $4.00 per share is $320? Why not take it. I only had 80 shares. I bought some at 10 or 11 bucks a few years ago through robinhood. and then I watched a steady increase, so i bought more. Some I bought at 10$ per share and I paid as high as $37.00 per share. In the end, I had 80 share, they paid cash of $40.00 per share.

https://investors.chinooktx.com/news-releases/news-release-details/chinook-therapeutics-enters-agreement-be-acquired-novartis-ag

Under the transactions section, it reads:

Under the terms of the merger agreement, Novartis will acquire all of the outstanding shares of Chinook through a subsidiary for a price of $40 per share in cash at closing. The CVRs to be issued to Chinook shareholders will provide for payments of up to an additional $4 per share with respect to specific regulatory approvals for atrasentan, $2 of which is related to IgA nephropathy and $2 of which is related to focal segmental glomerulosclerosis. The closing of the proposed transaction is subject to certain conditions, including approval by Chinook’s stockholders, the expiration of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act and other customary conditions. A copy of the merger agreement will be filed with the Securities and Exchange Commission (“SEC”) and will be publicly available.

The yellow warnings just indicate that there is no tradable contract for that symbol. Just ignore those because you're going to have to live with that for the time being.

You posted a partial image of the Accounts tool. I thought you said you get "kicked out of wealth lab". I thought "kicked out" meant "crash", but now I'm confused to what that means exactly.

Re: Knife Juggler

Limit order strategies won't buy unless the limit price is hit. Luckily, I made a very detailed video about how to trade dip buyers and even used the Knife Juggler as the example. Grab a beer, sit back, relax and watch this -

https://www.youtube.com/watch?v=4S2sgDRwMuY

You posted a partial image of the Accounts tool. I thought you said you get "kicked out of wealth lab". I thought "kicked out" meant "crash", but now I'm confused to what that means exactly.

Re: Knife Juggler

Limit order strategies won't buy unless the limit price is hit. Luckily, I made a very detailed video about how to trade dip buyers and even used the Knife Juggler as the example. Grab a beer, sit back, relax and watch this -

https://www.youtube.com/watch?v=4S2sgDRwMuY

Your Response

Post

Edit Post

Login is required