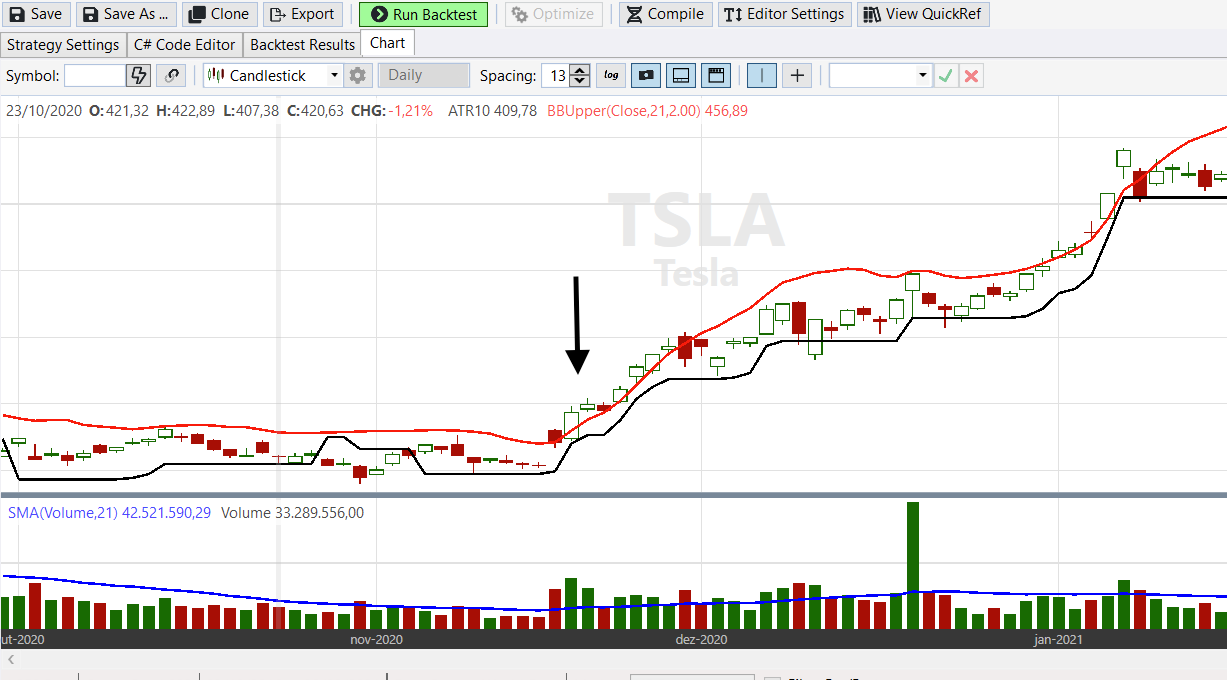

I'm coding the follow backtesting:

Buy strategy:

When the Price of 2 days ago closed under of UpperBB and the Price of yesterday closed over of UpperBB and the volume of yesterday Closed over of SMA21[volume] then, buy when the Price of today cross over of the High Price of yesterday

Sell strategy

Trailling ATR 10

I didn't understand why the strategy doesn't works in the example attached. Probably I'm missing something.

Buy strategy:

When the Price of 2 days ago closed under of UpperBB and the Price of yesterday closed over of UpperBB and the volume of yesterday Closed over of SMA21[volume] then, buy when the Price of today cross over of the High Price of yesterday

Sell strategy

Trailling ATR 10

I didn't understand why the strategy doesn't works in the example attached. Probably I'm missing something.

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Indicators; using System.Drawing; using System.Collections.Generic; using WealthLab.TASC; namespace WealthScript9 { public class MyStrategy : UserStrategyBase { public override void Initialize(BarHistory bars) { BBUpper = BBUpper.Series(bars.Close,21,2.00); PlotIndicator(BBUpper,Color.Red); smaVolume = SMA.Series(bars.Volume, 21); PlotIndicator(smaVolume, Color.Blue); stopATRHigh = ATRTrail.Series(bars, 20, 2.00); PlotTimeSeries(stopATRHigh, "ATR10", "Price", Color.Black); } public override void Execute(BarHistory bars, int idx) { if (idx == bars.Count - 1) return; if (idx < 21) return; if ((bars.Close[idx - 1] < BBUpper[idx - 1]) && (bars.Close[idx] > BBUpper[idx]) && LastOpenPosition == null && (bars.Volume[idx] > smaVolume[idx]) && (bars.Open[idx + 1] > bars.High[idx])) PlaceTrade(bars, TransactionType.Buy, OrderType.Market); else if (bars.Close.CrossesUnder(stopATRHigh, idx +1) && LastOpenPosition != null) PlaceTrade(bars, TransactionType.Sell, OrderType.MarketClose); } private TimeSeries stopATRHigh; private BBUpper BBUpper; private SMA smaVolume; } }

Rename

It's because of the rule you have where the next day's open has to be above the current day's high. That's not the case in the bar you pointed out.

Also note that your strategy cannot generate alerts because of these idx+1 checks.

Tks guys!

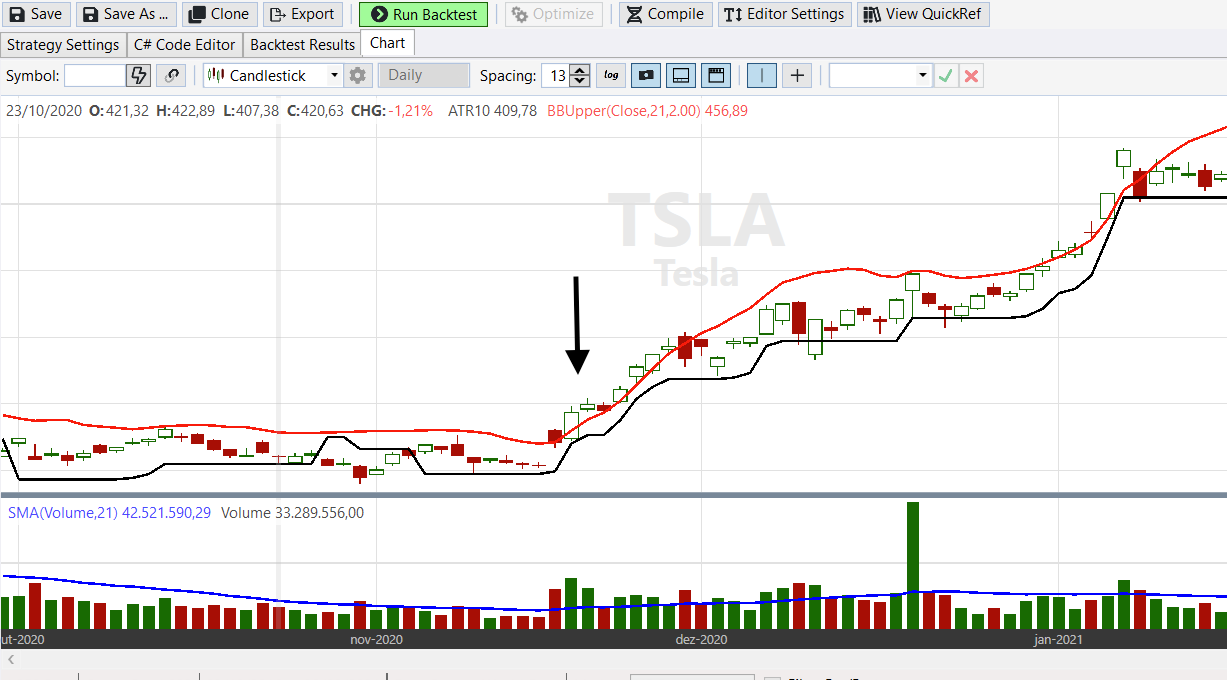

I had changed my code as below but I still missing something.

I'm trying to buy at the point detached on the picture below.

I had changed my code as below but I still missing something.

I'm trying to buy at the point detached on the picture below.

CODE:

public override void Execute(BarHistory bars, int idx) { if (idx == bars.Count - 1) return; if (idx < 21) return; if (LastOpenPosition == null && (bars.Close[idx - 1] < BBUpper[idx - 1]) && (bars.Close[idx] > BBUpper[idx]) && (bars.Volume[idx] > smaVolume[idx]) && (bars.High[idx + 1] > bars.Close[idx])) PlaceTrade(bars, TransactionType.Buy, OrderType.Limit, bars.Close[idx]); else if (bars.Close.CrossesUnder(stopATRHigh, idx +1) && LastOpenPosition != null) PlaceTrade(bars, TransactionType.Sell, OrderType.MarketClose); }

This implies having a stop order at yesterday's High rather the limit at Close.

CODE:

PlaceTrade(bars, TransactionType.Buy, OrderType.Stop, bars.High[idx]);

I think we're getting mixed up with the syntax. Let's do a reset, and just state the rules you'd like to use in plain English, I can then code up an example.

Your code here is problematic ...

what this does is check the high price of TOMORROW and then uses this information to determine whether to place a trade TODAY. So, it's peeking into the future.

Your code here is problematic ...

CODE:

&& (bars.High[idx + 1] > bars.Close[idx]))

what this does is check the high price of TOMORROW and then uses this information to determine whether to place a trade TODAY. So, it's peeking into the future.

Your Response

Post

Edit Post

Login is required