Hi, I have a question. So genetic evolver is a fantastic tool, but I have a problem regarding multiple orders on Binance. What seems to happen more often than not, is that there are "OR" sell orders and when it tries to execute another order, it cannot do so because there's not "enough sufficient funds" - because the previous order is still active and doesn't get cancelled.

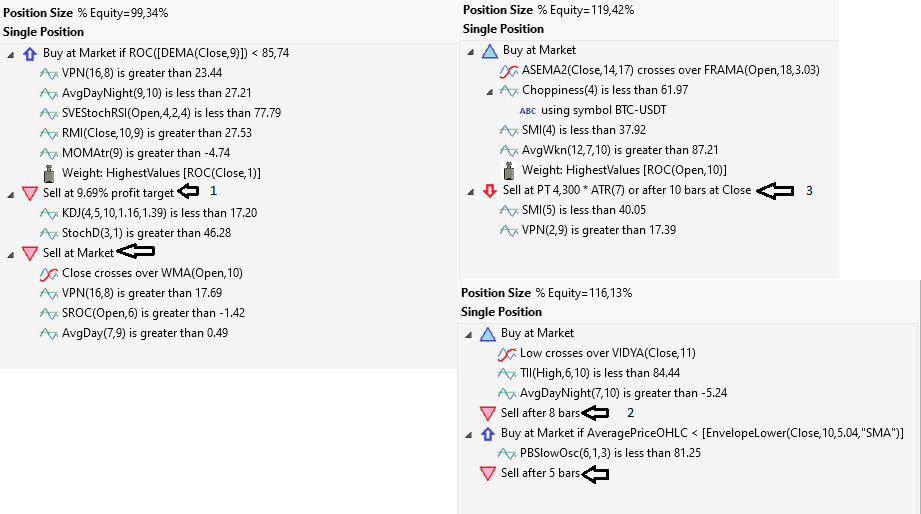

In example 1, it should sell at market price as a priority if all conditions are met if the market doesn't fill the Limit order, is that correct?

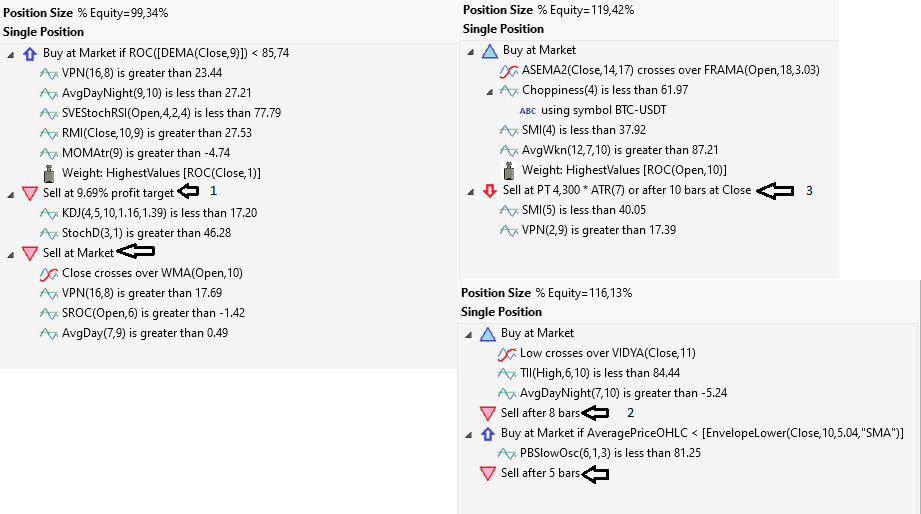

Or in example 3, price doesn't hit limit order but should close after 10 bars, yet when I tried this on Binance, it did not close after 10 bars. I got an "insufficient funds" error. I will try to replicate this since unfortunately the message log got cleared out.

Is there any way to set "priorities" to which orders are more important than others? Anyone else having problems with orders not getting cancelled?

edit: I know about position size being bigger than 100% in this case. I have a margin account with extra borrowed money and there was no problem filling the buy order at market.

In example 1, it should sell at market price as a priority if all conditions are met if the market doesn't fill the Limit order, is that correct?

Or in example 3, price doesn't hit limit order but should close after 10 bars, yet when I tried this on Binance, it did not close after 10 bars. I got an "insufficient funds" error. I will try to replicate this since unfortunately the message log got cleared out.

Is there any way to set "priorities" to which orders are more important than others? Anyone else having problems with orders not getting cancelled?

edit: I know about position size being bigger than 100% in this case. I have a margin account with extra borrowed money and there was no problem filling the buy order at market.

Rename

QUOTE:Yes, but just to express it more concisely... if the conditions exist to sell at market, then it will. Otherwise, the Limit order will be activated.

In example 1, it should sell at market price as a priority if all conditions are met if the market doesn't fill the Limit order, is that correct?

The Market order takes precedence, so the Limit order would be "pruned" (not placed).

QUOTE:WealthLab prunes orders automatically, but AtClose orders are a different animal. There's is no other way for a Stop/Limit order to be active on the same bar as a MarketClose order unless they're both active on the same bar. Change the SellAtClose after 10 bars rule to SellAtMarket after 11 bars. In an intraday market, the only difference between an AtClose order and an AtMarket order is 1 trade.

Is there any way to set "priorities" to which orders are more important than others?

Furthermore, AtClose aren't applicable to cryptos, right?

Thank you for clarification. So they do have a priority.

I see it's actually the 3rd example that I wasn't really certain about. I assumed "Close" was meant as in "candlestick close", but it is about market close, but market never closes in crypto :D. Then it makes sense to then manuall change the order, yes.

Okay, for the market / limit order example - even if limit order is active, if conditions are met for market order to happen - it will cancel the limit order?

I see it's actually the 3rd example that I wasn't really certain about. I assumed "Close" was meant as in "candlestick close", but it is about market close, but market never closes in crypto :D. Then it makes sense to then manuall change the order, yes.

Okay, for the market / limit order example - even if limit order is active, if conditions are met for market order to happen - it will cancel the limit order?

In terms of a Strategy, an "at Close" order is OrderType.MarketClose. The idea is to trade at the session's close. This is how it's used for live trading. At any time of the day that the order is placed, it will be executed at the market close. But there are Trading Preferences for MOC - see User Guide.

However, in an intraday backtest, if you're going to use that order, you need to control when you execute it - because in that context it *does* mean the bar's close. The point is, don't use a market close order for intraday strategies. It just doesn't make any sense to do that.

However, in an intraday backtest, if you're going to use that order, you need to control when you execute it - because in that context it *does* mean the bar's close. The point is, don't use a market close order for intraday strategies. It just doesn't make any sense to do that.

QUOTE:Of course. If an order isn't signaled, it's canceled. That simple.

even if limit order is active, if conditions are met for market order to happen - it will cancel the limit order?

Your Response

Post

Edit Post

Login is required