In a competing software, I used a lot an indicator called "Internal Bar Strength":

https://www.forexmt4indicators.com/internal-bar-strength-ibs-indicator-for-metatrader-4/

(by the way, I just noticed that it was developed by Volker Knapp)

Is there something similar available in the current library?

Thank you!

https://www.forexmt4indicators.com/internal-bar-strength-ibs-indicator-for-metatrader-4/

(by the way, I just noticed that it was developed by Volker Knapp)

Is there something similar available in the current library?

Thank you!

Rename

CODE:

public class IBR : IndicatorBase { public IBR() : base() { LibraryName = "Custom"; } public IBR(BarHistory source) : this() { Parameters[0].Value = source; Populate(); } public override string Name { get; } = "Inter Bar Rank"; public override string Abbreviation { get; } = "IBR"; public override string HelpDescription { get; } = "Internal Bar Rank (IBR) is an idea that has been around for some time. IBR is based on the position of the day's close in relation to the day's range: it takes a value of 0 if the closing price is the lowest price of the day, and 1 if the closing price is the highest price of the day."; public override string PaneTag { get; } = "IBRPane"; public override Color DefaultColor => Color.FromArgb(255, 0, 0, 255); public override PlotStyles DefaultPlotStyle => PlotStyles.Histogram; public static IBR Series(BarHistory source) { return new IBR(source); } protected override void GenerateParameters() { AddParameter("source", ParameterTypes.BarHistory, null); } public override void Populate() { var source = Parameters[0].AsBarHistory; DateTimes = source.Close.DateTimes; for (var n = 0; n < source.Close.Count; n++) Values[n] = (source.Close[n] - source.Low[n]) / (source.High[n] - source.Low[n]); } }

I much prefer your IBR abbreviation rather than IBS 🤢

Thank you very much for sharing the code, mjj3!

What I don't gather from the link (or other related links) is the concept of lookback period which doesn't seem to manifest itself anyhow in the code: "The period that is equal to five bars is usually used."

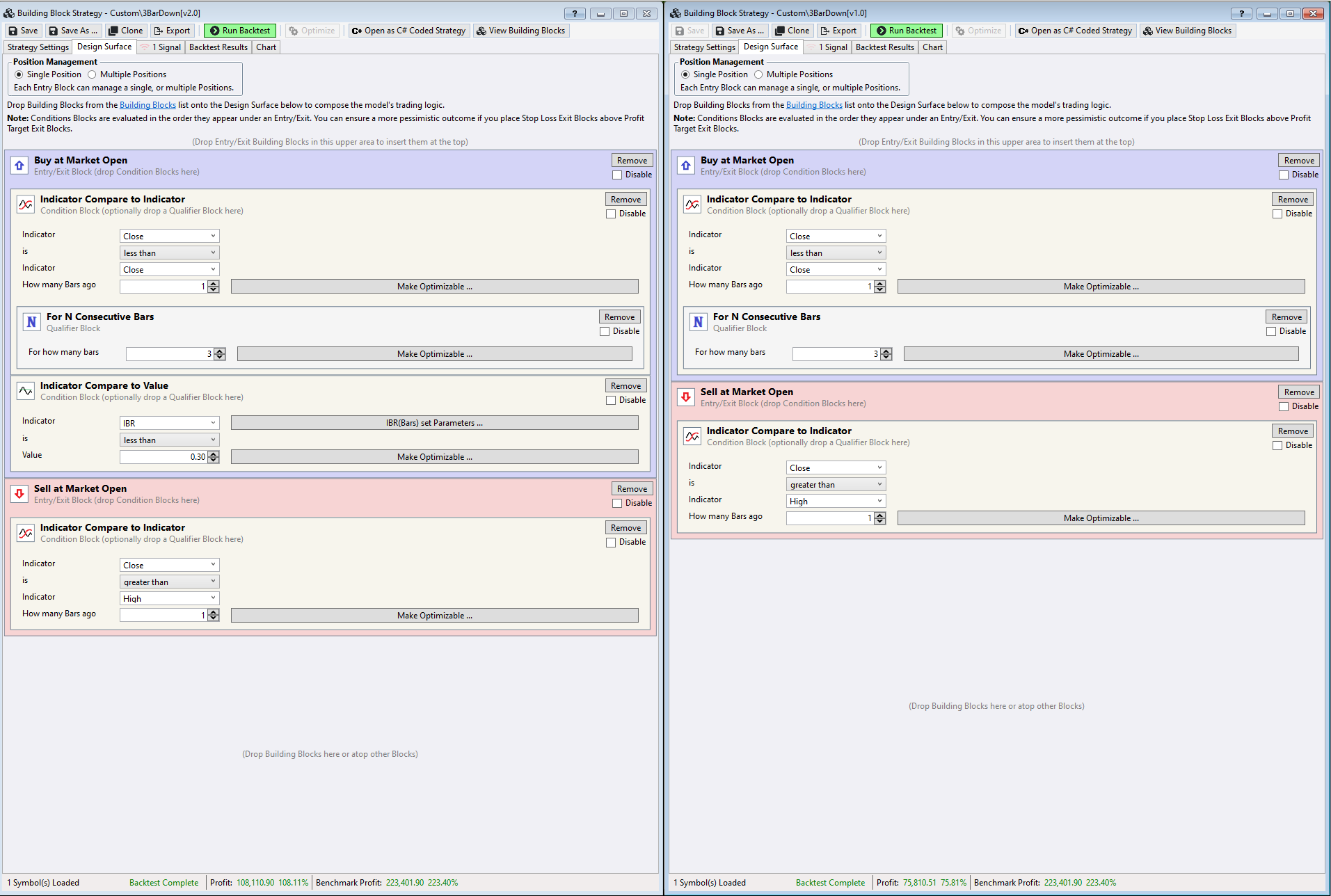

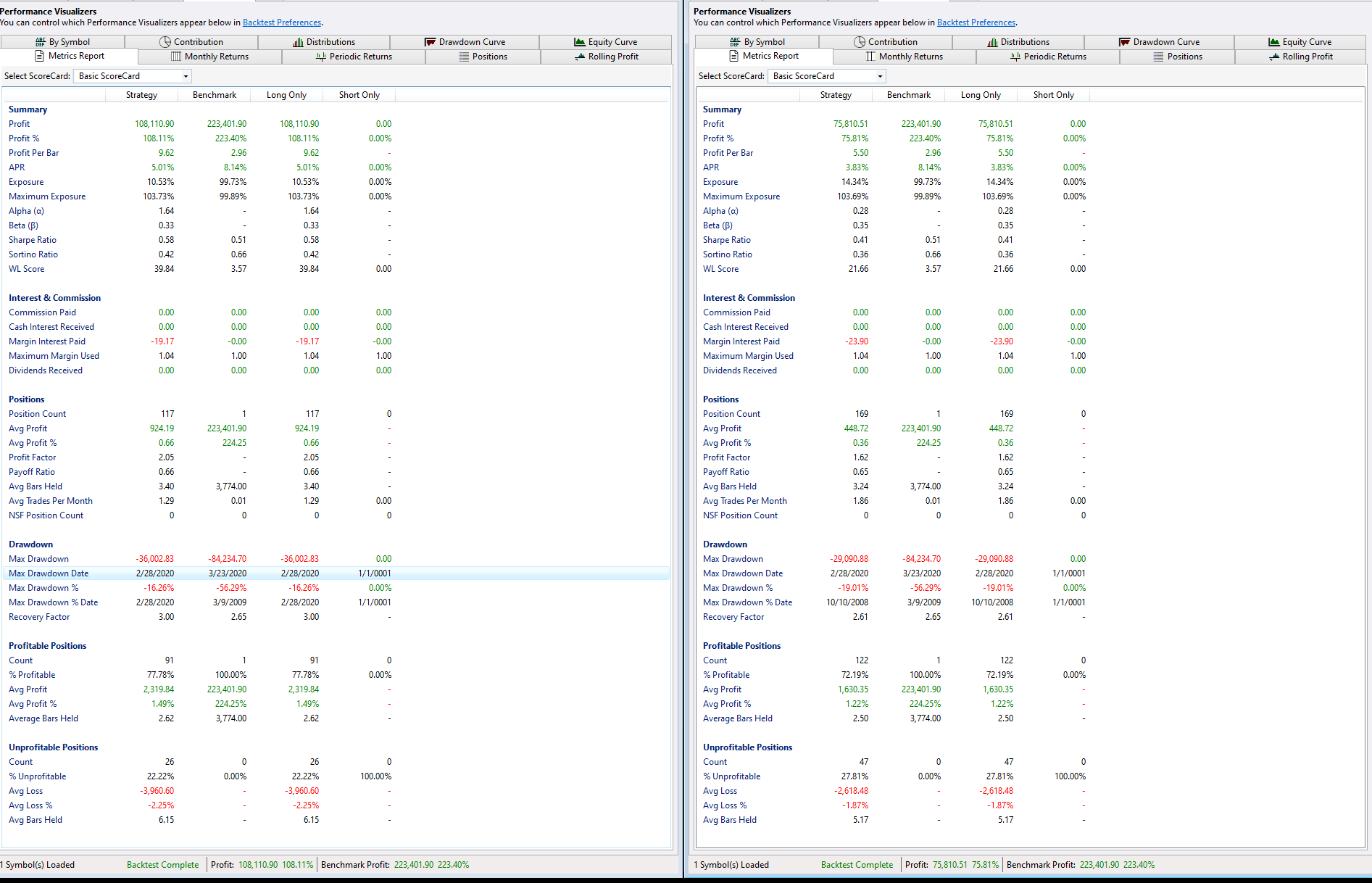

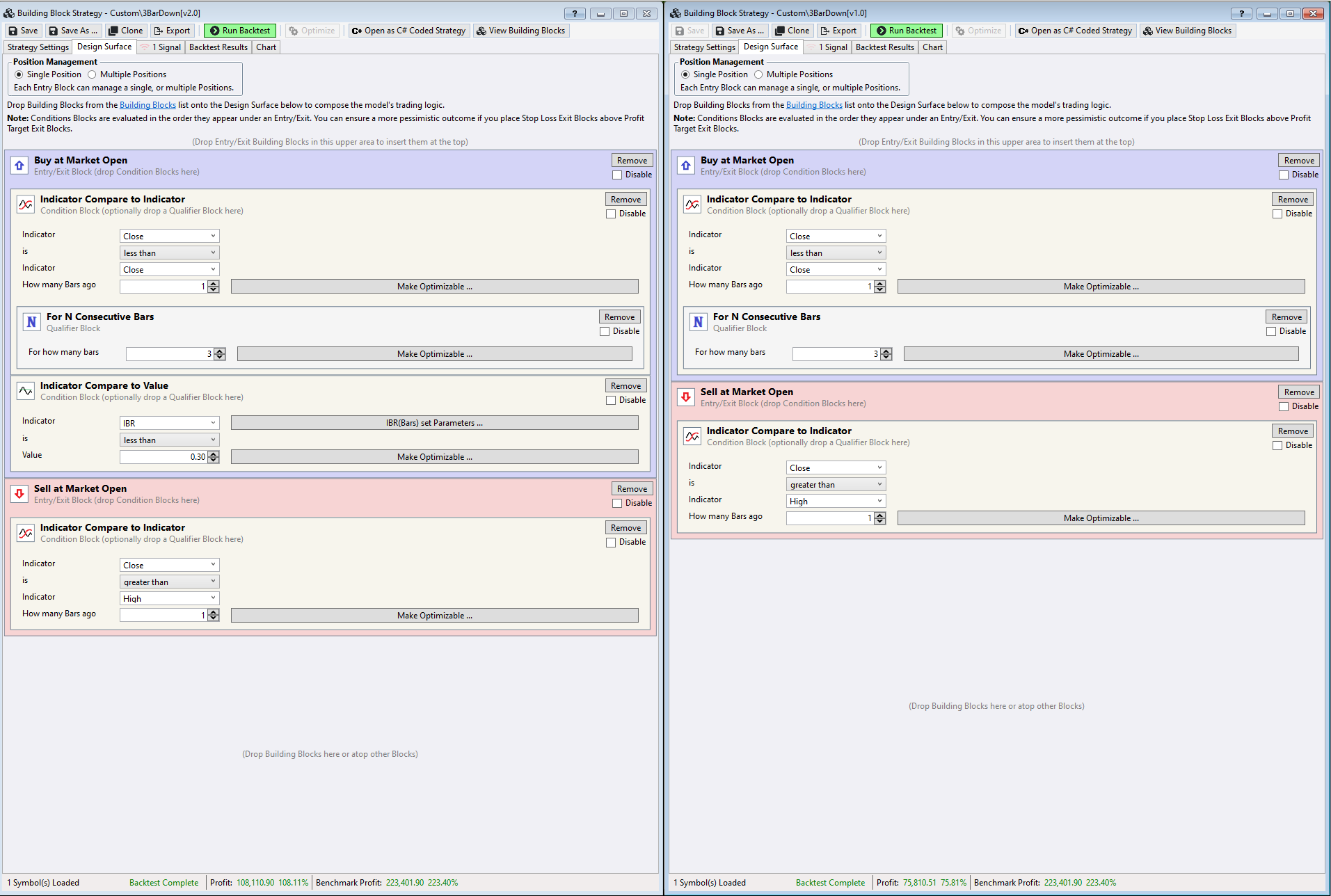

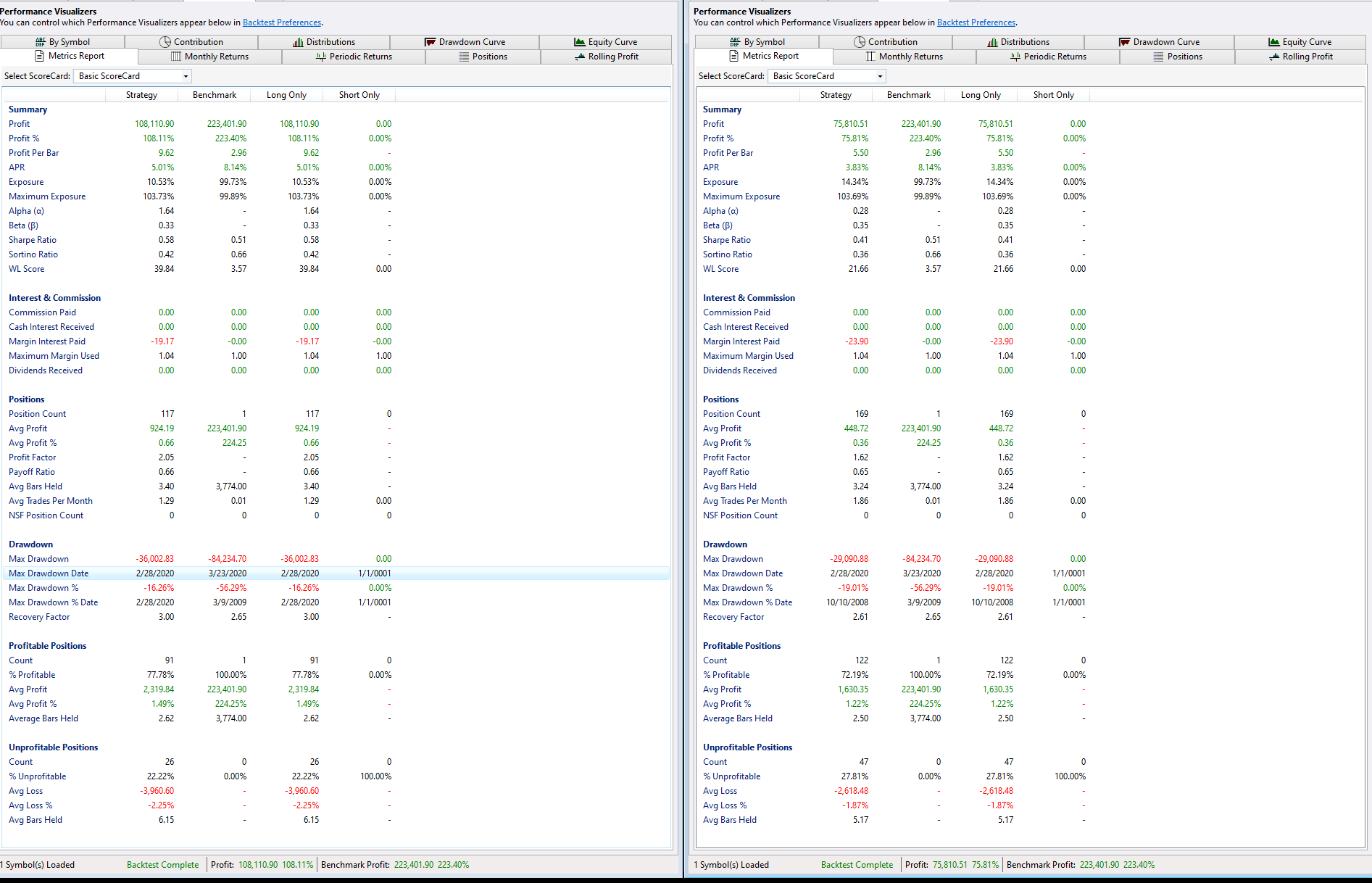

I've only seen it used on the last closing bar. Generally, it is helpful in conjunction with another setup. See simple 3 bar down example (with and without IBR)

I have been playing a bit with the indicator and it is already interesting as it is. However, I did manage to find its alternative calculation described over a certain period (passed as input):

IBSI = ((L - C) / (H - L)) + ((L - C) / (H - L) of previous days (period)) / Period * 100

IBSI = ((L - C) / (H - L)) + ((L - C) / (H - L) of previous days (period)) / Period * 100

Your Response

Post

Edit Post

Login is required