Hello,

I have recently began using the live positions feature on WL. However, I am running into a couple of problems. One of them is that if I have multiple strategies that operate on the same symbol/contract, WL cannot differentiate between the two. Is there a workaround I haven't thought of? Could I run two separate instances of WL on my machine?

One solution I thought of and mentioned in another post was to make each strategy able to use a different set of settings. For example, one would use live positions and another would not.

Another solution, and one that I was hoping was already the case, would be that the live position would determine the net total contracts for each strategy and compare that to the live positions. So if one is long 3 contracts and the other is short 2, it would expect a live position of 1 and would not change the orders from the backtest.

Thanks,

Dandude

I have recently began using the live positions feature on WL. However, I am running into a couple of problems. One of them is that if I have multiple strategies that operate on the same symbol/contract, WL cannot differentiate between the two. Is there a workaround I haven't thought of? Could I run two separate instances of WL on my machine?

One solution I thought of and mentioned in another post was to make each strategy able to use a different set of settings. For example, one would use live positions and another would not.

Another solution, and one that I was hoping was already the case, would be that the live position would determine the net total contracts for each strategy and compare that to the live positions. So if one is long 3 contracts and the other is short 2, it would expect a live position of 1 and would not change the orders from the backtest.

Thanks,

Dandude

Rename

QUOTE:

Could I run two separate instances of WL on my machine?

Not for this purpose.

QUOTE:

One solution I thought of and mentioned in another post was to make each strategy able to use a different set of settings. For example, one would use live positions and another would not.

That is not a solution because WL operates with only ONE set of settings. You're likely to experience a partial loss of your settings if you try to run several instances concurrently.

You can't do it with "Use Live Positions" because any strategy trading that symbol would sync to the full position.

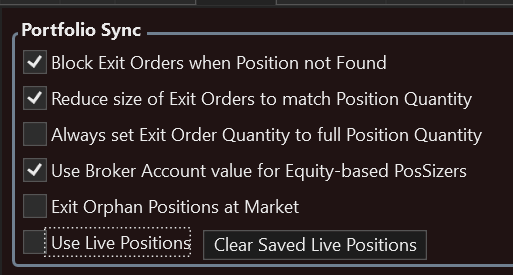

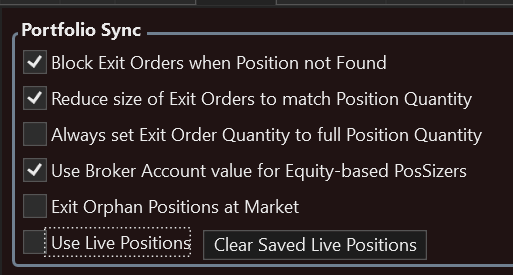

The best you can do is disable Use Live Positions and go with this Portfolio Sync configuration -

This will do 2 things for you:

1. Not allow you to exit (Sell or Cover) a position not owned in the account, and,

2. Reduce the size so that you don't "over-sell" a position.

The best you can do is disable Use Live Positions and go with this Portfolio Sync configuration -

This will do 2 things for you:

1. Not allow you to exit (Sell or Cover) a position not owned in the account, and,

2. Reduce the size so that you don't "over-sell" a position.

I understand it might be quite complicated to reprogram WL to allow a wide variety of settings for different strategies. However, maybe just this one setting could have a checkmark box in the configuration box? If each strategy could be selected for using live positions or not, I would imagine the implementation would be quite simple and it would allow a wider variety of strategies.

For example, I have found strategies that are far easier to optimize when I separate long and short versions. I have also found strategies that work on contracts in various timeframes.

And of course, many different strategies work on popular contracts like NQ, ES, ect.

For example, I have found strategies that are far easier to optimize when I separate long and short versions. I have also found strategies that work on contracts in various timeframes.

And of course, many different strategies work on popular contracts like NQ, ES, ect.

Also, might each strategy adding to the theoretical position size as I described above be worthy of a feature request?

Your Response

Post

Edit Post

Login is required