Hello, for trading with IB, the market order is most useful to ensure fidelity of executions. There is an additional option to append the IB Algo option to market trades, for the sake of price improvement.

In the past when I coded my own trading with IB it was easy to add a line of code to market orders to make it market + adaptive algo. Is it possible to do so in Wealth Lab? The only thing might be that there is also an urgency setting that a user could select, or else just leave normal priority as a default. This is a potentially easy thing that can improve trading results through IB.

In the past when I coded my own trading with IB it was easy to add a line of code to market orders to make it market + adaptive algo. Is it possible to do so in Wealth Lab? The only thing might be that there is also an urgency setting that a user could select, or else just leave normal priority as a default. This is a potentially easy thing that can improve trading results through IB.

Rename

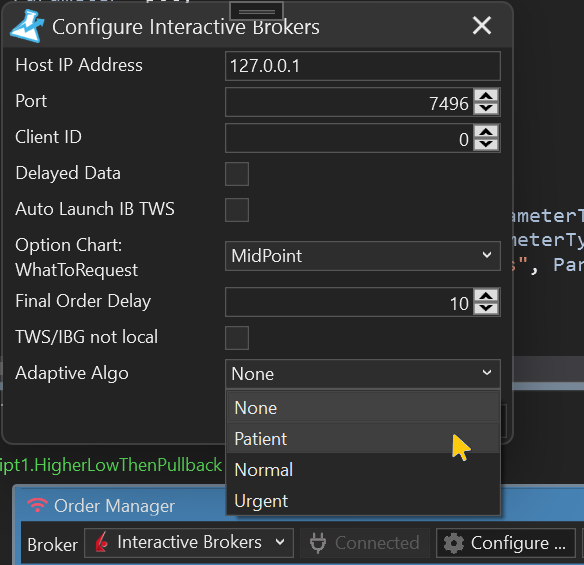

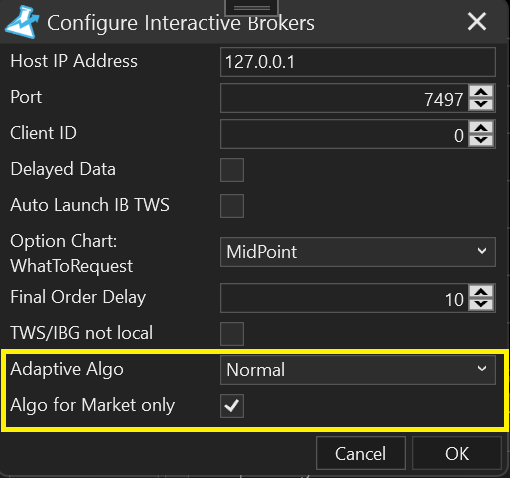

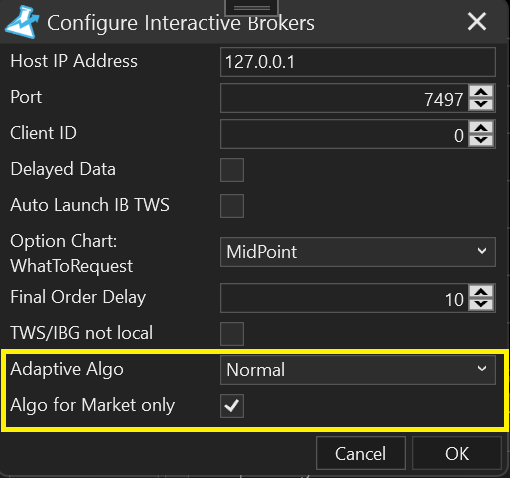

Good idea. I think the best way to implement this would be as another preference on the IB configuration page. How's this?

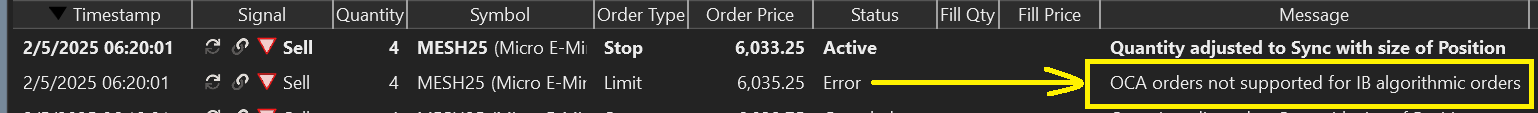

This works, but comes with a caveat - you can't use Adaptive algo with OCA orders. If you have a strategy that trades bracketed exits, you'll have to turn if off by selecting "None".

In light of this, I added another check box to apply the Algo to Market orders only. That way you can enter at Market with Algo and exit with OCA stop/limit.

Is there a reason we need the check box and not just have it apply only to market orders as the standard behavior?

Yes, because Adaptive algo can also be used for Limit orders. It just can't be applied to a Limit order that is part of an OCA bracketed exit.

The checkbox also you to use the algo for Market orders, but still trade strategies with OCA.

The checkbox also you to use the algo for Market orders, but still trade strategies with OCA.

It seems superfluous, the default behavior could be to just not apply it to OCA orders.

Good point. Wilco.

QUOTE:

additional option to append the IB Algo option to market trades, for the sake of price improvement.

So how does one select which price improvement algorithm to use?

Wouldn't it be better if "normal" did the selecting based on recent price movement and Level II status? (And I doubt Wealth-Lab traders would even be looking at Level II stuff, although if they are asking about price improvements, maybe they are.)

Perhaps all these years I just haven't researched enough, but it seems obscure exactly how the adaptive algo works. IB has numerous (perhaps too numerous) order types purporting to be price improvement strategies, but these aren't that practical when running autotrade algorithms that need to get executed 10min before the market close to maintain fidelity between the algorithm and the actual trade record.

The adaptive algo is also, usefully, valid for trading with futures and some other instruments as well.

The proposed solution looks just fine and probably should be used by everyone trading market orders through IB.

The adaptive algo is also, usefully, valid for trading with futures and some other instruments as well.

The proposed solution looks just fine and probably should be used by everyone trading market orders through IB.

Do the adaptive algo orders also apply to stop orders or just limit and market?

Market and Limit only.

Hello, while placing a few test manual orders for market with adaptive set to ‘normal’ through IB TWS, I received an error message that the order type is not supported. When I turned off adaptive and used a regular market order, the order immediately went through.

Now, I am trading subaccounts under an advisor login, and I gather that is not 100% officially supported. Is there some setting I could adjust to enable the adaptive market order, or might this be related to the use of the advisor?

Now, I am trading subaccounts under an advisor login, and I gather that is not 100% officially supported. Is there some setting I could adjust to enable the adaptive market order, or might this be related to the use of the advisor?

Your Response

Post

Edit Post

Login is required