When backtesting, the first thing I look for is the APR. I change a parameter and see if the new APR is better. When it's above 18 percent I look into more details.

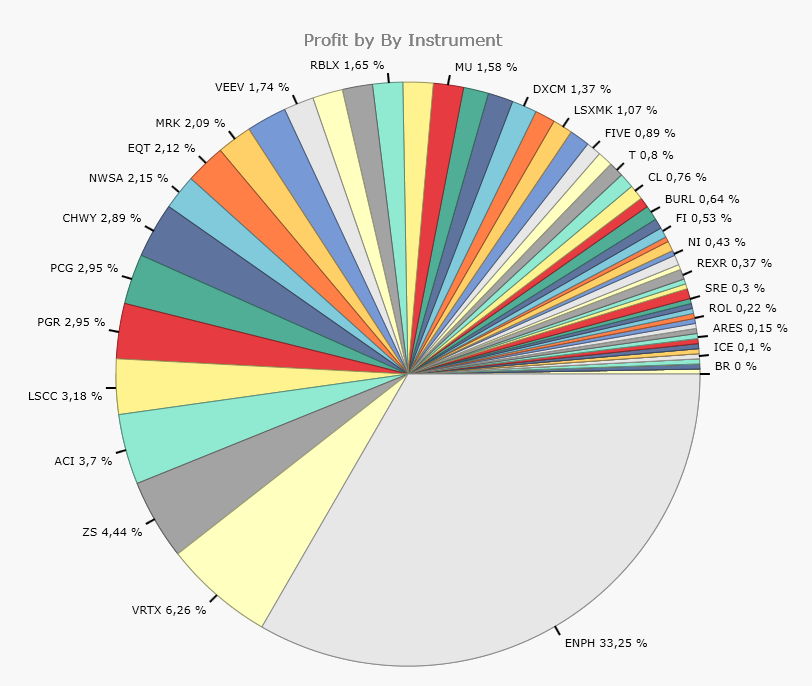

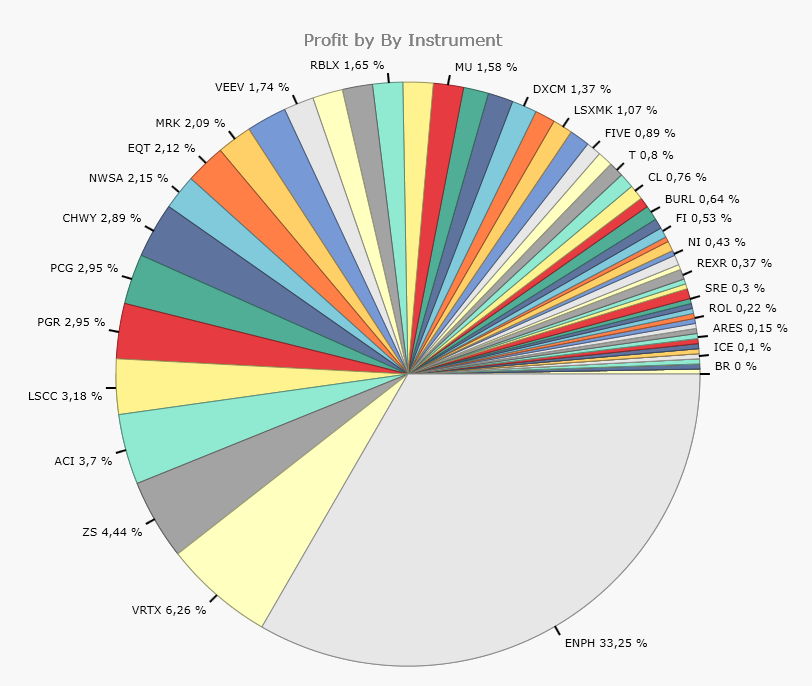

Unfortunately, sometimes the high APR is thanks to one big winner.

When managing a real portfolio, a portfolio management rule could be to sell any position when it's percentage of the total is above 20%.

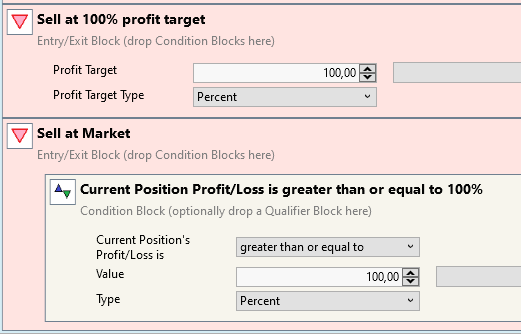

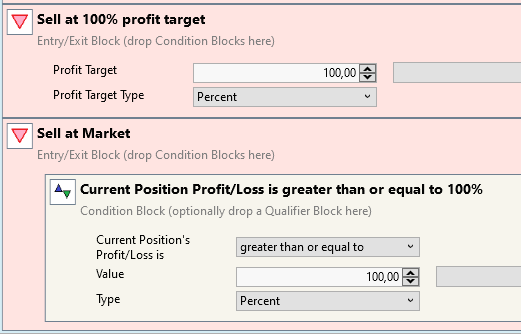

I tought a condition in the powerpack was the solution:

"Position's Profit/Loss Value

The last (most-recent) open position's Profit/Loss is greater/less/equal/not equal than X percent/dollar/points."

It looks the same as 'take profit at x percent' but it isn't.

The result is not the same.

So, now I have 2 questions. What is the difference between these 2 methods?

Secondly, is there a way to say: sell (partial) when the position of the stock in the portfolio is greater than 20 percent of the total capital?

Coming from an initial buy at 10 percent of the capital, for example.

I realize the subject is not really covering the questions.

Unfortunately, sometimes the high APR is thanks to one big winner.

When managing a real portfolio, a portfolio management rule could be to sell any position when it's percentage of the total is above 20%.

I tought a condition in the powerpack was the solution:

"Position's Profit/Loss Value

The last (most-recent) open position's Profit/Loss is greater/less/equal/not equal than X percent/dollar/points."

It looks the same as 'take profit at x percent' but it isn't.

The result is not the same.

So, now I have 2 questions. What is the difference between these 2 methods?

Secondly, is there a way to say: sell (partial) when the position of the stock in the portfolio is greater than 20 percent of the total capital?

Coming from an initial buy at 10 percent of the capital, for example.

I realize the subject is not really covering the questions.

Rename

might want to check that trade on a chart to make sure it isn't the result of an un-adjusted stock split, thats what I have found these huge winners to be.

QUOTE:Keep in mind that all of these blocks are described in the Help F1 > Strategy > Building Block > Entries

What is the difference between these 2 methods?

Sell at 100% profit target

Uses a Limit order the would result in a 100% Profit. Trades would exit only at a 100% profit or greater, if price gapped higher.

Sell at Market > Current Position Profit....

Based on a closing price that results in a 100% profit, exits at market on the next bar. Because it exists on the next bar, the actually profit can be greater or less than 100% due to gaps.

QUOTE:Yes, but not currently with blocks. In C# Code you would modify a percentage of the Transaction.Quantity and add logic to manage the number of partial exits and when each triggers. There's an example in the QuickRef > Class: Transaction > Quantity

Secondly, is there a way to say: sell (partial) when the position of the stock in the portfolio is greater than 20 percent of the total capital?

QUOTE:

I realize the subject is not really covering the questions.

Me too, so let's rename it in accordance with your 2nd question.

@moptop13 : that is indeed part of the check. I always sort on the biggest winners and check why the profit is soo big.

When using a trend strategy with a trailing stoploss (let winners run..) it is possible that some stocks (like: TSLA, MNST, AMZN, NVDA, ENPH,..) are responsible for most of your profits, even the APR for some years.

@Cone: correct, always check the F1 first. But the description was quite short:

Position's Profit/Loss Value

The last (most-recent) open position's Profit/Loss is greater/less/equal/not equal than X percent/dollar/points.

Your explanation could be added.

When using a trend strategy with a trailing stoploss (let winners run..) it is possible that some stocks (like: TSLA, MNST, AMZN, NVDA, ENPH,..) are responsible for most of your profits, even the APR for some years.

@Cone: correct, always check the F1 first. But the description was quite short:

Position's Profit/Loss Value

The last (most-recent) open position's Profit/Loss is greater/less/equal/not equal than X percent/dollar/points.

Your explanation could be added.

Your Response

Post

Edit Post

Login is required