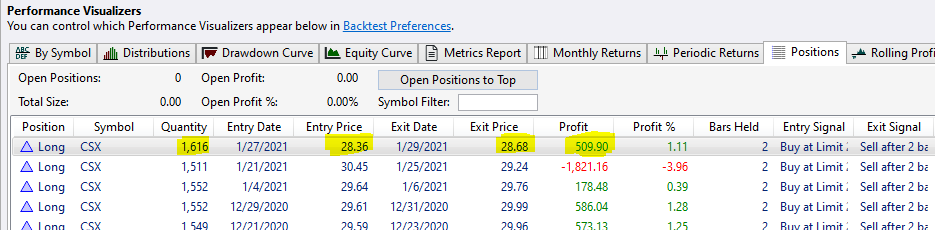

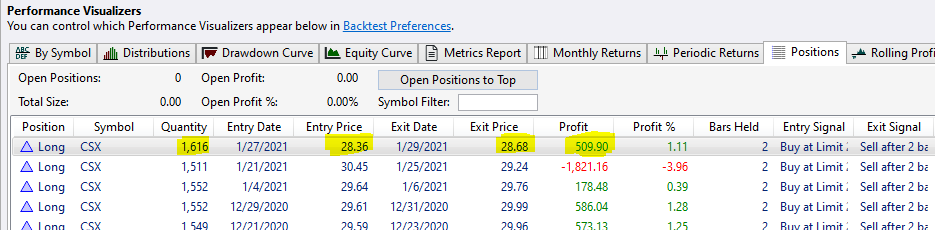

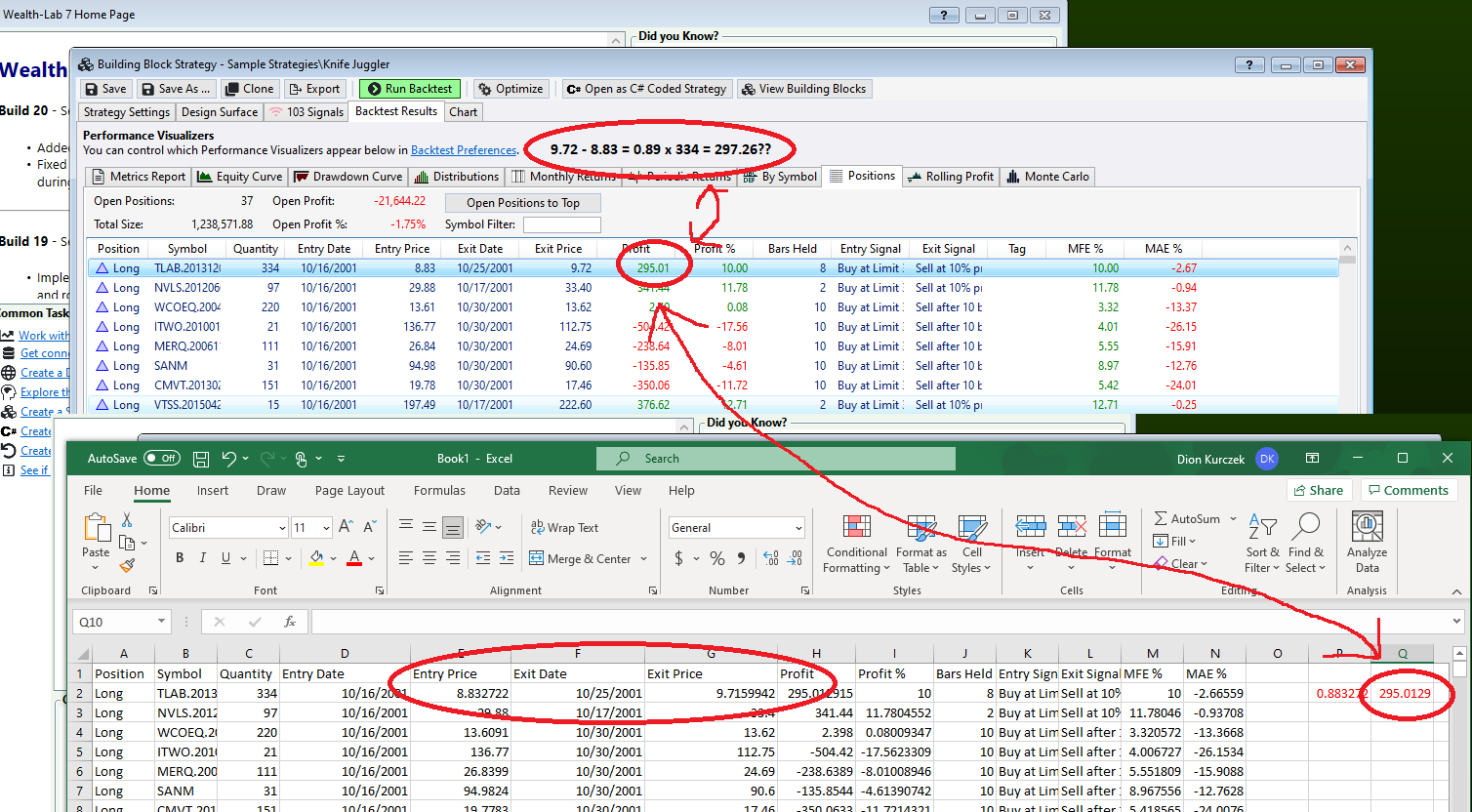

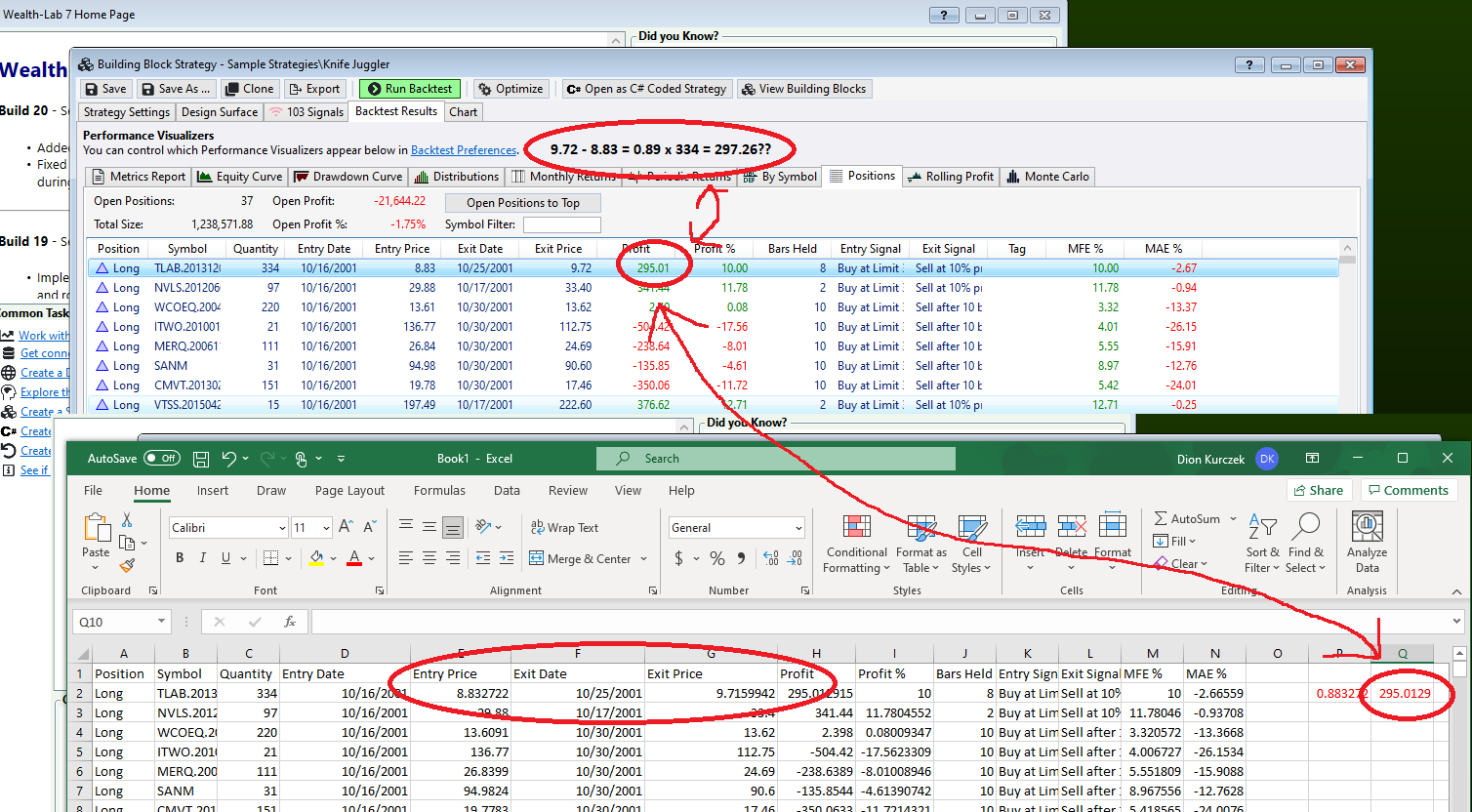

Take the Knife Juggler system as an example. Let's test, for example, the CSX ticker. Commissions and slippage = 0. Let's look at the list of transactions.

The figures in the Profit column clearly do not correspond to the calculations.

For example, on the first line:

(28.68 - 28.36) * 1616 = 517.12 (But not 509.90 like in the picture)

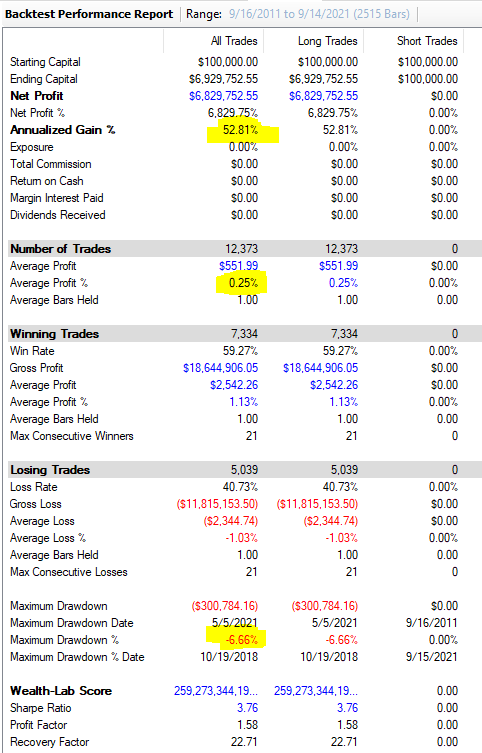

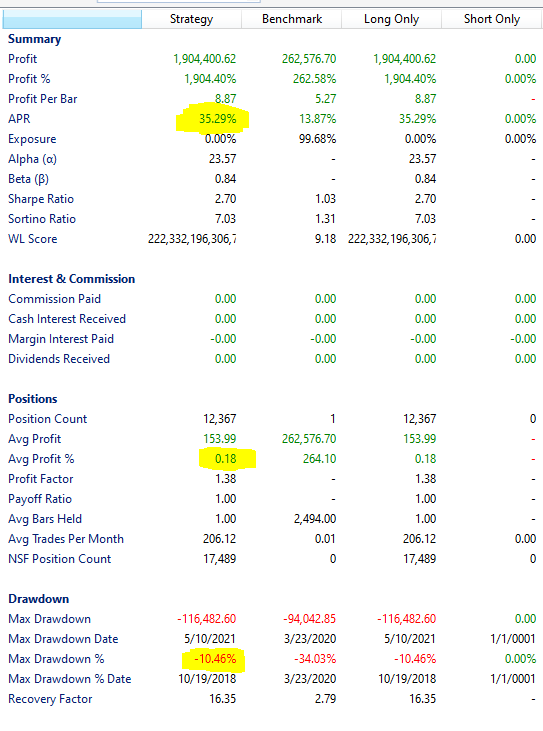

Over a long period of time, for example, 10 or more years, the error gradually accumulates and, the difference in the profitability of the test of the same system in WL6 and WL7 can reach 1.5-2 times. Especially in systems with a small average trade.

The figures in the Profit column clearly do not correspond to the calculations.

For example, on the first line:

(28.68 - 28.36) * 1616 = 517.12 (But not 509.90 like in the picture)

Over a long period of time, for example, 10 or more years, the error gradually accumulates and, the difference in the profitability of the test of the same system in WL6 and WL7 can reach 1.5-2 times. Especially in systems with a small average trade.

Rename

Commission? Slippage?

Commissions and slippage = 0

OK then. It's not an error. We discussed this before on the forum, it's display rounding:

https://www.wealth-lab.com/Discussion/Profit-Calculation-Off-Why-5881

https://www.wealth-lab.com/Discussion/Profit-Calculation-Off-Why-5881

It is clear that rounding, but this does not make it easier)

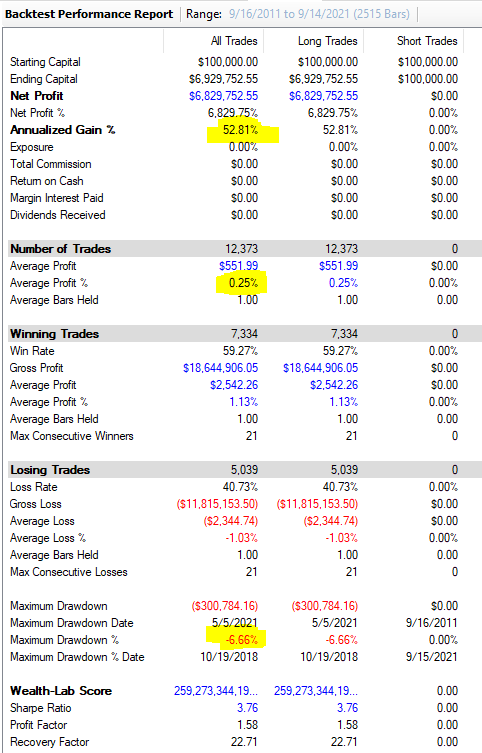

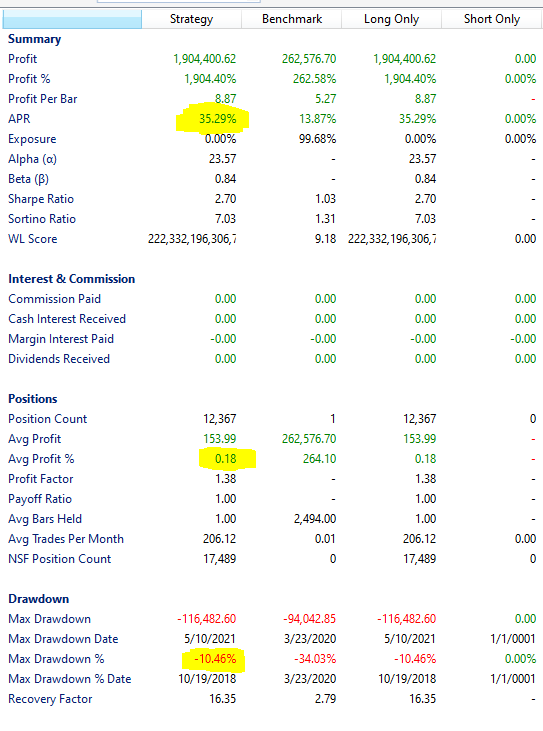

For example, a test of the same strategy over 10 years in WL6 and WL7, without slippage and commission. The position is held for one day, the exit is at the close. True, one is based on Norgate data, and the other is WealthData. The difference due to rounding off the WL7 is impressive.

For example, a test of the same strategy over 10 years in WL6 and WL7, without slippage and commission. The position is held for one day, the exit is at the close. True, one is based on Norgate data, and the other is WealthData. The difference due to rounding off the WL7 is impressive.

QUOTE:

True, one is based on Norgate data, and the other is WealthData.

But this doesn't make for a head to head comparison. Even Wealth-Data will be different between WL6 and WL7 depending on your signup date because the depth of historical index constituents depends on it in WL6 (unlike WL7 which doesn't have this limitation). Also, there are 17K NSF trades suggesting a random outcome is in play if Position.Priority isn't assigned in WL6 etc.

You can copy the positions to Excel and calculate things yourself if you have any doubts. The rounding effects the entry/exit price DISPLAY ONLY, there's no "errors" in any calculations as far as I can see.

Yes, I do not argue that the profit is calculated correctly from the entry price, which is calculated using the indicator (Close [bar] - 2%) in this system.

For example, the closing price was 10.33. We calculate the purchase price for tomorrow 10.33 - 2% = 10.1234. As I understand it, at this price the purchase is made in the backtest. In real trading, the order would have to be placed at 10.12. That is, in this trade we lose 0.0034. And so in every transaction.

Thus, the lost profit gradually accumulates)

For example, the closing price was 10.33. We calculate the purchase price for tomorrow 10.33 - 2% = 10.1234. As I understand it, at this price the purchase is made in the backtest. In real trading, the order would have to be placed at 10.12. That is, in this trade we lose 0.0034. And so in every transaction.

Thus, the lost profit gradually accumulates)

QUOTE:

Also, there are 17K NSF trades suggesting a random outcome is in play if Position.Priority isn't assigned in WL6 etc.

Yes, for the purity of the experiment, priority is assigned)

QUOTE:

In real trading, the order would have to be placed at 10.12.

This isn't 100% certain. Due to numerous historical splits, the actual (split-adjusted) prices would probably be closer to the ones with more decimal precision.

Now, we could concievably look at the splits we have to calculate things out, but IMO this would add too much overhead to the Backtester. I don't want to make things more sluggish, so I'm ok with the way things are.

Your Response

Post

Edit Post

Login is required