Is it possible to approximate a strategy's slippage by running in "paper" mode? (for example, the Alpaca Paper option in the WL7 extension)

Alternatively, would it be possible for WL7 to calculate and display the actual slippage for buy/sell signals that were executed during a live strategy run?

Alternatively, would it be possible for WL7 to calculate and display the actual slippage for buy/sell signals that were executed during a live strategy run?

Rename

I am going to answer your first question based on a long experience with “holy grail” trading systems (based on backtesting results) turned into an expensive piece of crap, due to the effect of slippage:

- Absolutely not!

There is no way you can realistically approximate a strategy’s slippage paper-trading. I would go even further and state that you cannot even properly measure it in real-trading!

You might be familiar with the “observer effect”:

https://en.wikipedia.org/wiki/Observer_effect_%28physics%29

Might sound a bit philosophical, but the simple fact that you are executing a trade influences the market in a way that distorts the reference price that your are trying to measure your slippage against. This is even more pronounced in less liquid markets and in moments of extreme volatility.

Just an example: you have a short-term trading system with fantastic backtesting results, which buys at the open based on a certain condition. You then place the order for the next day to buy that particular market; your order gets executed at precisely the official market open price (slippage=0). Looks great, but you just made the open price yourself! Maybe without your order, the official open price would have been 0.5% better (and hence you would in reality have a slippage of 0.5%)…

- Absolutely not!

There is no way you can realistically approximate a strategy’s slippage paper-trading. I would go even further and state that you cannot even properly measure it in real-trading!

You might be familiar with the “observer effect”:

https://en.wikipedia.org/wiki/Observer_effect_%28physics%29

Might sound a bit philosophical, but the simple fact that you are executing a trade influences the market in a way that distorts the reference price that your are trying to measure your slippage against. This is even more pronounced in less liquid markets and in moments of extreme volatility.

Just an example: you have a short-term trading system with fantastic backtesting results, which buys at the open based on a certain condition. You then place the order for the next day to buy that particular market; your order gets executed at precisely the official market open price (slippage=0). Looks great, but you just made the open price yourself! Maybe without your order, the official open price would have been 0.5% better (and hence you would in reality have a slippage of 0.5%)…

If the discussion is limited to end-of-day trading...

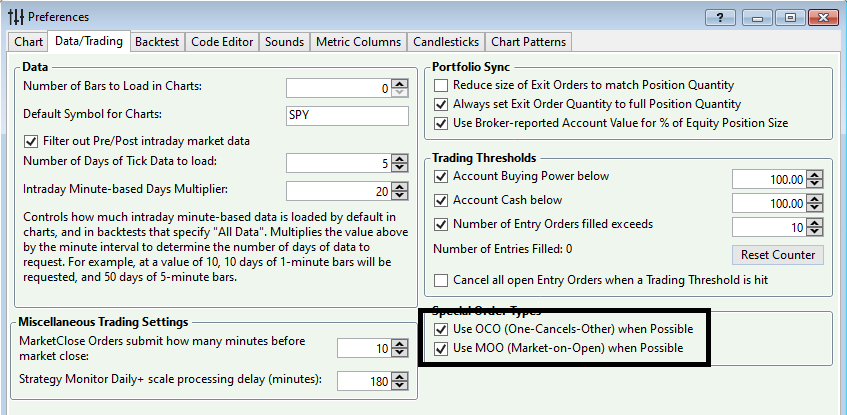

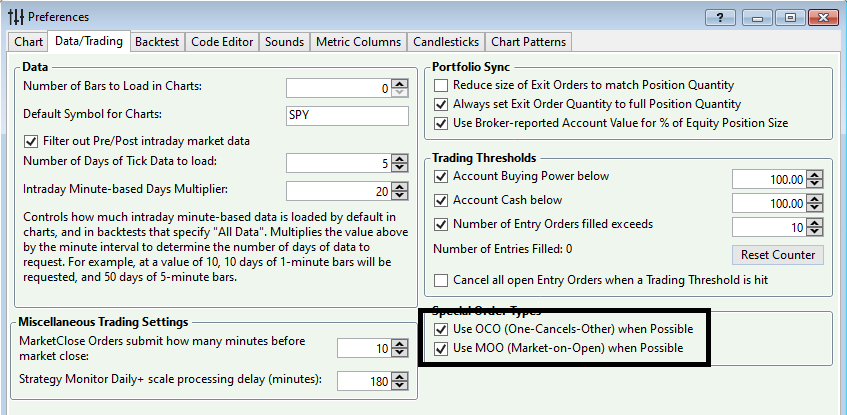

Wealth-Data, which unlike any other EOD provider has primary opening prices and simulates zero slippage for Market On Open trades. That is, you need to enter MOO orders with your broker to get the price that Wealth-Data reports. For MOO in Wealth-Lab, check this option -

If you trade on the close, all data providers use the settled close, and you can get that by entering MOC orders, which must be placed 5 minutes (Nasdaq) or 10 minutes (NYSE) before the close.

Wealth-Data, which unlike any other EOD provider has primary opening prices and simulates zero slippage for Market On Open trades. That is, you need to enter MOO orders with your broker to get the price that Wealth-Data reports. For MOO in Wealth-Lab, check this option -

If you trade on the close, all data providers use the settled close, and you can get that by entering MOC orders, which must be placed 5 minutes (Nasdaq) or 10 minutes (NYSE) before the close.

Your Response

Post

Edit Post

Login is required