Hello,

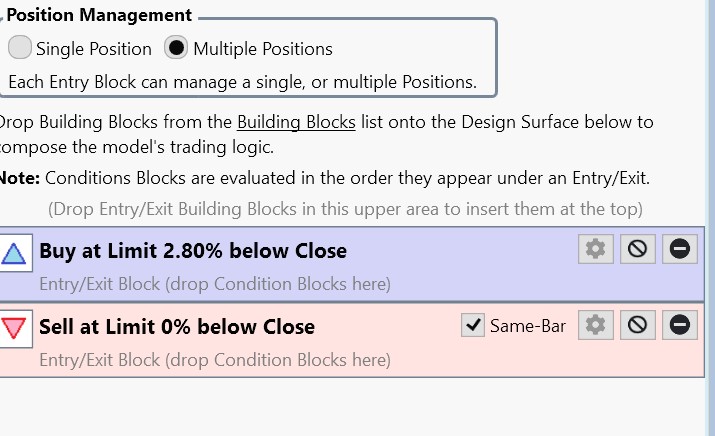

I have been using this to buy and sell during the same day:

But now I am only buying during the day, but placing the sell order AFTER the close in order to take any upgaps the next day (or later).

I plan on entering the sell orders manually but, as there can be more than 100 of them, am trying to see if I can use WL to do it.

Removing the buy portion of the strategy produces something that does not compile when I try to start it in the Strategy Manager.

Can this even be done? Blocks? C#?

Thanks!

I have been using this to buy and sell during the same day:

But now I am only buying during the day, but placing the sell order AFTER the close in order to take any upgaps the next day (or later).

I plan on entering the sell orders manually but, as there can be more than 100 of them, am trying to see if I can use WL to do it.

Removing the buy portion of the strategy produces something that does not compile when I try to start it in the Strategy Manager.

Can this even be done? Blocks? C#?

Thanks!

Rename

In the blocks, you need to create a Position to sell, OR, you can use Short at Limit.

What's the purpose of creating 100 sell orders for positions you don't own?

Or do you? Walk me through it.

If you just want the sell orders for the positions you bought today, then just uncheck the Same-Bar exit so that it will generate the Sells for the next day.

What's the purpose of creating 100 sell orders for positions you don't own?

Or do you? Walk me through it.

If you just want the sell orders for the positions you bought today, then just uncheck the Same-Bar exit so that it will generate the Sells for the next day.

D'oh!

Of course. I musta taken dumdum pills this morning.

Muchas gracias.

Of course. I musta taken dumdum pills this morning.

Muchas gracias.

I unchecked the Same-Bar and tried this today.

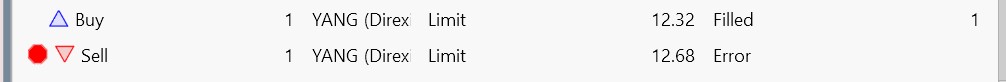

For every order that I placed, I got a matching error.

The Strategy was run, and the orders placed and active, prior to the open in case that is causing them. If it it does, do I have any other option besides manually placing the sell orders after the close?

For every order that I placed, I got a matching error.

The Strategy was run, and the orders placed and active, prior to the open in case that is causing them. If it it does, do I have any other option besides manually placing the sell orders after the close?

And what's the Error? (See the Message to the right or double click it.)

There is so much more information available that you're not showing us - to the left and right of your image.

Just a guess, but probably you didn't make sure you were using the same Account before Placing the signals.

There is so much more information available that you're not showing us - to the left and right of your image.

Just a guess, but probably you didn't make sure you were using the same Account before Placing the signals.

Sorry. Narrow window, and did not see far enough to the right.

There is nothing to the left (that I can see) and I have only one account, and that's the one where the buy went through. Where should I be looking?

The error message is "Could not find a matching Position to exit."

Of course, this make sense as the stock had not yet been bought before the open. I thought that WL would hold off until after today's close to submit the sell order.

Maybe this Strategy only works if it is activated after the market has opened?

There is nothing to the left (that I can see) and I have only one account, and that's the one where the buy went through. Where should I be looking?

The error message is "Could not find a matching Position to exit."

Of course, this make sense as the stock had not yet been bought before the open. I thought that WL would hold off until after today's close to submit the sell order.

Maybe this Strategy only works if it is activated after the market has opened?

The left side shows the Broker for the signal block.

The strategy shown above won't create the exit order unless the Limit Buy occurred. The thing is, you've got Multiple Positions seleted, which means that it's trying to exit a hypothetical position that was purchased at some time in the past - there could be many of them if a stock keeps gapping down.

There's no problem here. You can trade this strategy just as you did. Portfolio Sync will keep from exiting a Position you don't own.

The strategy shown above won't create the exit order unless the Limit Buy occurred. The thing is, you've got Multiple Positions seleted, which means that it's trying to exit a hypothetical position that was purchased at some time in the past - there could be many of them if a stock keeps gapping down.

There's no problem here. You can trade this strategy just as you did. Portfolio Sync will keep from exiting a Position you don't own.

I think I got it. All of the sells were at the bottom of the SM window. I now assume that I should have only selected the buys to to place the orders, and held off until after the close to pick and choose the matching sells of the stock that I would up buying.

Sorry for the trouble, if that's the correct process to follow.

Sorry for the trouble, if that's the correct process to follow.

If it's not clear, you need to send in the Sells too.

Yes. But not until, at least, I assume, after the market has closed today.

Sending the sells before the open, when I do not yet own the stocks, creates the error.

Sending the sells before the open, when I do not yet own the stocks, creates the error.

The sell signals are there because the strategy hypothetically bought a position, i.e., there's an open Position. It might have bought it that day or 10 days ago, but there's a position that is open.

If your live (or paper) account doesn't have that position, then you'll get an "Error" that just means that you don't have the position to sell. It's not really an "Error", that's just what we call it because your trying to sell something you don't actually own.

If you have the Position then the order will go live, because the Account actually owns the position that the strategy would have bought.

All EOD orders should go in before the open. Ignore the "Errors" for the Positions you don't own.

If your live (or paper) account doesn't have that position, then you'll get an "Error" that just means that you don't have the position to sell. It's not really an "Error", that's just what we call it because your trying to sell something you don't actually own.

If you have the Position then the order will go live, because the Account actually owns the position that the strategy would have bought.

All EOD orders should go in before the open. Ignore the "Errors" for the Positions you don't own.

Your Response

Post

Edit Post

Login is required