Many thanks for adding "how many bars ago?" filter to the building block "indicator % above / below Indicator %"! Very helpful to identify gaps. A follow-up question would be, can I also design this block to avoid taking trades after a gap ? Like close is "not below" / "less than" x% below close y bars ago?

Rename

Can you simply invert the rule to avoid gaps? For example, to filter out any down gaps you set the condition to "Open is e.g. 0.01% above Close (with "How many bars ago" = 1)".

Thanks Eugene, that works. I also thought about allowing for some gaps (e.g. down to -5%), but exclude more extreme ones. Do you have an idea for that, too?

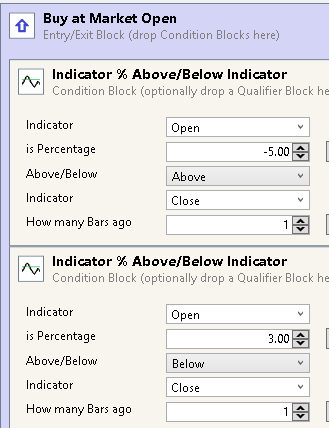

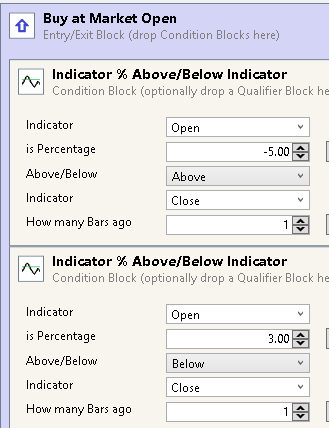

I think this can be accomplished if you get a bit creative. Like on this screenshot, the negative percentage (-5) above sets a cap to how deep can the worst gap be. The paired condition requires a gap to be at least 3% below (just for example):

The thing that isn't obvious in this rule is that the first Indicator (Open) is evaluated on the current index and the second indicator (Close) is evaluated on "bars ago". Nonetheless, the rule reads well, and it's covered in the Help.... which reminds me that we forgot to explain that new Trendline Break condition there!

Your Response

Post

Edit Post

Login is required