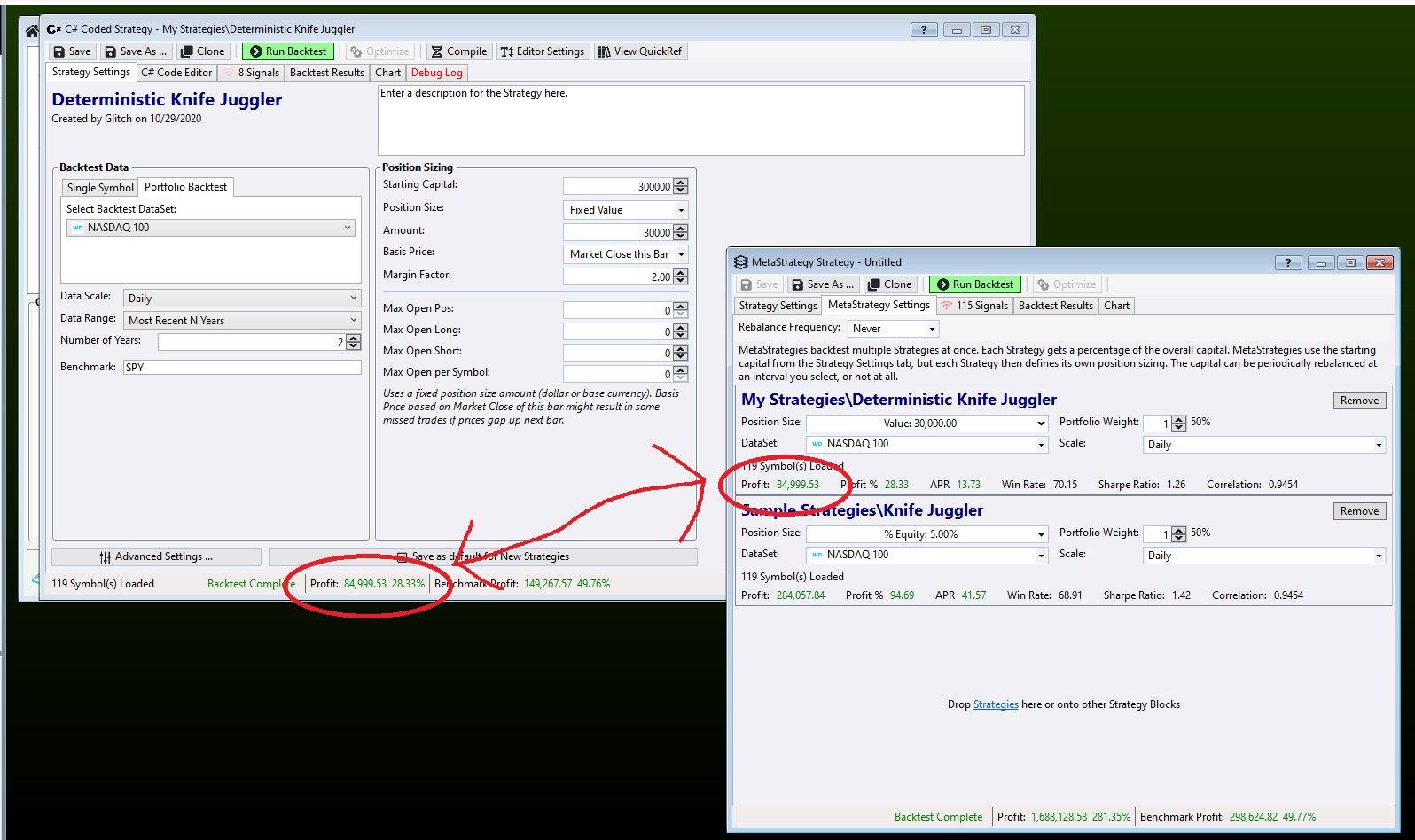

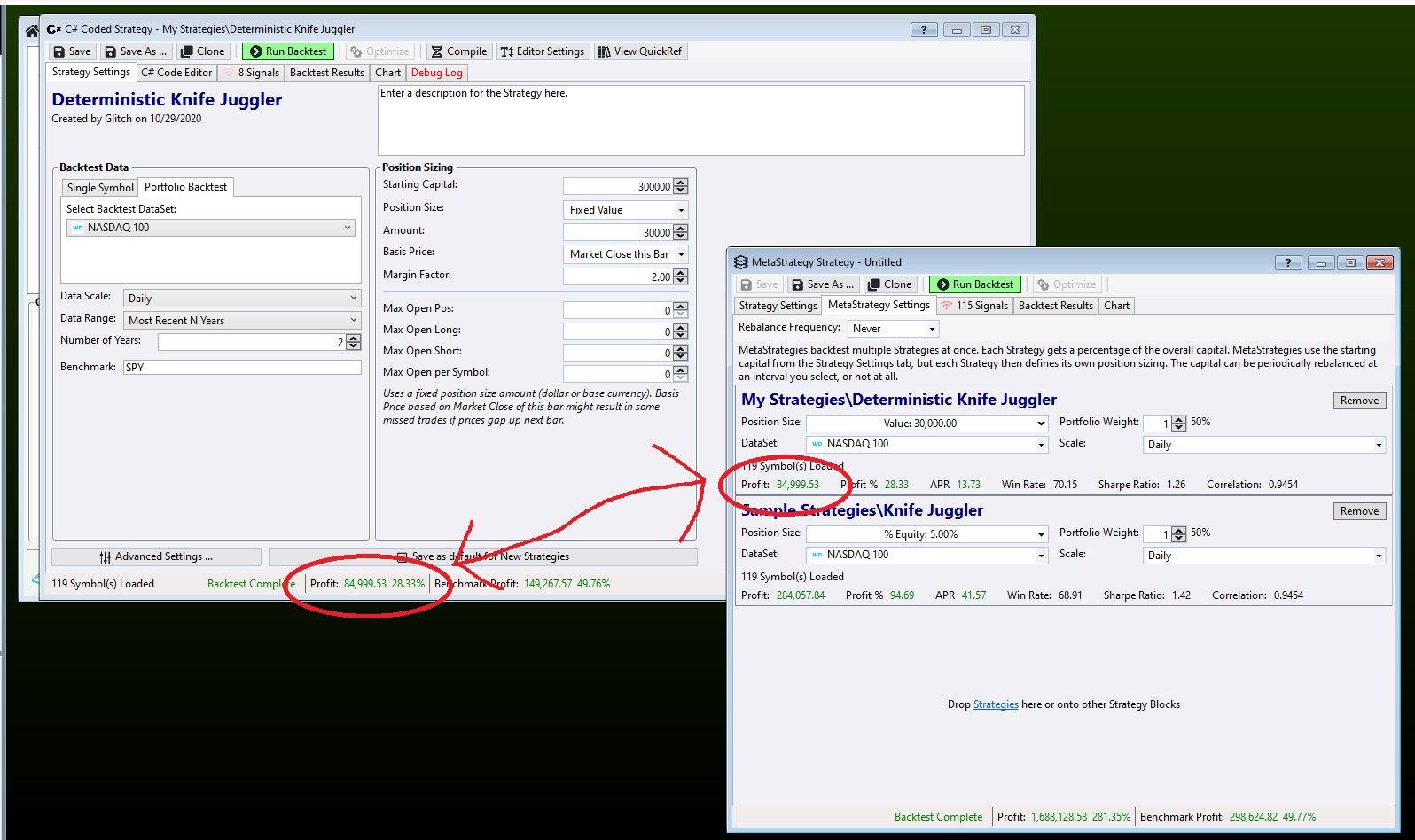

I'm getting different results when I run a strategy individually versus running it as a meta strategy with just one strategy. Is there a reason they should give different results?

Rename

Try to follow the troubleshooting suggestions from topic below, please:

https://www.wealth-lab.com/Discussion/Getting-less-trades-in-a-MetaStrategy-than-expected-5725

https://www.wealth-lab.com/Discussion/Getting-less-trades-in-a-MetaStrategy-than-expected-5725

All else being equal, the results should match identically. Looks for NSF, different range, same starting capital and position sizing, etc...

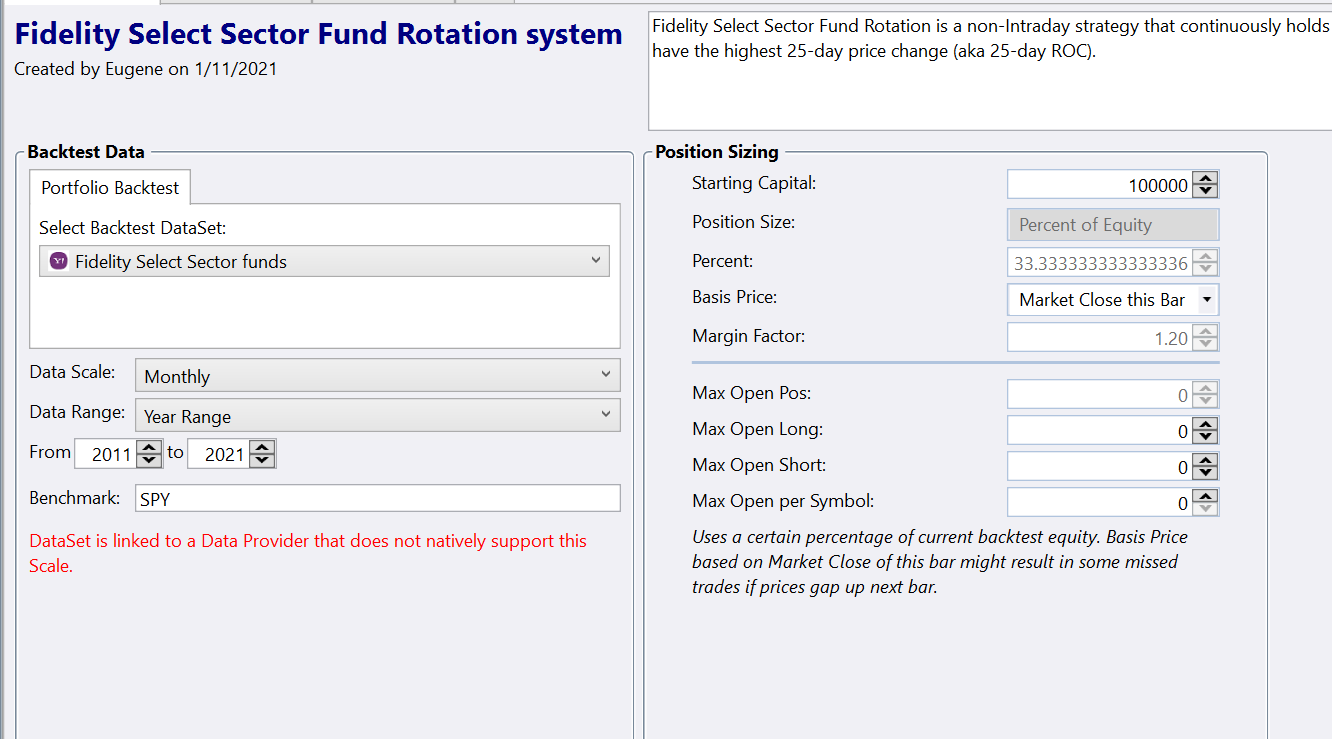

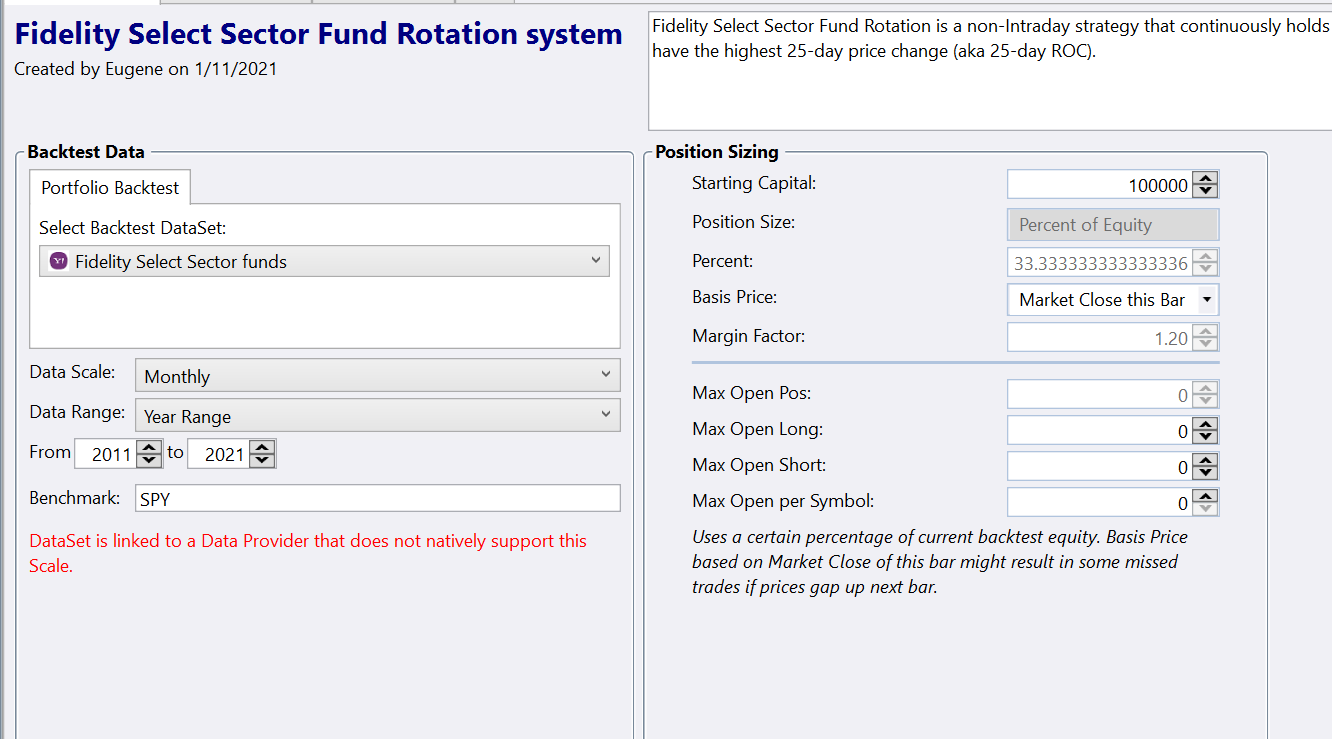

So I tracked down where the problem seems to be. I was able to recreate it using the sample Fidelity Rotation Strategy by using the Monthly scale.

Try running the strategy on it's own versus the meta with the scale being monthly for each. Daily scale is fine.

Try running the strategy on it's own versus the meta with the scale being monthly for each. Daily scale is fine.

Settings used

Confirmed. Assuming other settings being equal, the Rotation strategy starts trading on 10/2012 whereas the MetaStrategy does it on 07/2011. Hence it takes a lot more trades. This doesn't seem right because the ROC period is 20 (months) which haven't passed since the From date (2011).

P.S. Let's rename the topic to reflect the significant fact discovered: a Rotation strategy.

P.S. Let's rename the topic to reflect the significant fact discovered: a Rotation strategy.

Solution:

1. Create your Rotation strategy from scratch.

2. Create a MetaStrategy from scratch. Add the new Rotation strategy.

We believe that some settings stored with the canned Rotation strategy's file got in conflict with some fixes made to the code base in builds that followed.

1. Create your Rotation strategy from scratch.

2. Create a MetaStrategy from scratch. Add the new Rotation strategy.

We believe that some settings stored with the canned Rotation strategy's file got in conflict with some fixes made to the code base in builds that followed.

Your Response

Post

Edit Post

Login is required