Is there a WL8 C# class available where I can read out the max. exposure % per bar?

Rename

No, there isn't. Do you need this metric as the resulting value or on a bar by bar basis?

QUOTE:

Do you need this metric as the resulting value or on a bar by bar basis?

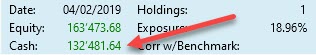

Bar by bar, as shown in the bottom left of the equity curve.

I could of course calculate it by myself since I need equity - cash, but I don't know how to get the cash value via code?

See: QuickRef > Class: Backtester > CurrentCash

Very quick example -

Very quick example -

CODE:

public override void Execute(BarHistory bars, int idx) { if (!HasOpenPosition(bars, PositionType.Long)) { if (Backtester.CurrentCash > 5000) PlaceTrade(bars, TransactionType.Buy, OrderType.Market); } else { //code your sell conditions here } }

It is not possible/meaningfull to access equity/cash in a WL Strategies code because the sequence of events is different from what you think.

A single symbol is executed completely before the code is run for the next symbol. So you dont get correct equity/cash for all but the last symbol.

Whatever you want to do you should do it in a PositionSizer.

Probably send some info from the strategy to the PosSizer in the position tag.

A single symbol is executed completely before the code is run for the next symbol. So you dont get correct equity/cash for all but the last symbol.

Whatever you want to do you should do it in a PositionSizer.

Probably send some info from the strategy to the PosSizer in the position tag.

QUOTE:With respect to WealthLab versions prior to Version 7, that's correct.

It is not possible/meaningfull to access equity/cash in a WL Strategies code because the sequence of events is different from what you think.

Beginning with Version 7 that statement is incorrect.

Strategies have access to the portfolio's end-of-bar Cash and Equity for the current bar/index. You can access these values from the Backtester properties CurrentCash and CurrentEquity.

Thank you for your assistance. In this case, I'll code the max. exposure by myself.

In return for the quick help, a sample system with the Max Exposure as indicator.

CODE:

using WealthLab.Backtest; using System; using WealthLab.Core; using WealthLab.Indicators; using System.Collections.Generic; namespace WealthScript22 { public class MyStrategy : UserStrategyBase { private IndicatorBase consDown; private IndicatorBase consUp; private TimeSeries stops; private Transaction _transaction; private TimeSeries cashCurve; private TimeSeries equityCurve; private TimeSeries exposureCurve; public MyStrategy() : base() { AddParameter("Entry Consecutive Down", ParameterType.Double, 9, 1, 15, 1); AddParameter("Exit Consecutive Up", ParameterType.Double, 3, 1, 15, 1); AddParameter("Exit After N Days", ParameterType.Int32, 17, 1, 20, 1); AddParameter("% Stop Loss", ParameterType.Int32, 10, 1, 20, 1); // 10 9 7 } public override void Initialize(BarHistory bars) { consDown = new ConsecDown(bars.Close,4); consUp = new ConsecUp(bars.Close, 1); PlotIndicator(consDown,new WLColor(0,0,0)); PlotIndicator(consUp,new WLColor(0,0,255)); cashCurve = new TimeSeries(bars.DateTimes); equityCurve = new TimeSeries(bars.DateTimes); exposureCurve = new TimeSeries(bars.DateTimes); PlotTimeSeries(cashCurve, "Equity-Cash-Curve USD", "Equity-Cash", WLColor.Red, PlotStyle.Line); PlotTimeSeries(equityCurve, "Equity-Cash-Curve USD", "Equity-Cash", WLColor.DarkGray, PlotStyle.Histogram); PlotTimeSeries(exposureCurve, "Max Exposure %", "Exposure", WLColor.CornflowerBlue, PlotStyle.Line); PlotStopsAndLimits(3); StartIndex = 20; } public override void Execute(BarHistory bars, int idx) { cashCurve[idx] = Backtester.CurrentCash; equityCurve[idx] = Backtester.CurrentEquity; exposureCurve[idx] = (((equityCurve[idx] - cashCurve[idx]) / equityCurve[idx]) * 100); int index = idx; Position posLong = FindOpenPosition(0); if (posLong == null) { if (consDown[index] >= Parameters[0].AsDouble) _transaction = PlaceTrade(bars, TransactionType.Buy, OrderType.Market, 0, 0, "Enter Long"); } else { if (consUp[index] >= Parameters[1].AsDouble) if (index - 1 >= 0 && bars.Open[index] > bars.Open[index - 1]) ClosePosition(posLong, OrderType.Market, 0, "Sell when condition is true"); if (idx - posLong.EntryBar + 1 >= Parameters[2].AsInt) ClosePosition(posLong, OrderType.Market, 0, "Sell after 10 bars"); ClosePosition(posLong, OrderType.Stop, posLong.EntryPrice * (1.0 - (Parameters[3].AsInt / 100.0)), "Sell at stop loss"); } } } }

Your Response

Post

Edit Post

Login is required