Hello, I have the following WL6.9 strategy:

Buy at Market

Moving Average is trending down (SMA/Close/26/1)

Price is below Moving Average (Close/SMA/Close/10)

Sell at Market

Active Position is older than a number of bars (3)

I backtested it for the period 2015-2019 (5 years) on the S&P500 dataset. Position sizing = 33.33%, margin factor = 1.1, portfolio mode with starting capital $ 100.000.

Since it has no priority, I ran it more than 50 times and on average it results in an APR of 20%.

I transferred the strategy to WL7:

Buy at market open

Indicator Turns: SMA (Close,26) / Down

Indicator compare to Indicator: Close less than SMA (Close, 10) / 0 bars ago

Sell after N Bars

How many bars = 3

However, the WL7 strategy acquires only 7% on average.

Does anybody see a mistake?

Best regards,

Werner

Buy at Market

Moving Average is trending down (SMA/Close/26/1)

Price is below Moving Average (Close/SMA/Close/10)

Sell at Market

Active Position is older than a number of bars (3)

I backtested it for the period 2015-2019 (5 years) on the S&P500 dataset. Position sizing = 33.33%, margin factor = 1.1, portfolio mode with starting capital $ 100.000.

Since it has no priority, I ran it more than 50 times and on average it results in an APR of 20%.

I transferred the strategy to WL7:

Buy at market open

Indicator Turns: SMA (Close,26) / Down

Indicator compare to Indicator: Close less than SMA (Close, 10) / 0 bars ago

Sell after N Bars

How many bars = 3

However, the WL7 strategy acquires only 7% on average.

Does anybody see a mistake?

Best regards,

Werner

Rename

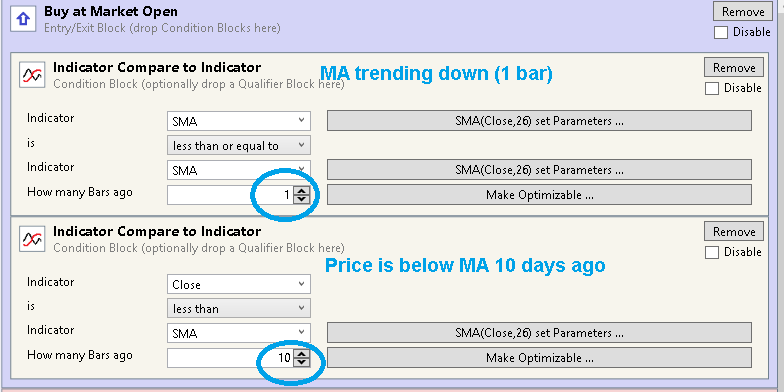

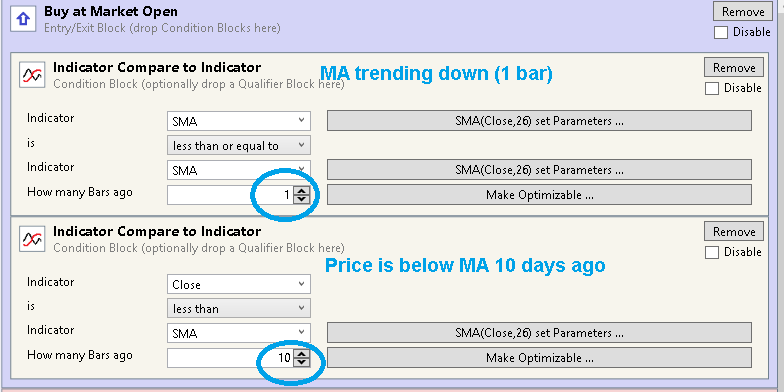

Hi Werner,

"Moving Average is trending down" is simply a way to say that the MA has declined i.e. its value is lower than it was the day (or bar) before.

So for trending down, choose "Indicator compare to Indicator", choose the 26-period SMA as both the indicators, "Less than..." and finally, "How many bars ago" >= 1 because it's the Lookback period.

I've updated the cheat sheet:

https://wl6.wealth-lab.com/Forum/Posts/Rules-WL6-gt-Building-Blocks-WL7-40617

"Moving Average is trending down" is simply a way to say that the MA has declined i.e. its value is lower than it was the day (or bar) before.

So for trending down, choose "Indicator compare to Indicator", choose the 26-period SMA as both the indicators, "Less than..." and finally, "How many bars ago" >= 1 because it's the Lookback period.

I've updated the cheat sheet:

https://wl6.wealth-lab.com/Forum/Posts/Rules-WL6-gt-Building-Blocks-WL7-40617

Thanks!

Your Response

Post

Edit Post

Login is required