Some ideas on how to speed up the processing time to be able to run more in-depth analysis on portfolios of strategies (from easiest to more difficult):

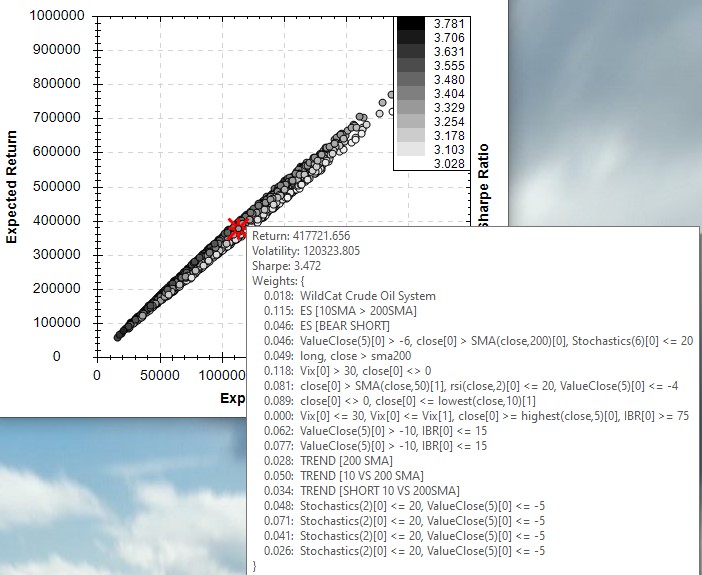

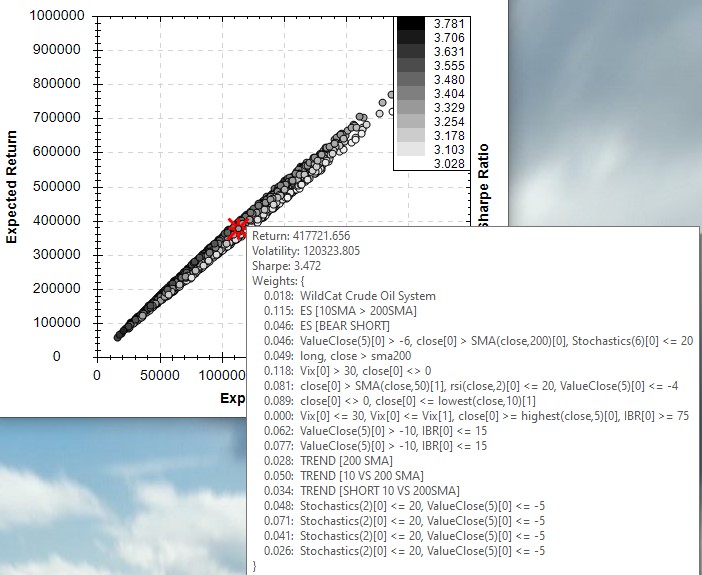

- Have you considered just combining equity curves and scaling sizing by allocation? This should work fine as long as the sizer used isn't path dependent. You can then take a portfolio of equity curves and solve for the minimum variance of the sharpe ratio to get ideal weights.

- If you save the nsf positions from a backtest/optimization you can solve for the optimal equity percent allocation of the individual strategy within the portfolio of strategies.

- Have you considered just combining equity curves and scaling sizing by allocation? This should work fine as long as the sizer used isn't path dependent. You can then take a portfolio of equity curves and solve for the minimum variance of the sharpe ratio to get ideal weights.

- If you save the nsf positions from a backtest/optimization you can solve for the optimal equity percent allocation of the individual strategy within the portfolio of strategies.

Rename

Some ideas to realize this without any changes to WL8:

* Write a special ScoreCard/Performance metric which saves all positions (including NSF) to a file (csv file, named after the strategy)

* Write a special strategy which reads all positions and re-executes them with adjustable position sizes.

* use ScottPlots to create the graphics

* Write a special ScoreCard/Performance metric which saves all positions (including NSF) to a file (csv file, named after the strategy)

* Write a special strategy which reads all positions and re-executes them with adjustable position sizes.

* use ScottPlots to create the graphics

Could be somehow built into Monte Carlo Lab too.

QUOTE:

* Write a special ScoreCard/Performance metric which saves all positions (including NSF) to a file (csv file, named after the strategy)

Maybe replace it with StrategyRunner?

All of these ideas sound great. Let me know if I can help.

Your Response

Post

Edit Post

Login is required