Good evening, I probably have a somewhat unusual question regarding the use of Wealth-Lab, but I'll try anyway, sorry in advance.

When I apply a single strategy, I specify the ticker symbol QQQ as an example, set the position size to 100% equity, and the margin to approximately 1.1. So far, so good.

Now, if I want to test all the individual symbols of the Nasdaq 100 for this strategy, I actually have to run the backtest with each symbol individually, meaning 100 runs where I have to enter each symbol in the settings.

Is that correct, or is there a faster way to do this?

Thanks in advance.

When I apply a single strategy, I specify the ticker symbol QQQ as an example, set the position size to 100% equity, and the margin to approximately 1.1. So far, so good.

Now, if I want to test all the individual symbols of the Nasdaq 100 for this strategy, I actually have to run the backtest with each symbol individually, meaning 100 runs where I have to enter each symbol in the settings.

Is that correct, or is there a faster way to do this?

Thanks in advance.

Rename

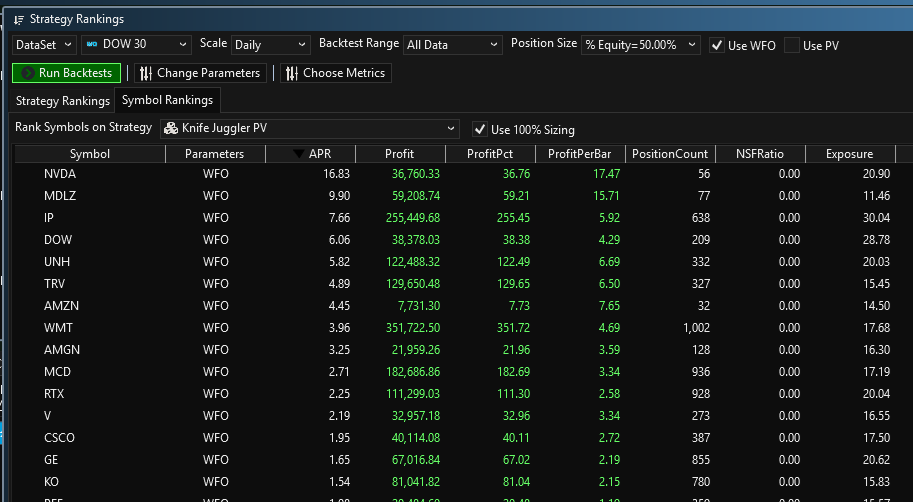

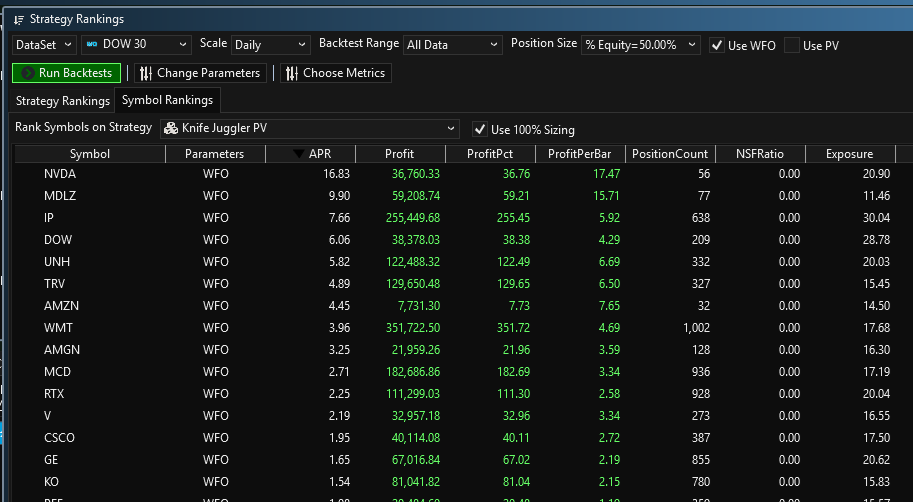

The Strategy Rankings tool can do this. Use the second tab, Symbol Rankings, and check the box "Use 100% sizing." If you want to explore any run in more detail, double click it to open it in a Strategy window.

Thank you for your reply.

Does it matter what value I enter for Position Size?

Does it matter what value I enter for Position Size?

If you check the box that says “Use 100%” then it does not. It’s an override for that tab.

Your Response

Post

Edit Post

Login is required